BREAKING: VF Corporation just sold streetwear brand Supreme at a $600,000,000 discount after acquiring the company just three years ago.

VF Corporation (owner of Vans, Timberland and more) announced today they are selling Supreme to Luxottica (maker of Ray-Ban) for $1.5 billion. In November 2020, VF paid $2.1 billion to acquire the company. Here’s a look back at the Supreme acquisition pitch deck, and what went wrong 👇

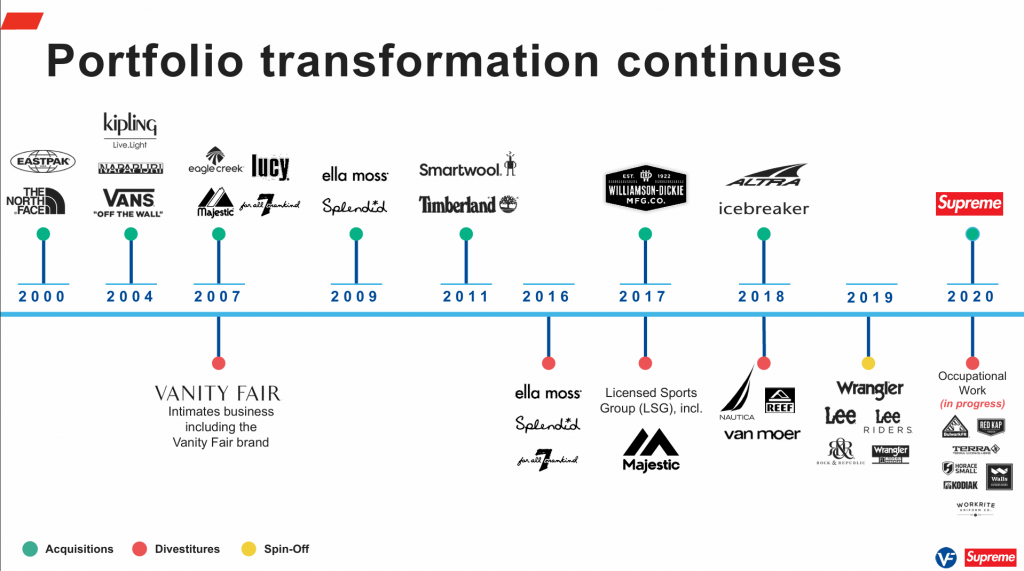

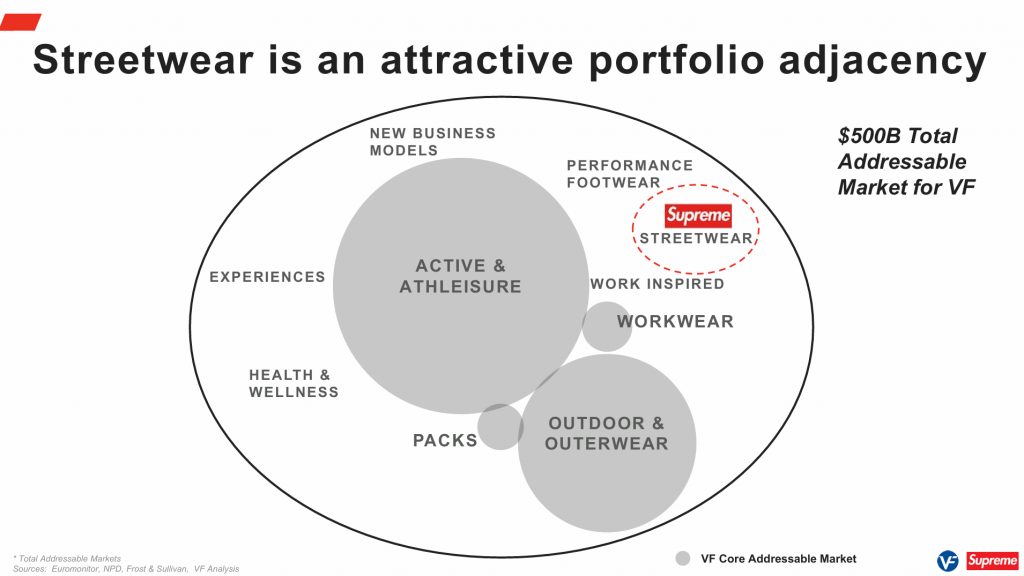

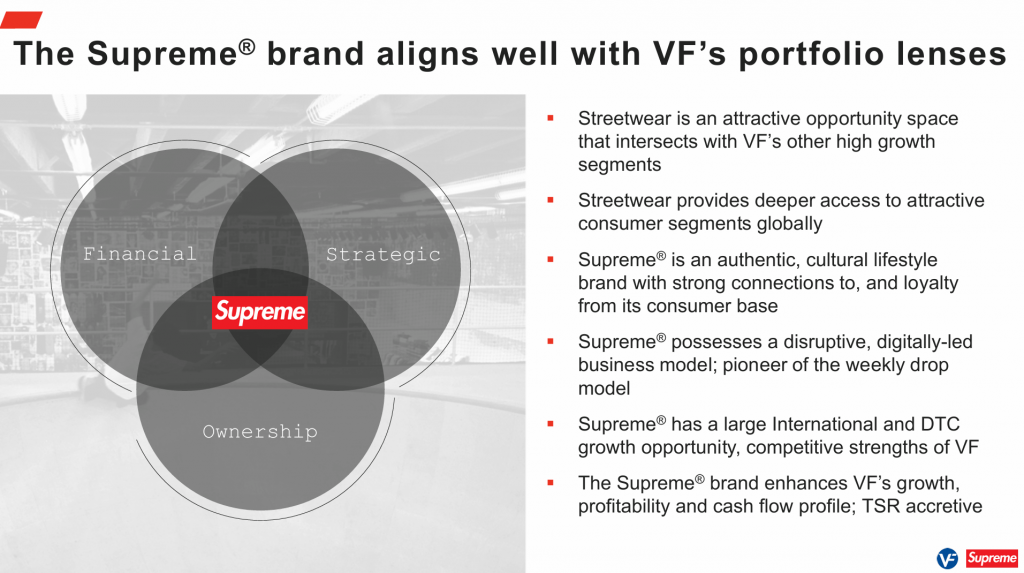

VF owns several apparel brands such as The North Face, Vanity Fair, Wrangler, Timberland, Vans, and more. VF bought Supreme in November 2020 to expand into streetwear with the goal of growing the total portfolio’s TAM to $500B.

