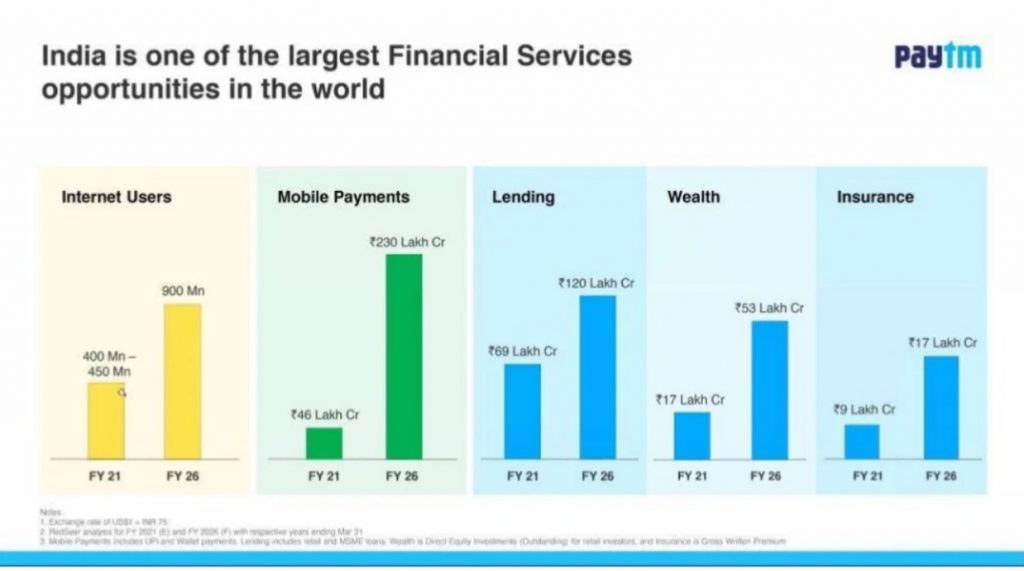

Warren Buffett’s Berkshire Hathaway recently exited its investment in Paytm, India’s largest digital payments company, at a 40% loss. The move surprised many observers, as Buffett is known for his long-term and value-oriented approach to investing. Why did Berkshire Hathaway sell Paytm shares at a loss, and what does it mean for the future of the Indian fintech sector? To understand this, we’ll look back at the IPO deck Paytm used to go public in October 2021:

Berkshire Hathaway’s Investment in Paytm

Berkshire Hathaway invested $260 million for a 3% stake in Paytm in 2018, at a valuation of around $10 billion. The Warren Buffett firm recorded a dismal $157M return five years later. The deal was reportedly initiated by Todd Combs, one of Buffett’s portfolio managers, who saw potential in Paytm’s growth and dominance in the Indian digital payments market.

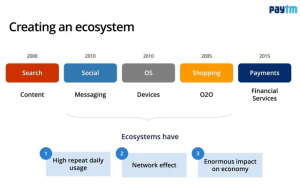

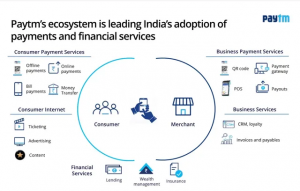

Although Vijay Shekhar Sharma, Paytm’s founder & CEO purported to “always carry his company’s pitch deck,” he pitched the deal with Berkshire with “no paper or powerpoint” according to India Times. Here’s a peek inside a much earlier pitch deck for PayTm, which described Sharma’s vision to lead the charge in bulding an ecosystem for India’s adoption of fintech:

Paytm’s IPO and Performance

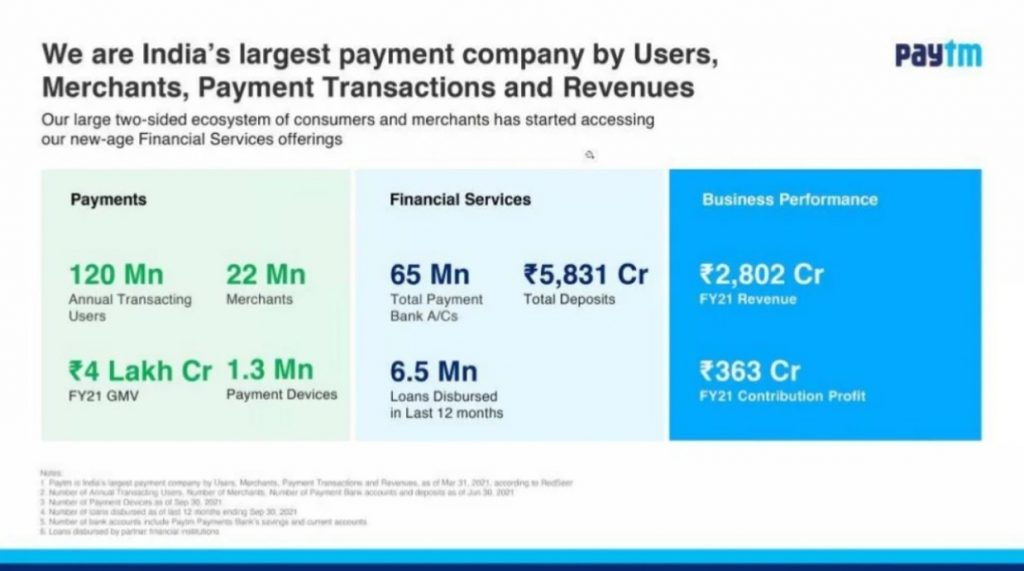

Paytm started as a mobile recharge platform in 2010, and has since expanded into various segments such as e-commerce, lending, insurance, and wealth management, reaching over 300 million users and 16 million merchants.

Paytm went public in October 2021, in one of the largest and most anticipated IPOs in India’s history. The company raised $2.5 billion at a peak valuation of $18 billion, making it the most valuable startup in India. However, the IPO was met with lukewarm response from investors, who were concerned about Paytm’s high losses, low margins, and intense competition. Paytm’s share price fell below its issue price on the first day of trading, and has since declined by more than 50%.

As of December 2021, Paytm’s market capitalization was around $8 billion, less than half of its IPO valuation. Less than a month after Berkshire sold their shares, Paytm announced mass layoffs of over 1,000+ employees. See the Paytm’s full IPO pitch deck from 2021 here →