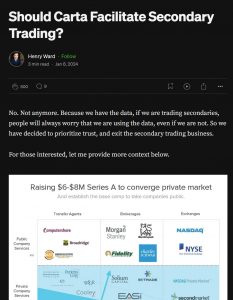

When Carta decided to exit the secondary business in January 2024 to “prioritize trust,” co-founder & CEO Henry Ward began his post started by saying “Liquidity has been a problem I wanted to solve for almost a decade” with a screenshot from the company’s 2014 Series A deck:

Carta was valued between $2 to $4 billion in a secondary sale announced in June 2024, which slashed the company valuation by $6.5B billion from previous financing. Carta’s pitch decks over the years offer unique insight into the company’s evolution and consistency over a decade of growth and development:

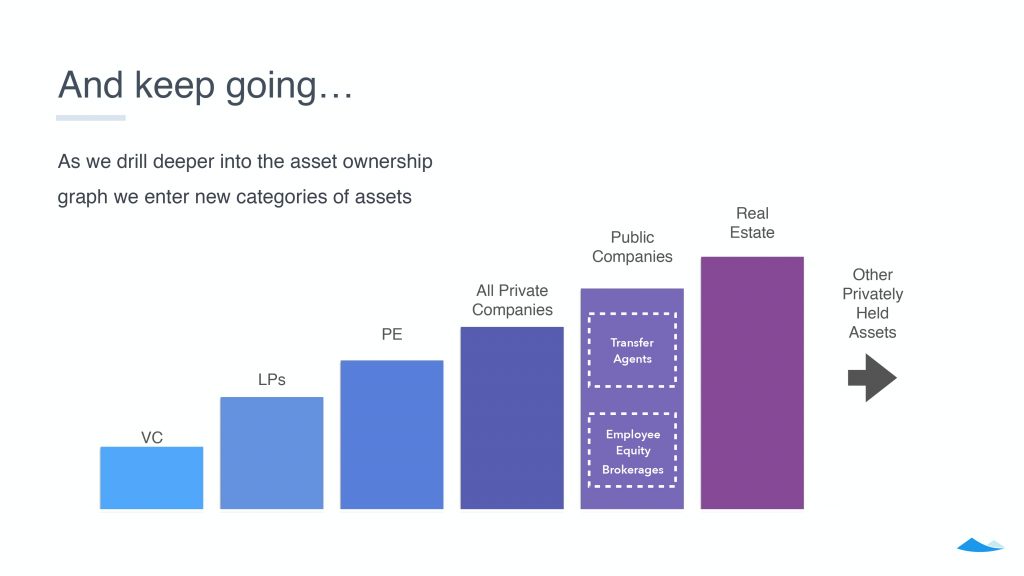

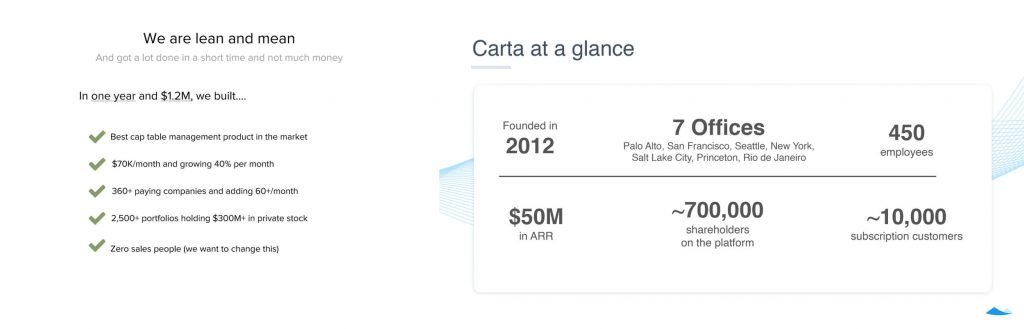

Just over ten years ago, Carta (then called eShares) was founded to be the “Nasdaq for Private Markets.” eShares was established by entrepreneur Henry Ward and serial investor Manu Kumar in 2012, starting with equity management for private companies. To-date, Carta raised ~$1.2B from investors.

