Over the last decade, investors poured billions during the “ZIRP” era into digital media startups like BuzzFeed and Vice, betting on their ability to disrupt traditional news with content tailored for younger generations and distributed online. But today, that dream seems to be fading.

As they continue to struggle to achieve profitability, many of these once-high-flying media startups have gone through multiple rounds of layoffs, sold off acquisitions for cents on the dollar, and even bankruptcy.

This week, has been particularly tough for digital media startups, with some traditional news outlets calling it “the end of the digital media revolution.”

tl;dr:

- Vice.com is shutting down, hundreds to be laid off

- BuzzFeed sold Complex for nearly one-third what they paid

- Refinery29 and Tasty also in talks to be sold

Vice and BuzzFeed were meant to be the future of news, but are now worth a fraction of their peak valuations:

BuzzFeed sold Complex for 30 cents on the dollar

BuzzFeed announced this week they sold Complex for $108M, nearly one-third what they paid to buy the company in 2021.

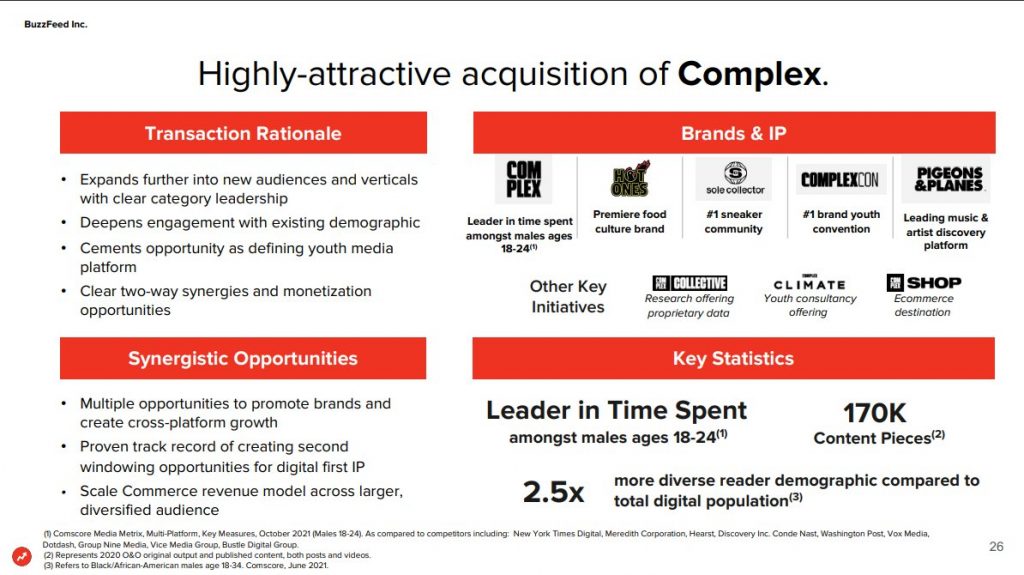

At the time of the deal, they called Complex a “highly-attractive acquisition.” BuzzFeed acquired Complex for $300M.

Three years later, BuzzFeed announced they have sold Complex to livestream shopping platform NTWRK for $108.6M, earning a dismal -64% ROI.

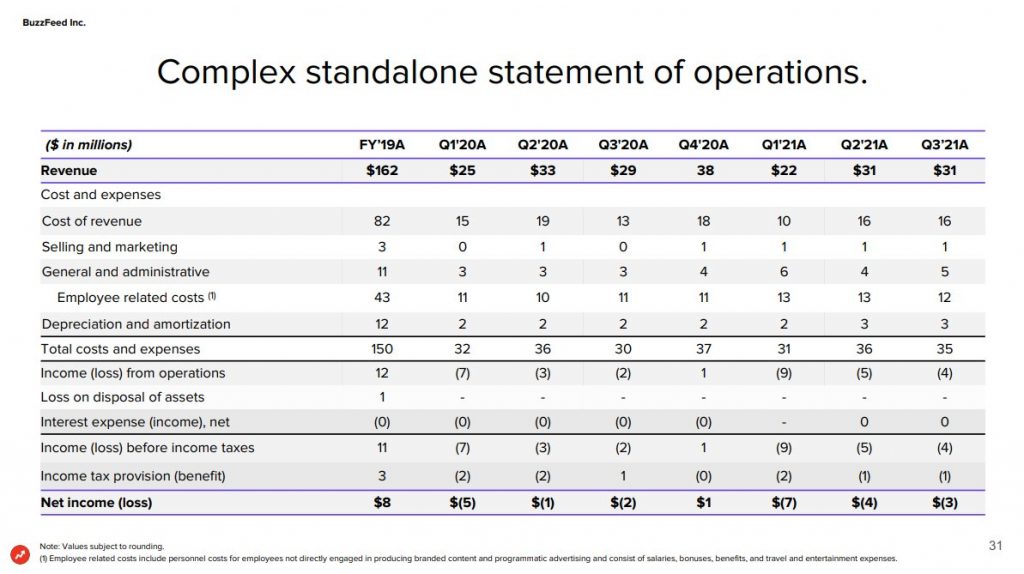

At the time of acquisition, Complex reported over $30M in quarterly revenues and a net $3M quarterly loss.