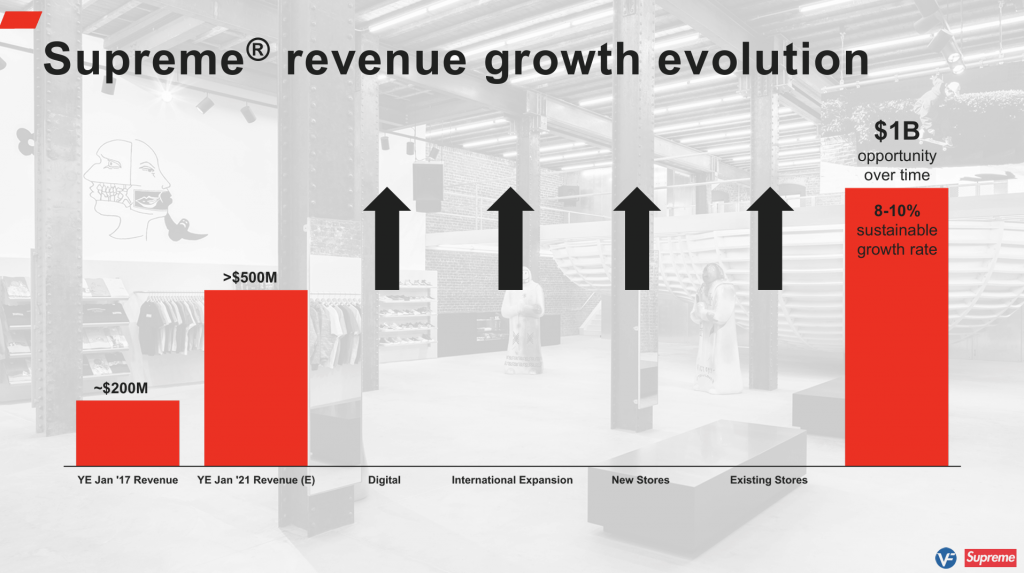

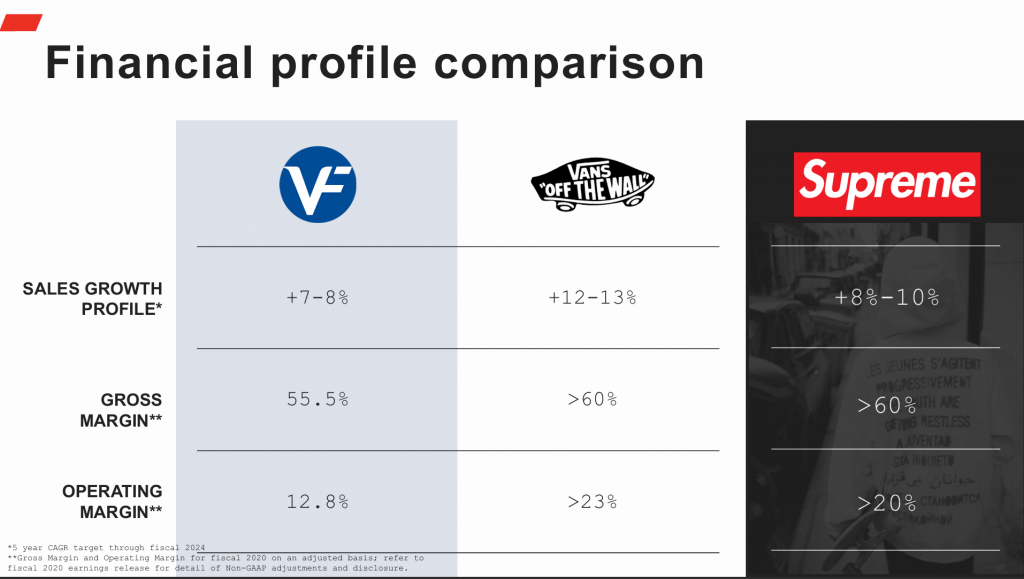

Supreme’s financials at the time were excellent:

- $500m annual revenue

- >60% gross margin

- 20% and operating margin

VF hoped to grow to Supreme to $1B in revenue, at an 8-10% annual growth rate. Compared to other VF brands like Vans, this growth projection didn’t seem too high (see “Financial profile comparison” slide), and Supreme earned higher-than-average profit margins.

However, their plan didn’t work out: today Bloomberg reported “VF Corp. will offload the skater-inflected apparel giant at a significant discount amid sliding sales and declining interest in streetwear.”

