What David Ellison’s pitch deck says about Skydance’s plans for the Paramount acquisition

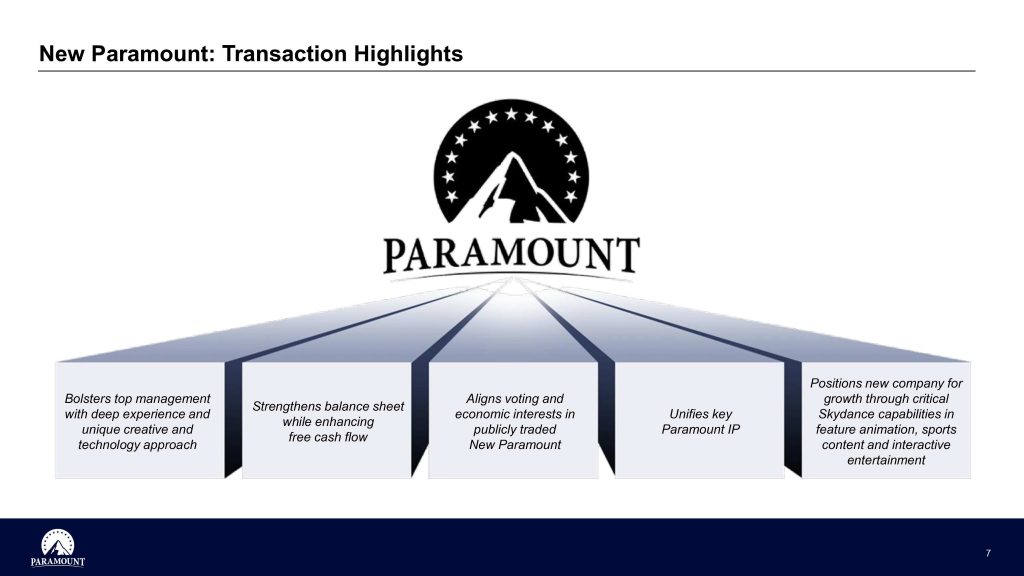

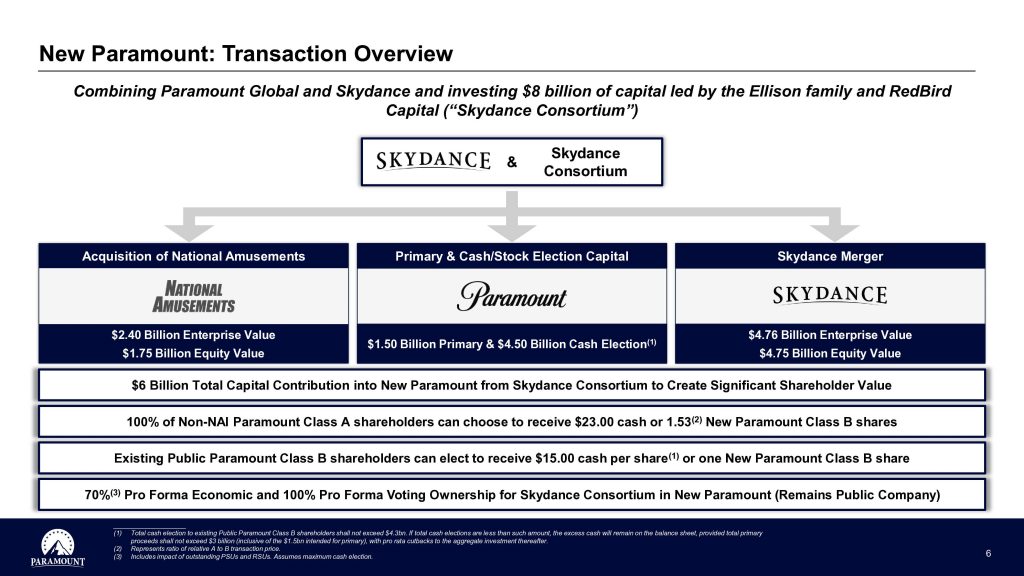

After initial talks of a merger in June fell through, Paramount and Skydance signed an $8 billion “definitive agreement” on July 2, 2024 for Skydance to merge with Paramount Global and acquire National Amusements. The pitch deck released shortly afterwards offers an inside look at David Ellison’s plan for turning around the company, tentatively named “New Paramount.”

