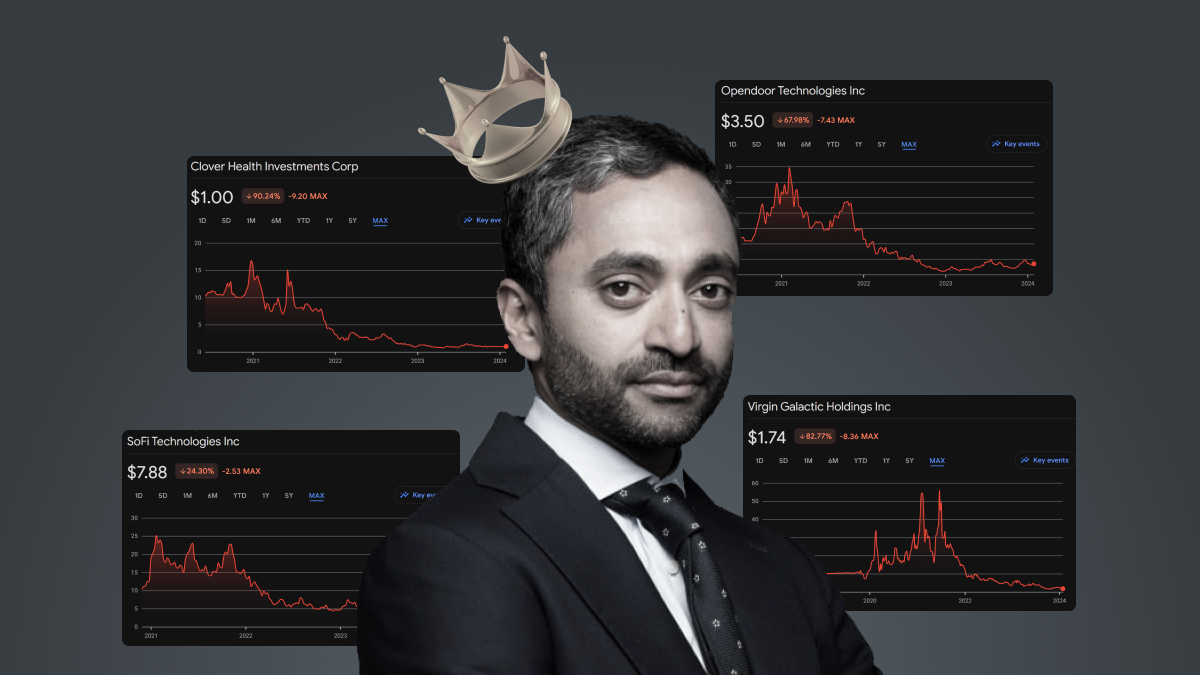

So-called “SPAC King” Chamath Palihapitiya (who famously compared himself to Warren Buffett) created 12 SPACs through his investment firm, Social Capital. Today, most of those companies are down 80% from their IPO price.

Here’s a look back at Chamath’s top SPAC deal decks, what they promised, and where they are now.

All of Chamath’s SPACs had a ticker symbol of “IPO” followed by a letter (IPOA, IPOB, etc):

