Shark Tank alum and dry erase innovator mcSquares (aka M.C. Squares) filed for Chapter 11 bankruptcy on Dec 22.

According to the filing, mcSquares has:

- $5.7M in net operating losses

- $3.34M owed to creditors

- Only ~$903,000 in assets

Where did things go wrong for the promising collaboration & stationery startup? Here’s a look back at their story & early pitch decks:

Startup veteran Anthony Franco founded the company in 2015 to empower people to collaborate and communicate more efficiently, and to reduce the environmental impact of traditional office stationery (ie. sticky notes, planners).

M.C. Squares Planners are dry-erase, adhesive-free stickers that can be reused up to 2,000 times; a replacement for wasteful paper planners. The startup appeared on ABC’s Shark Tank in 2020.

Kevin O’Leary acquired an 11% stake in the firm by investing $50,000 (though he initially wanted 25% for $300k), and helped mcSquares launch a crowdfunding campaign that raised $500,000.

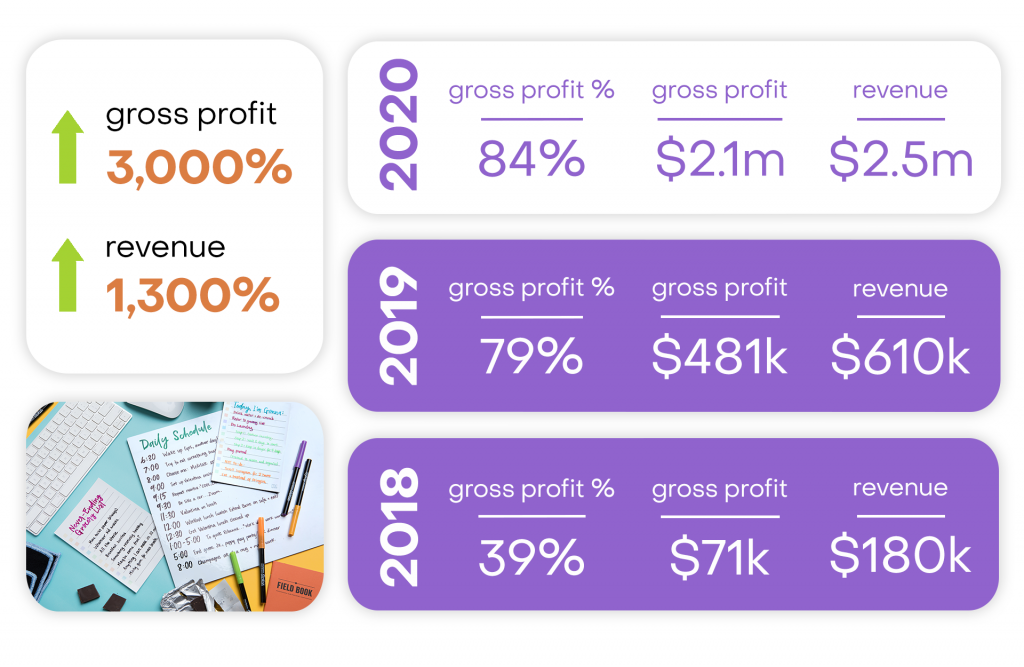

Here’s an inside look into the deck mcSquares used to raise funding in 2021. According to the deck, the company earned $2.1M in 2020, up 4× from the year prior.