As part of the all-cash deal, BuzzFeed will retain ownership of some popular franchises like “Hot Ones.”

WSJ reported BuzzFeed may be looking to also sell food brand Tasty. BuzzFeed also announced a plan to cut expenses, which includes 16% layoffs.

Despite recent troubles, BuzzFeed’s story is still remarkable: 12 years ago, Jonah Peretti raised $3.5M in Series A funding for the site, which had 2.5M pageviews and $60k monthly burn.

For comparison, BuzzFeed reported $13.9M net loss this Q3, serving over 100M monthly pageviews. You can see the full BuzzFeed Series A pitch deck from 2008 here.

BuzzFeed acquired Complex as part of the SPAC deal that took the company public in 2021. The transaction gave BuzzFeed an implied valuation of $1B, but $BZFD fell 39% in its debut week (closing just over $6 per share). BuzzFeed became a penny stock (below $1 per share) at the start of 2024 and is trading around $2 at the time this article was written (Jul 2024).

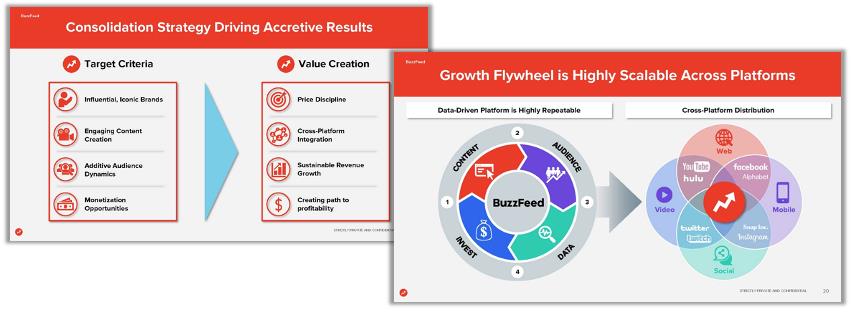

Ironically, some of the slides from ( which were quoted in the Ozy Media court filing, as seen below) the BuzzFeed 2021 SPAC deck flaunted their “accretive” consolidation strategy and “highly scalable” growth flywheel, both of which have suffered in recent years.

This same week, Vice Media announced plans to discontinue publishing on Vice.com and cutting several hundred jobs

Vice.com to shut down, hundreds to be laid off

Once valued at $5.7B, Vice filed for Chapter 11 bankruptcy in July 2023, before a massive round of layoffs in fall.

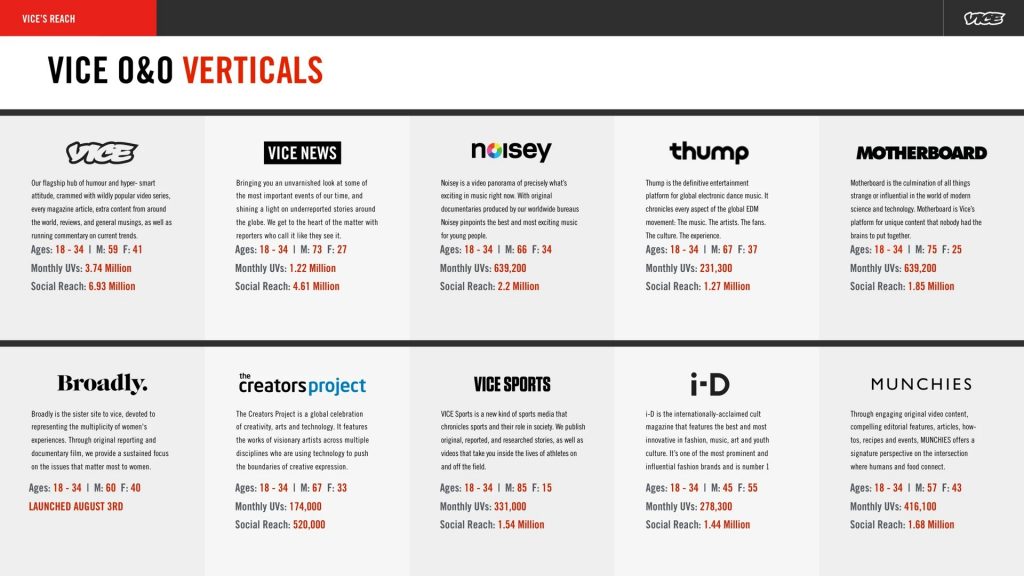

Vice Media’s core selling-point to advertisers was their highly-engaged, youthful audience. It’s notable that this slide focused on social channels and omitted the flagship website, which is now being shut down.

It’s funny how similar the selling points from this 2016 Vice Media deck are to those in Faze Clan’s (also bankrupt) 2022 SPAC deck.

Apart from their young audience, Vice Media also bragged of high engagement across channels. But that success has slowed in recent years: back in 2016, Vice Digital brought in over 24M uniques; according to WSJ, that number halved last year.

To add to their various verticals and reach more female audiences, Vice acquired women-focused media site Refinery29 in 2019 for $400M. Today, they are reportedly “in advanced discussions” to sell Refinery29.

* * *

Does this spell the end for ZIRP-era digital media startups? Only time will tell. See more examples of media startup pitch decks here, including names like Overtime and Curio.