Investment banks are the financial powerhouses that help companies raise capital, buy and sell businesses, and manage complex financial transactions. They act as intermediaries between companies and investors, bringing together the resources needed to fuel growth and innovation.

One of the key tools in an investment banker’s arsenal is the pitch book. But what exactly is an investment banking pitch book, and how do you create a compelling one?

What are investment banks? What do they do?

Investment banks are financial middlemen who connect companies with investors. They help businesses raise capital, find potential acquirers, and navigate large financial transactions such as mergers or initial public offerings (IPO).

Investment bankers generally specialize in advising companies on mergers and acquisitions (M&A), capital formation (raising funding), and other financial matters ranging from restructuring finances to strategic planning.

Put simply, investment banks keep the financial world running smoothly by helping companies get the money they need and navigate complex financial decisions.

What is an investment bank pitchbook? What is its purpose?

An investment banking pitch book goes beyond a simple sales presentation. It’s a strategic document designed to attract and engage current and potential clients by showcasing the bank’s expertise and ability to deliver exceptional results.

In a competitive landscape, a well-crafted pitch book can be the difference between landing a lucrative deal or watching it go elsewhere.

There are many types of investment banking pitch books:

- General Pitch Book: This provides a general overview of the investment firm and its capabilities. It is used to introduce the firm to potential clients and highlight its track record, expertise, and resources.

- Sell-Side Pitch Book: This is used when an investment bank is helping a company sell itself (or a part of the business). The goal is to get the best price for the company and make sure the sale goes smoothly.

- Buy-Side M&A Pitch Book: This type is used when an investment bank is helping a company acquire another company. The focus is on finding good companies to buy, vetting them thoroughly, and negotiating the best deal for the buyer.

- Financing Mandate: Used when an investment bank helps a company raise money. They figure out how much money the company needs and then find the best way for them to get it, such as loans or selling shares in the company.

What slides should be in your investment bank pitchbook?