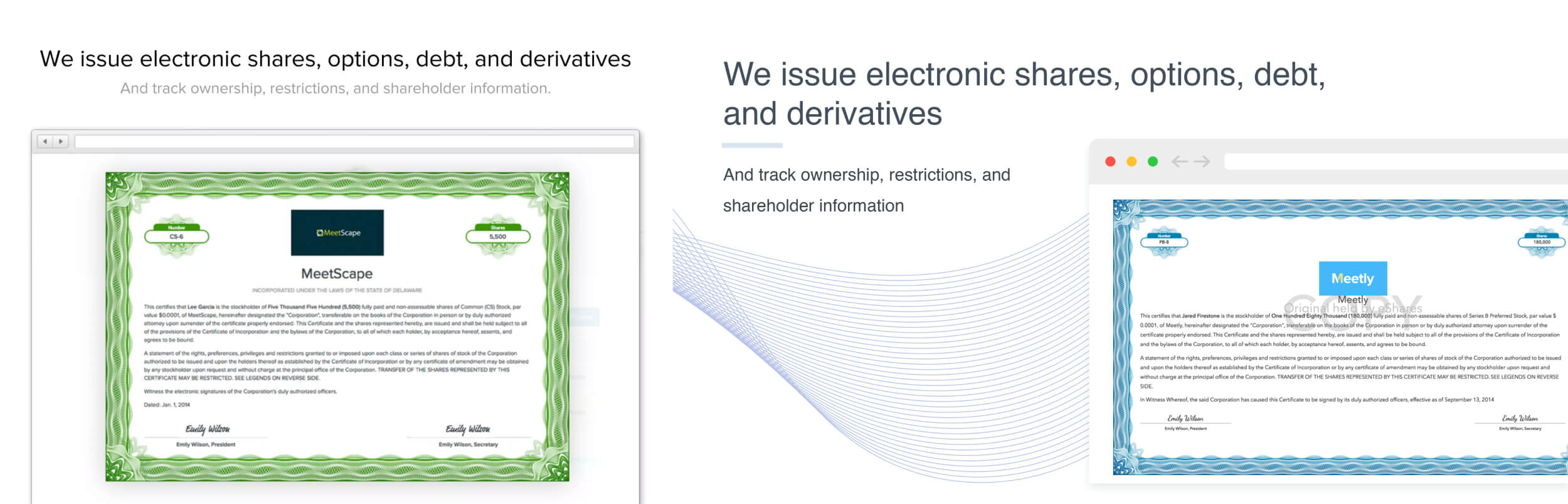

The company raised $7M with this deck in a Series A round led by Union Square Ventures. Fast forward four years to their Series D, and Carta’s focus had not changed much:

In Aug 2014, Carta hit at a $70k monthly run rate and 2.5k portfolios, with no salespeople.

By 2018, company crossed the $50M ARR market with over 700,000 shareholders on the platform

Ten years later, Carta is reportedly at $370M/year (breakdown below courtesy of @pitdesi):

Carta is doing a secondary sale at $2B.

Earlier this year Henry posted that revenues were at ~$370M/year.

Captable management: $250M/year

Fund admin: $100M

PE: $20M

Secondary trading: $3M (sunsetted)The company has raised ~$1.2B, not sure how much secondary.

links below pic.twitter.com/9UrC9uat93

— Sheel Mohnot (@pitdesi) June 7, 2024

Throughout their decks, Carta place an emphasis on tapping into network effects to drive growth

This strategy seemed to pay off: By 2021, Carta hit the $150M ARR mark, and achieved a $7B valuation with their $500M Series G led by Silver Lake

Over the years, Carta’s vision has remained the same: to start with private markets, and expand across asset classes