Founded in 2013 by Jacob DeWitte and Caroline Cochran, Oklo Inc. is a nuclear technology company based in Santa Clara, California. The company designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States.

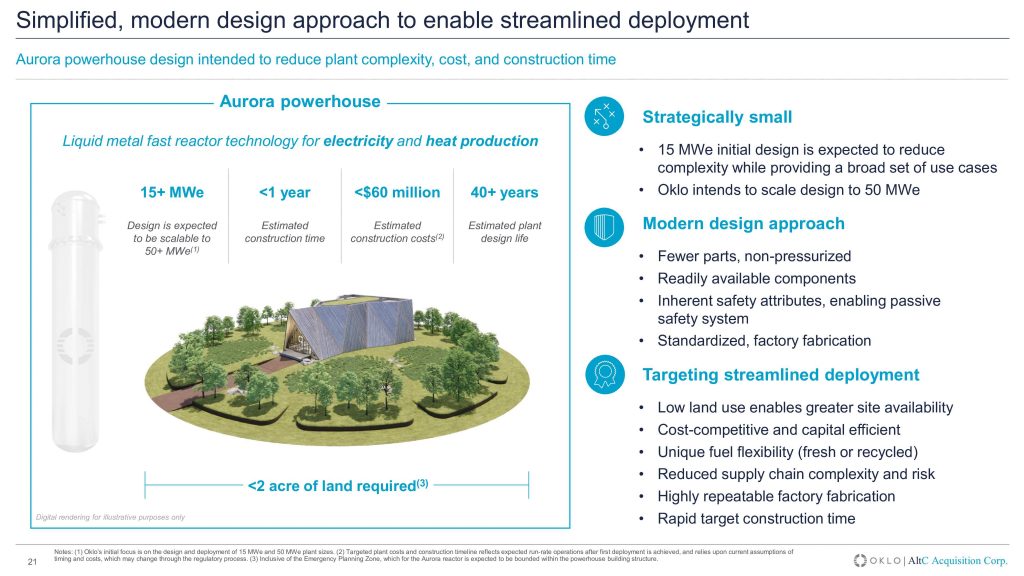

Oklo’s main product line consists of the Aurora nuclear reactor powerhouse. It is a small power plant designed to generate 15-50 MWe of electrical power via a Siemens or similar power generation system and utilizing a compact fast neutron reactor to produce heat.

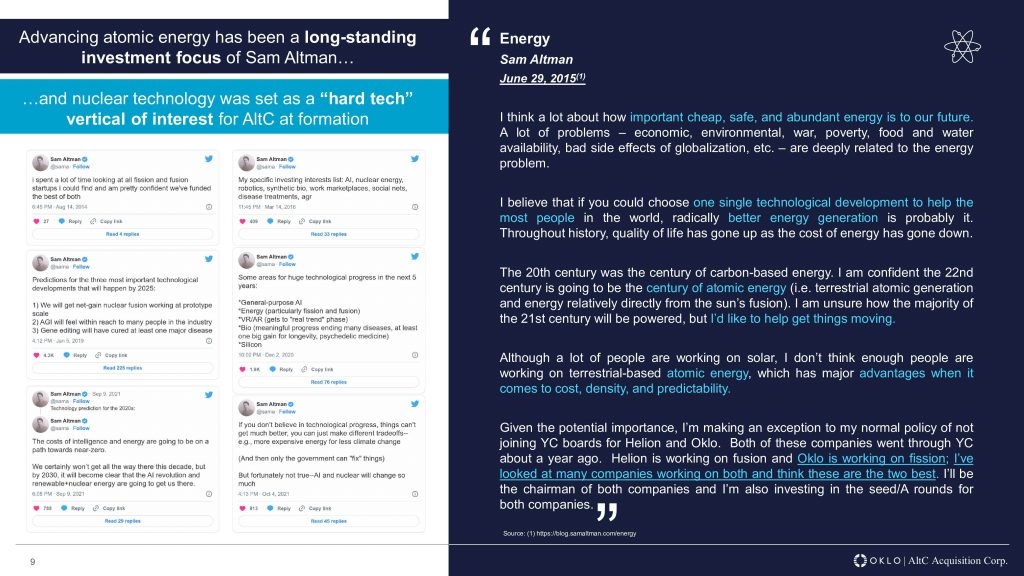

Oklo went public in May through a SPAC merger with AltC Acquisition Corp, backed by Sam Altman, who has also been the chair of Oklo’s board since 2015.