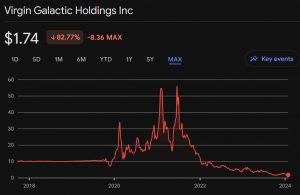

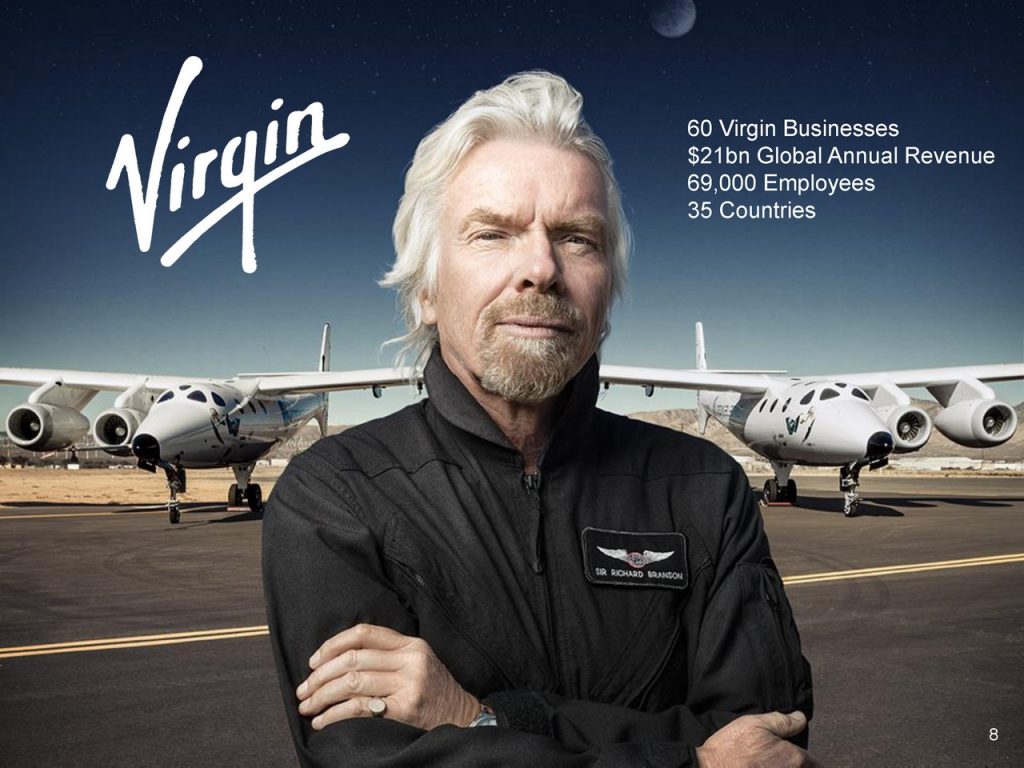

IPOA: Virgin Galactic ($SPCE)

🔻$11.75 (Oct ’19) → $1.74 (Jan ’24)

Richard Branson’s suborbital space tourism was IPO, the Chamath’s SPACs. The SPAC raised $450M and valued the company over $2.4B.

The SPAC deck claimed to have over 600 customer reservations and ~$80M in total collected deposits.

With commercial service delayed again in August 2022, $SPCE stock price tumbled >80% from IPO to under $2 as of January 2024.

You can see the full 68-slide Virgin Galactic deck here.

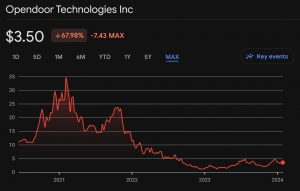

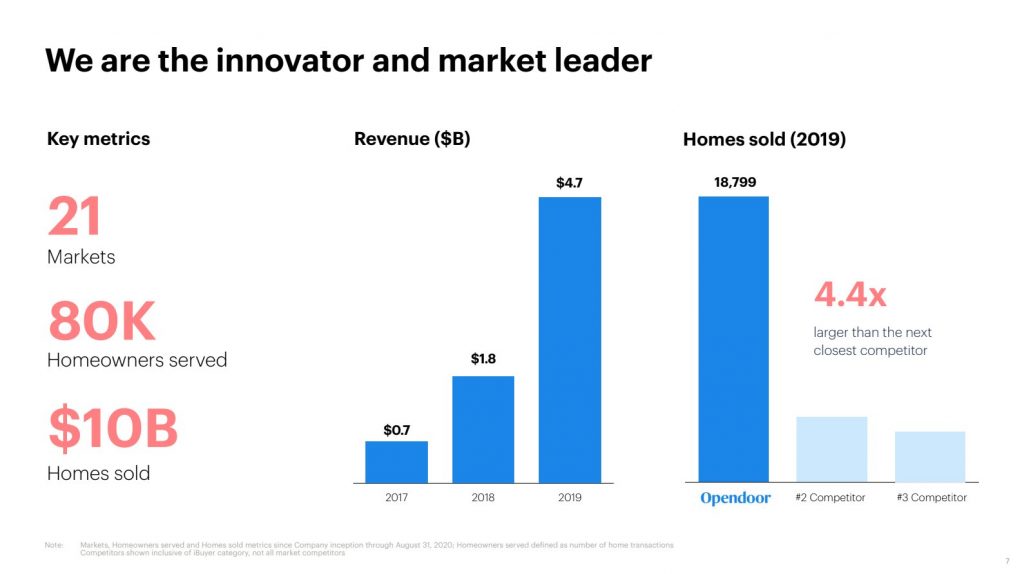

IPOB: OpenDoor ($OPEN)

🔻$31.47 (Dec ’20) → $3.50 (Jan ’24)

After a strong 2019 with 18,000 homes sold for nearly $5B revenue, OpenDoor started 2020 by laying 600 employees (35% of its team) and temporarily suspended home buying activity.

Months later, the company went public through a SPAC deal that valued the company at $4.8 billion.

Since then, the company has faced struggles including mounting losses: the company’s market cap was down under $1B in 2023 from $18B at IPO.

You can see the full 49-slide OpenDoor SPAC deck here.

