Another SPAC merger bites the dust: Redbox owner Chicken Soup for the Soul filed for bankruptcy on Jun 30, 2024 and reportedly owes nearly $1 billion to debtors.

The following week, a bankruptcy court judge ruled that $CSSE will be liquidated, after the company & lenders accused its former CEO of mismanagement. The company was unable to secure $8M in emergency financing to pay its ~1,000 employees

Two years after SPAC mania hit its peak, many once-popular companies like Fisker and now Redbox, have come crashing down:

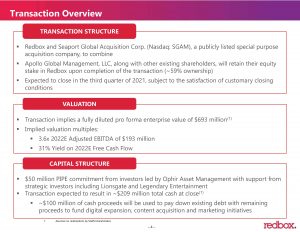

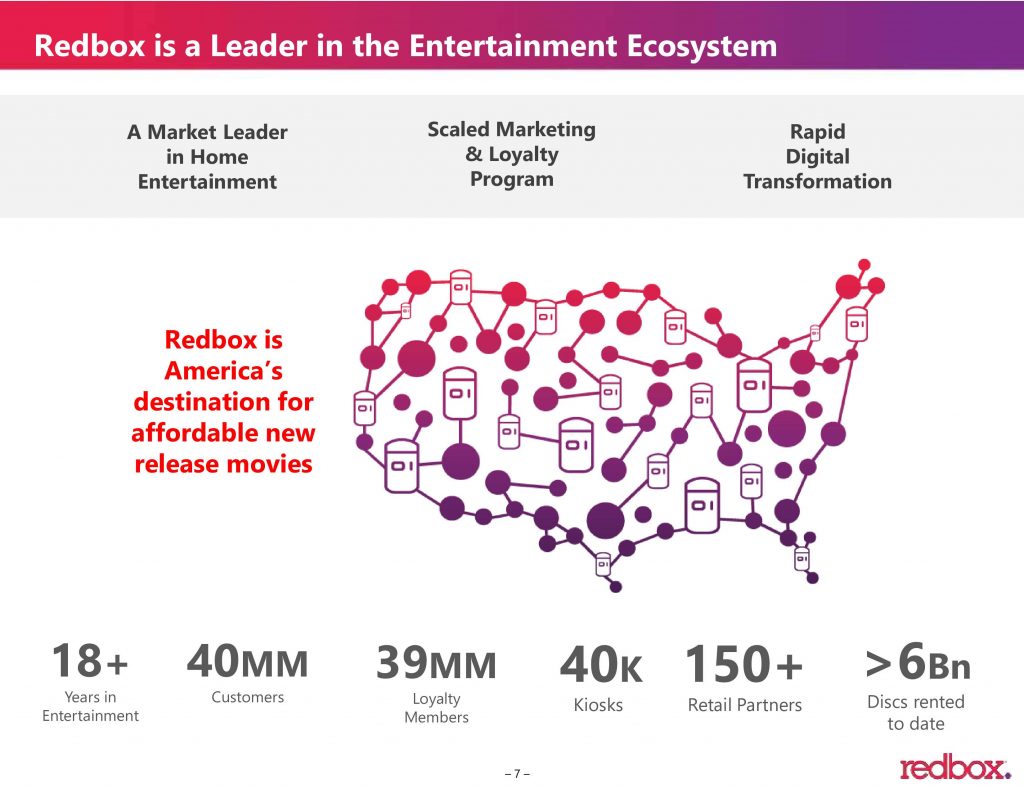

Redbox went public via SPAC merger in 2021 that promised $145M in cash + $50M in PIPE funding and valued the company at $693M (see the deck they used below). At the time, private equity firm Apollo Global held a 59% stake in Redbox.