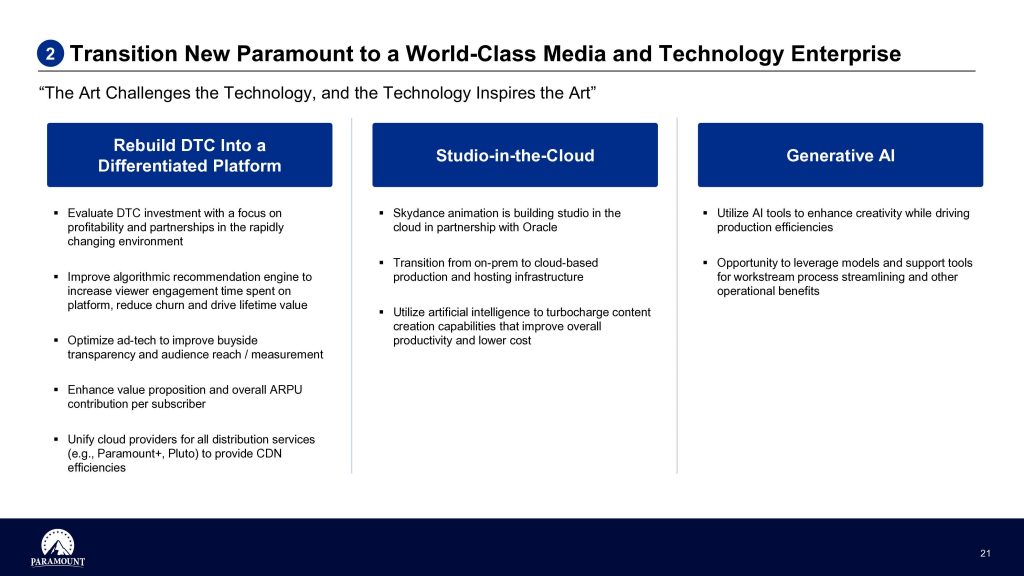

In an hour-long presentation to investors earlier this week, Ellison invoked Steve Jobs and described his vision to build a tech-media hybrid. His plans included improving the recommendation algorithm for Paramount+ users, upgrading advertising technology, and leveraging artificial intelligence to “turbocharge content creation.” The first thing many readers noted was the change in Paramount’s logo, shedding the iconic script wordmark that the company used for years.

Paramount Global is multinational media and entertainment conglomerate controlled by National Amusements, originally formed on December 4, 2019 as “ViacomCBS” through the merger of CBS and Viacom. The company rebranded to Paramount in 2022, and owns CBS, Nickelodeon, BET, MTV, among other notable media assets.