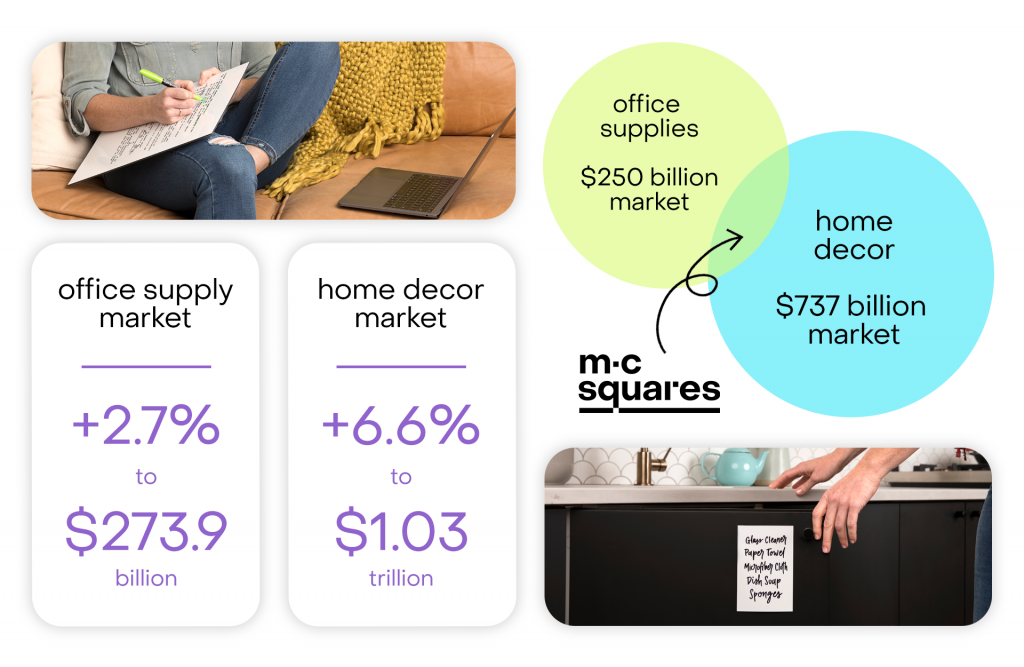

The company envisioned expanding to capture more of the home & office supply market with their portfolio of 24+ patent and trademark filings.

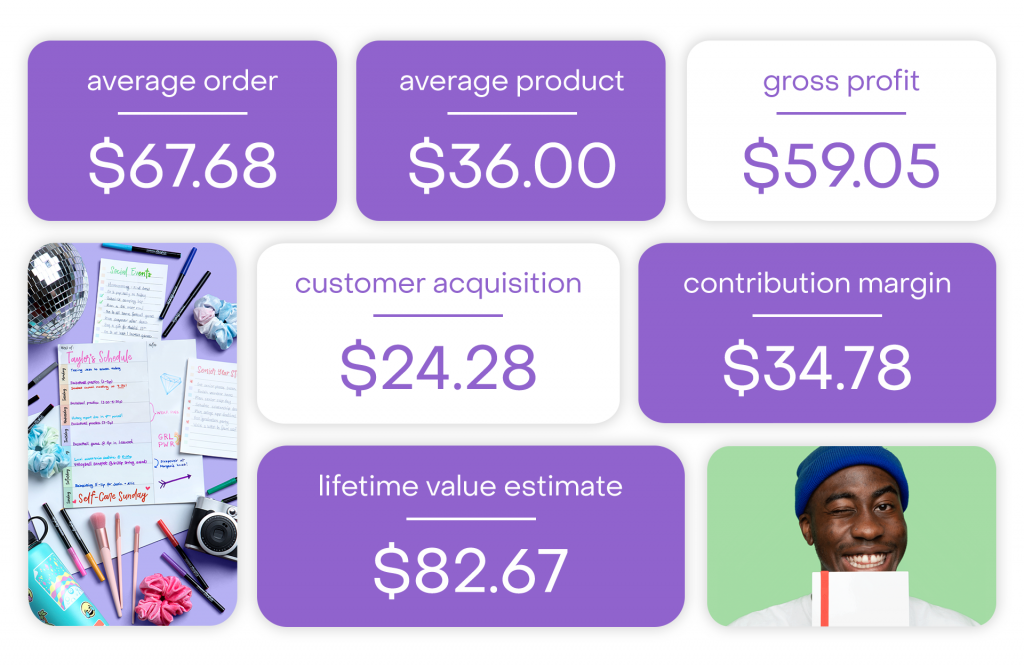

With a healthy >70% gross profit margin and 3.4× CAC:LTV ratio, one would expect the business to grow sustainably.

However, mcSquares quadrupled the size of its physical operations on the heels of their 2020 raise, expanding into a 25,000-square foot building in Thornton.

Like most failed startups, high burn and scaling too fast were likely the cause of mcSquares’ downfall.

You can see the full mcSquares deck at bestpitchdeck.com/mcsquares.