October 14, 2024, Google announced it would purchase power from a fleet of SMRs made by Kairos, as the company and other tech giants increasingly turn to nuclear for energy needs related to the AI.

After Google and Amazon announced nuclear deals to power their AI efforts, startups like nuclear tech companies Oklo Inc and NuScale Power stock jumped over 50% in the following two days.

The news helped lift nuclear stocks across the board, particularly for NuScale Power, which mounted an impressive comeback after laying off nearly half their staff in January. At that time, $SMR was at $3, down 75% from IPO. Now, the stock is at $19, up 88% from IPO.

Investors are speculating that Oklo could be one of the next companies to ink a deal with a big tech player, given the company’s ties to OpenAI and Sam Altman.

Here’s Oklo’s SPAC pitch deck

Co-founders Jacob DeWitte and Caroline Cochran graduated from the Massachusetts Institute of Technology. They also brought extensive experience from companies like GE, office of the Secretary of Defense, US Department of Energy.

Additionally, the company could flaunt the backing of influential individuals like Sam Altman who has also been the chair of Oklo’s board since 2015.

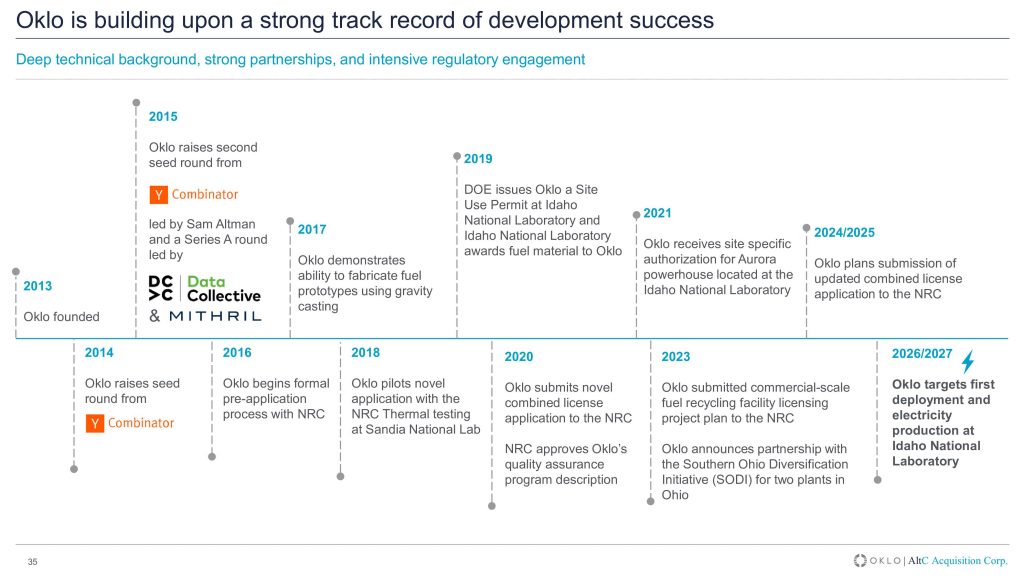

Okla has shown a strong track record of development over the years. This includes solid partnerships and hitting key milestones, such as raising multiple seed rounds, as well as backing from Y Combinator and investors like DCVC and Mithril.

The company has also been engaged with the Nuclear Regulatory Commission since 2016, with major accomplishments such as submitting a novel combined license application in 2020 and launching fuel recycling facility projects by 2023.

The Aurora design leverages inherent safety attributes, enabling passive safety systems and reducing supply chain complexity. Oklo’s strategy is to offer low-cost, capital-efficient plants that provide flexible fuel options and highly repeatable deployment.

The design prioritizes reducing plant complexity, cost, and construction time, with a targeted build time of under one year, a construction cost under $60 million, and a lifespan exceeding 40 years.

In various tweets and blog posts, Sam Altman had emphasized the importance of cheap, safe, and abundant energy as foundational for future progress for humanity. He also predicted that the 22nd century will be dominated by atomic energy, both from terrestrial sources like nuclear fission and fusion.

Understanding the importance, he made an exception to his rule of not joining the board of Y Combinator startups and joined the Oklo board.

See the full Oklo SPAC Pitch Deck (and thousands more) at bestpitchdeck.com/oklo-spac