Navigating the world of startup equity can be complex, especially when it comes to managing who owns what in your company. Enter the cap table—a powerful tool that gives founders, employees, and investors a clear view of a company’s ownership structure.

But what exactly is a cap table, and why is it so important for startups? In this guide, we’ll break down everything you need to know about cap tables: what they are, why they matter, how to build one effectively, and key considerations to keep it updated and accurate.

What is a cap table?

A cap table is a spreadsheet or database that details the equity ownership of a company. It lists the founders, investors, and other stakeholders, showing who owns what percentage of the company, how much they’ve invested, and what type of shares they hold (e.g., common stock or preferred stock). Cap tables are dynamic and evolve as the company grows, raises new funding rounds, or grants stock options to employees.

Why do I need a cap table?

There are several reasons why a cap table is essential for any startup:

Helps understand ownership and voting rights

A cap table provides clarity on the percentage ownership and voting rights of each shareholder. For instance, common stockholders may have different voting rights compared to preferred stockholders, and understanding these rights is crucial for governance.

Informs new investors about existing shareholders

Potential investors, particularly during seed rounds or Series A funding, rely on cap tables to understand the company’s ownership structure. This transparency helps investors evaluate the impact of their investment and negotiate terms accordingly.

Summarizes funding history

Cap tables serve as a historical record of all equity transactions, including pre-seed, seed, and subsequent funding rounds. Each round affects the company’s valuation and ownership percentages, which are crucial data points for any due diligence process.

Where to Build Your Cap Table

Many founders choose to build their cap tables in Excel. It’s a familiar tool, readily available, and can handle basic cap table needs. However, for growing companies, specialized cap table software like Carta offers several advantages, including:

- Automated calculations: Cap table software automates complex calculations, reducing errors and saving you time.

- Version control: Track changes and ensure everyone has access to the latest version of the cap table.

- Security: Securely store sensitive information about your company’s ownership structure.

- Compliance tools: Ensure you’re on top of regulatory requirements for shareholder communication.

Ultimately, the choice depends on your business needs and resources.

How to build a cap table

Creating a cap table involves several key elements, especially as you go through different funding rounds and add new stakeholders.

- Round type (priced round vs. convertible/SAFE note): Priced rounds involve setting a specific share price, while convertible notes or SAFE (Simple Agreement for Future Equity) allow you to defer the valuation of the company to a future funding round.

- Pre-money and post-money valuation: The pre-money valuation is the value of your company before receiving new investment, while post-money valuation includes the new capital raised.

- Authorized shares: This refers to the maximum number of shares a company can legally issue. Companies must carefully consider how many shares to authorize at incorporation to allow for future fundraising and employee stock options.

- Common vs. preferred stock: Common stock is typically owned by founders and employees, while preferred stock is generally issued to investors. Preferred stock often comes with additional rights, such as dividend preferences or anti-dilution protections.

- Stock options: Many startups offer stock options as a part of employee compensation. Cap tables need to account for these options, both granted and ungranted, as they represent a potential source of future dilution.

- Ownership and fully-diluted shares: This metric shows the total number of shares outstanding if all options, warrants, and convertible securities were exercised. Fully-diluted ownership helps investors and employees understand their potential ownership stakes if all outstanding equity were converted.

Important things to consider

A cap table is a living document that changes as your company evolves. Here are a few critical points to keep in mind:

- Keep the cap table up-to-date: As your startup grows, it’s vital to keep the cap table current. Regular updates ensure that all equity transactions, such as stock option grants or new funding rounds, are accurately reflected. Remember, shares can only be issued or transferred; they cannot be removed once on the cap table.

- Include convertible debt: Convertible notes or SAFEs must be accurately tracked in your cap table. These instruments convert into equity during future funding rounds, impacting ownership percentages and valuation.

- Plan for employee stock options: Employee stock option pools are crucial for attracting and retaining talent, so always leave room for these on your cap table. This helps manage expectations and minimizes surprises as the company scales.

Ready to take control of your startup’s equity?

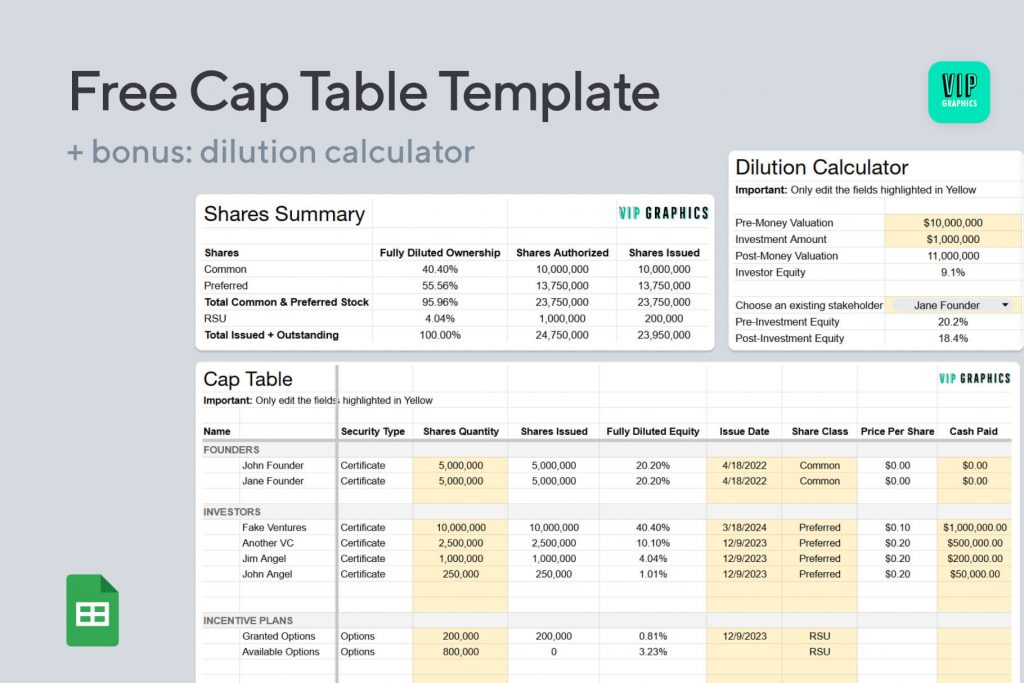

Creating a cap table from scratch can be daunting for founders. To simplify the process, you can use this Free Cap Table Template for Excel / GSheets by VIP Graphics to jumpstart the process. With step-by-step instructions and a built-in dilution calculator, this template is perfect for startups at any stage—whether you’re preparing for your first seed round or navigating a complex Series A.