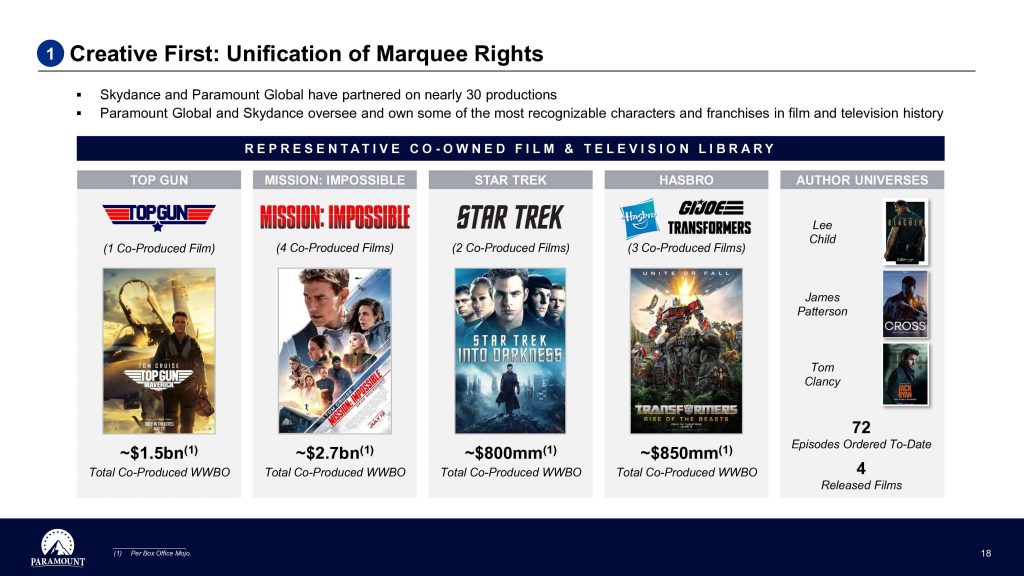

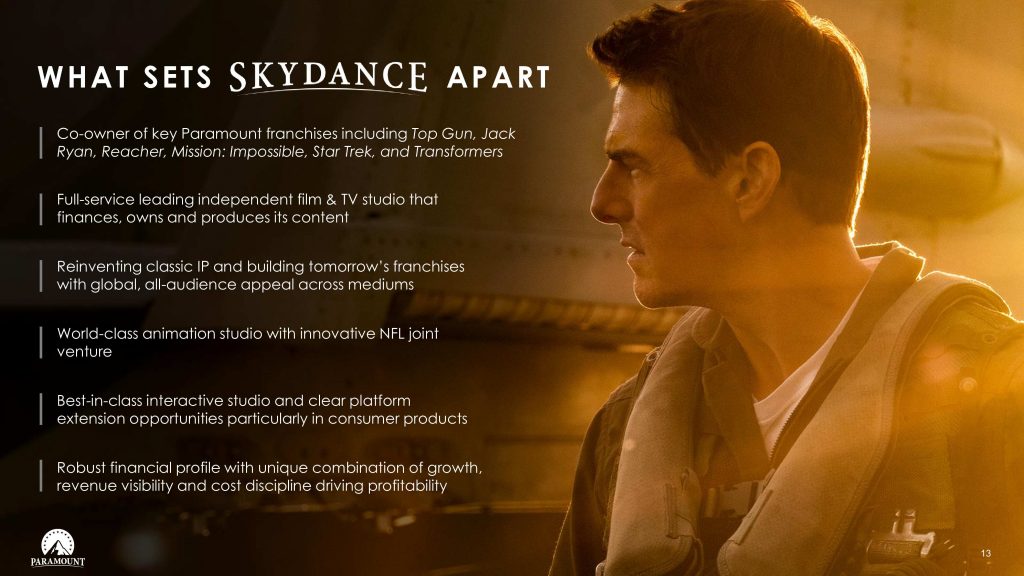

Skydance was founded in 2006 by David Ellison (son of Larry Ellison, co-founder of Oracle), and has been collaborating with Paramount since the Fall of 2009, co-producing franchises including Mission: Impossible, Star Trek, Top Gun, Terminator, Jack Ryan, and Transformers.

Ellison’s tech pedigree factored into Paramount controlling shareholder Shari Redstone’s decision to strike a deal with Skydance. Earlier this year, Sykdance worked with Oracle to create a cloud-based animation studio that produced part of “Spellbound,” an animated film releasing this fall on Netflix.

The deal will be structured such that Skydance will pay $2.4 billion in cash to purchase National Amusements, and Paramount Global will pay its Class A and Class B stockholders $4.5 billion in cash and shares. Most expect the merger to close in September 2025.

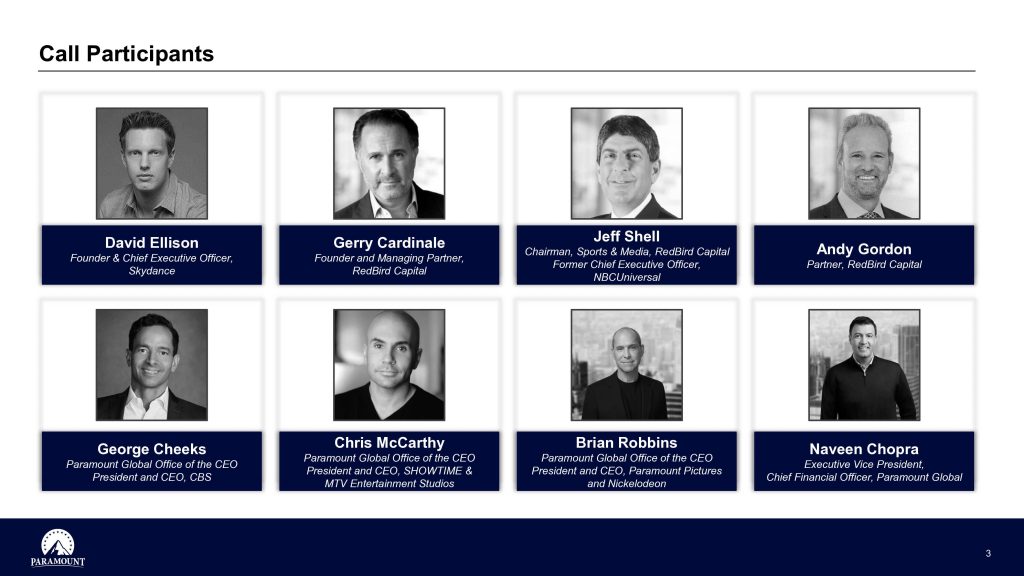

According to the deck, the $8 billion investment is being led by the Ellison Family and RedBird Capital (“Skydance Consortium”):

You can read the full 32-slide “New Paramount” deck detailing Ellison’s master plan to build “a next generation leading entertainment company” at bestpitchdeck.com