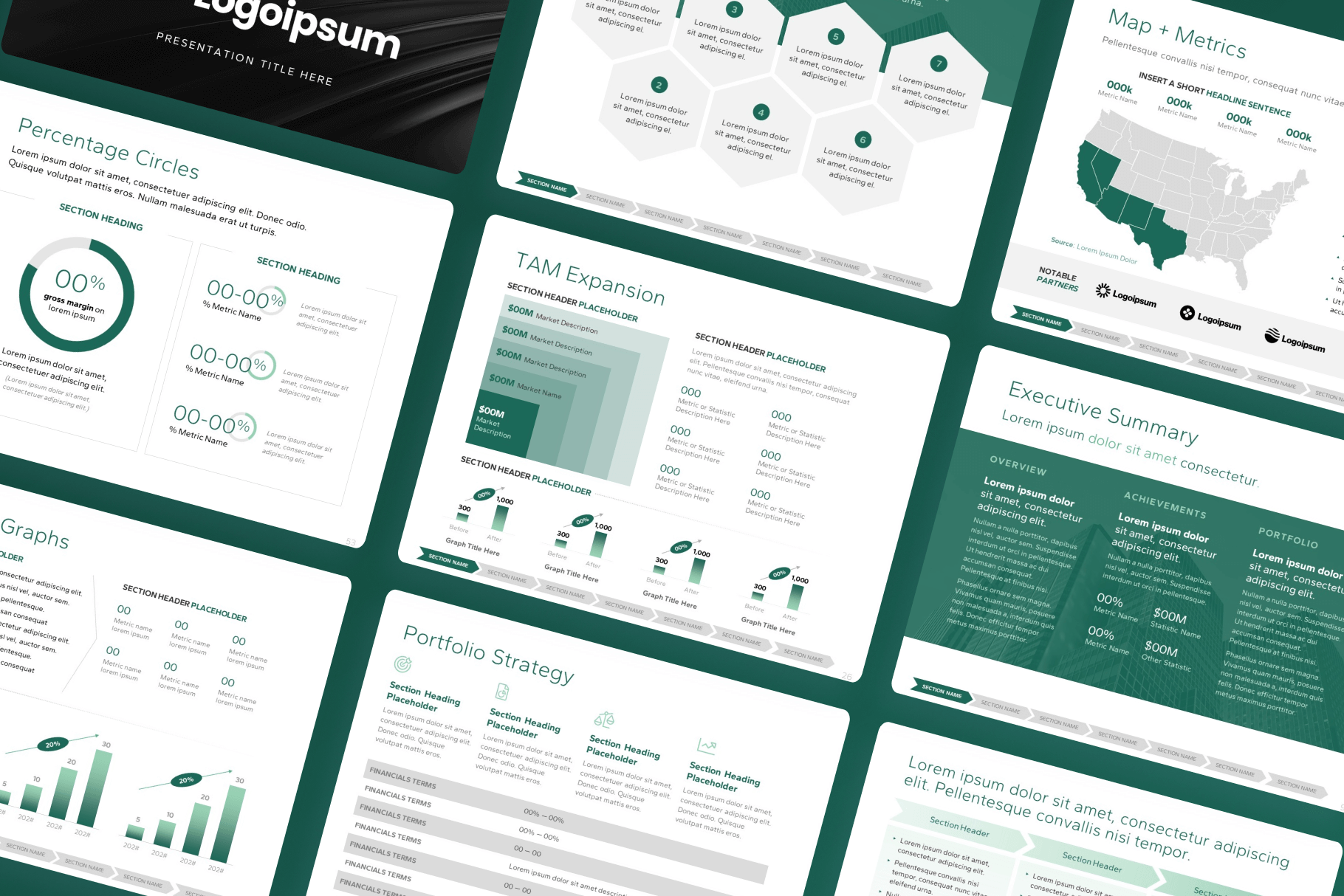

Investment banking pitch books are typically longer and more information-dense than a startup investor pitch deck, and dive in-depth to various details of the transaction. Here’s a breakdown of the key components a compelling investment banking pitch book should include, along with some additional insights:

Cover

The front page, which includes the investment bank’s name, the client’s name, and the date. This is your first impression, so keep it clean and professional. Ensure the design styles (ie. fonts & colors) are consistent with your firm’s branding for a professional-grade presentation.

Index (Table of Contents):

Given that pitch books are generally longer than a startup pitch deck, most will begin with a Table of Contents / Index slide listing of all the sections and subsections includes, to provides an overview of the contents for the reader.

Executive Summary

Similar to how startup’s often send an executive summary before their pitch deck, most investment bank pitch books begin with an overview of the transaction and/or circumstances. This section sets the stage for the presentation by summarizing the key points.

Firm Overview

Introduce the key team members working on this specific deal. Highlight their relevant experience, expertise, and past achievements specific to the client’s industry or transaction type. This section is usually broken into separate slides for the firm overview, team, corporate history, and track record.

Market Overview

Demonstrate your in-depth understanding of the client’s industry. Analyze current market trends, growth potential, and any relevant economic factors that could impact the deal.

Valuation Summary

Present various valuation methodologies, such as Discounted Cash Flow (DCF) analysis or comparable company analysis, to justify your proposed target price for the transaction.

Accurate and well-supported valuations are crucial in building a persuasive case for the proposed transaction, showing the bank’s expertise in financial analysis.

Transaction Strategy

This discusses the investment bank’s services and transaction process along with the proposed deal structure and strategic alternatives. It outlines the roadmap for executing the transaction.

Rationale of the Proposed Strategy & Solution

The rationale section of the explains the strategic reasons behind the proposed transaction. Often includes a risk analysis section (e.g., using a SWOT diagram). It justifies why the bank’s approach is optimal for the client.

A well-articulated rationale can convince clients of the benefits and strategic fit of the transaction, addressing potential concerns and highlighting the value proposition.

Summary

The closing slide highlights the key takeaways and why this bank is the right choice. It reinforces the main points and calls to action.

Appendix

Consider including supplementary materials in the appendix, such as detailed financial models, supporting charts, or relevant market research reports. Including detailed supporting materials in the appendix allows the main presentation to remain focused and concise, while still providing comprehensive data for those interested in further details and due diligence.

What key topics should an investment bank pitchbook address?

- The transaction’s virtues: Highlighting the benefits and strategic fit of the transaction.

- Analysis of prospective buyers or sellers: Identifying and evaluating potential parties involved in the transaction.

- Price and valuation information: Providing detailed pricing and financial metrics.

- Important risks to consider: Outlining the key risks and mitigations associated with the transaction.

Tips for designing an investment bank pitch book

When designing an investment bank pitch book, it’s essential to combine clarity, professionalism, and precision to effectively communicate the value proposition to potential clients. Here are some tips to guide the design of a compelling pitch book:

- Keep it concise and visually appealing. Financial information is crucial, but avoid overwhelming readers with text-heavy slides. Use clear visuals, data charts, and infographics to present complex information in a digestible way.

- Tailor your pitch book to the specific client. Generic content won’t win deals. Research your target audience and their specific needs. Address their pain points and demonstrate how your bank’s expertise aligns with their goals.

- Focus on the client’s perspective. Throughout the pitch book, maintain a client-centric approach. Explain how each section directly benefits them and addresses their specific challenges.

- Keep it updated. Regularly update the pitch book to include the latest market data, recent transactions, and evolving market trends. An up-to-date pitch book reflects your firm’s commitment to current industry standards and knowledge.

Ready to get started?

Create an investment banking pitch book that effectively captures your bank’s capabilities and secures valuable new clients. If you’re looking for a jumpstart on a professional-grade pitch book, try this Investment Bank Pitch Book Template by VIP Graphics. A well-crafted pitch book is a powerful tool for showcasing your expertise and building trust in the competitive world of investment banking.