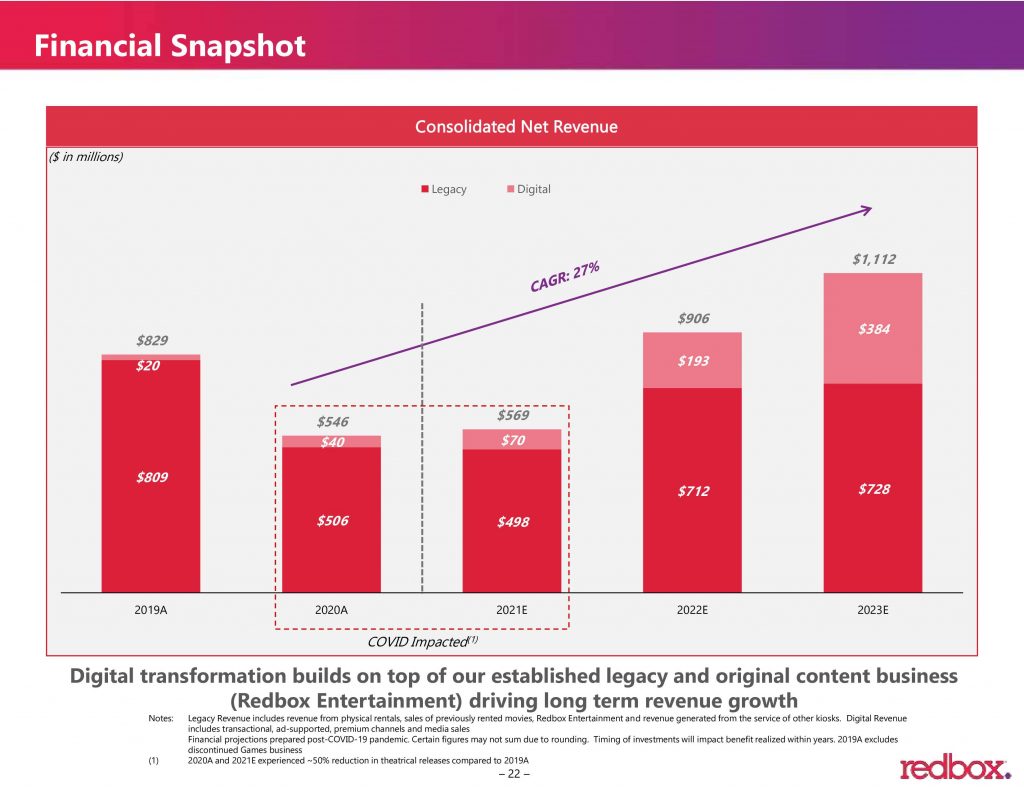

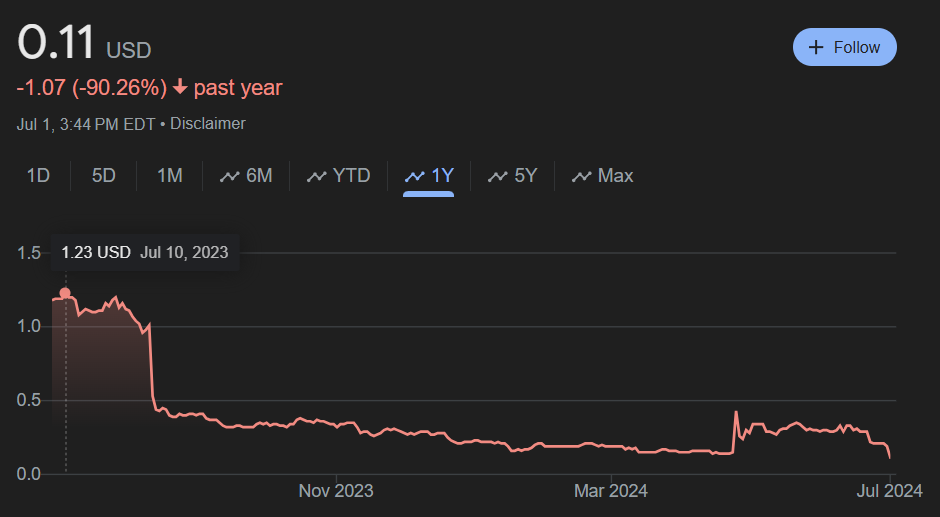

Like most SPAC decks, Redbox’s projections were sky high: expecting over $1B in revenue by 2023. Due to poor financials, Redbox stock sunk from $10 in October 2021 to under $2 and was delisted on June 30, 2022.

Chicken Soup for the Soul Entertainment, Inc. ($CSSE) came to the rescue with a $375M acquisition deal (an 88% discount on the IPO price). To finance the sale, Chicken Soup took on $325M in debt and has since been sued over a dozen times over unpaid bills.

Yesterday (precisely two years after the Redbox SPAC was delisted), Chicken Soup for the Soul Entertainment filed for bankruptcy.

According to the bankruptcy filing, Chicken Soup owed $970 million altogether to Redbox partners including Walmart, Walgreens, and major studios like Universal, Sony, Lionsgate and Warner Bros.

Redbox reportedly hasn’t paid employees for a week, and medical benefits have been suspended.

Since 2002, Redbox has grown to 34,000 locations across the US and rented over 1 billion discs to consumers. Due to the Chicken Soup for Soul bankruptcy and liquidation, Redbox has ceased operations after 22 years.

See the full 39-slide Redbox SPAC deck from 2021 here, where you can explore several other SPAC pitch decks.