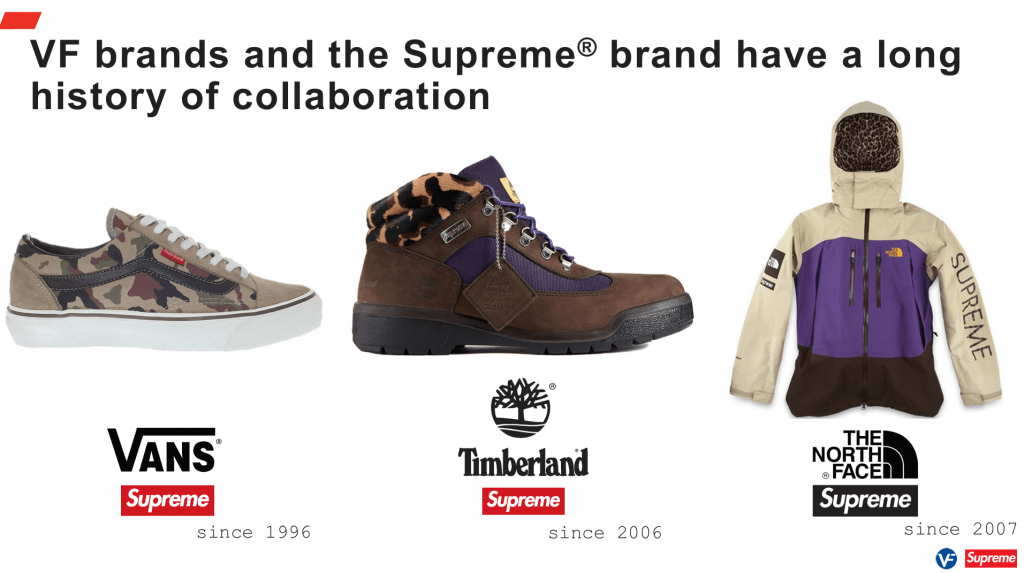

The 2020 acquisition deck heralded how VF and Supreme have been collaborating since 1996, which made it seem like a natural fit for VF’s portfolio. Ironically, today’s release said “our strategic portfolio review concluded there are limited synergies between Supreme and VF, making a sale a natural next step.”

As a result, VF has now sold Supreme to Luxottica at a $600,000,000 discount to the price they paid three years ago.

See the full 24-slide VF Corporation x Supreme acquisition pitch deck at bestpitchdeck.com