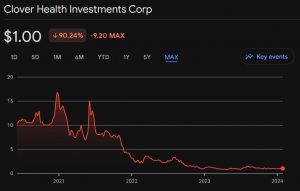

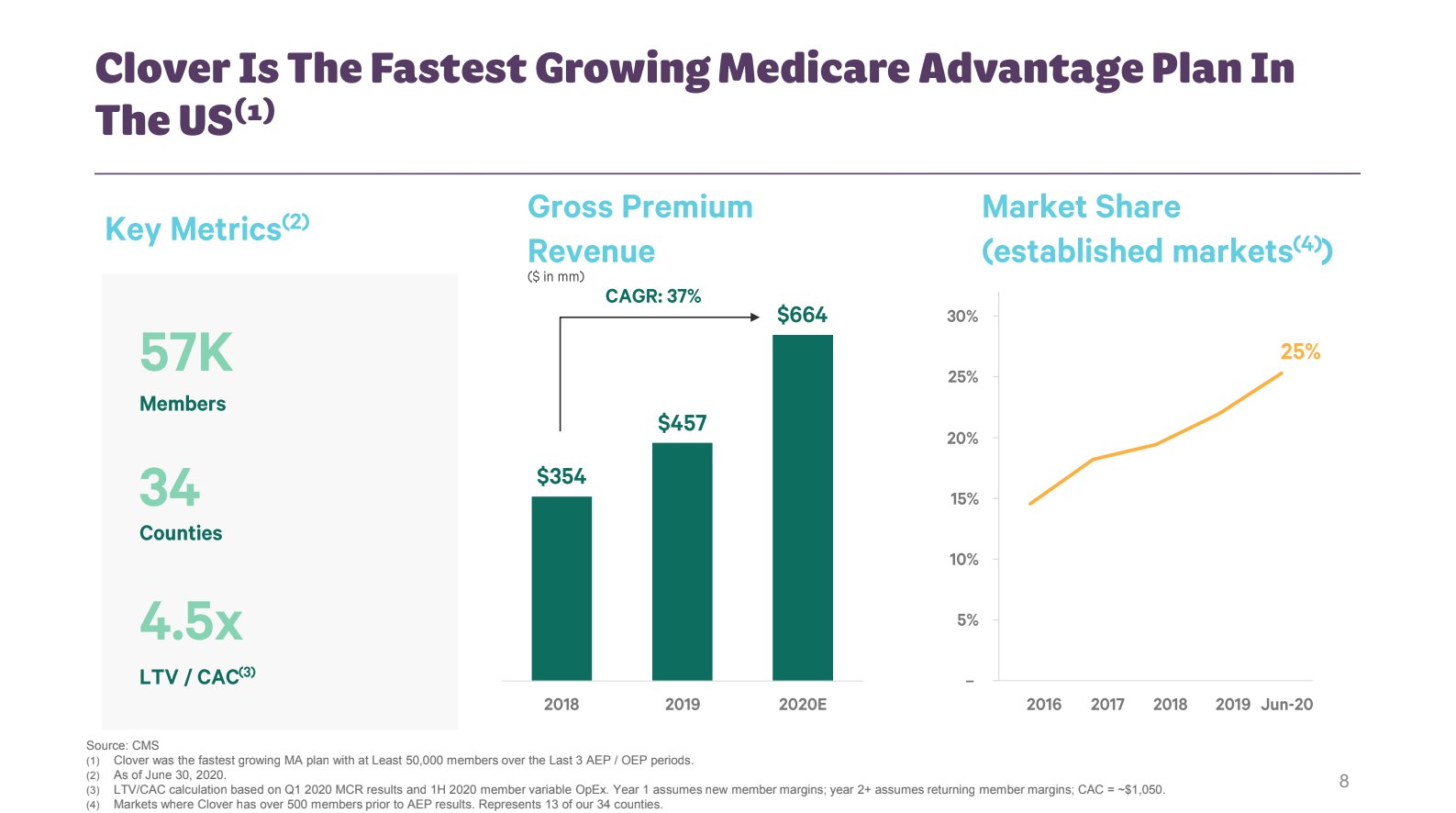

IPOC: Clover Health ($CLOV)

🔻$5.75 (Jan ’21) → $0.99 (Jan ’24)

Clover Health started with Medicare Advantage plans in New Jersey and has since expanded coverage to 6 other states.

In 2020, the company inked a $3.7B SPAC deal that raised $1.2B in funding.

$CLOV ended its first day on public markets (January 8, 2021) with a $7B market cap, falling to under $500M in two years.

See the full Clover Health SPAC deck here.

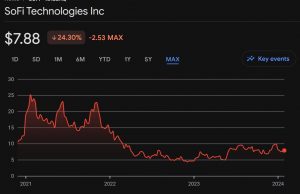

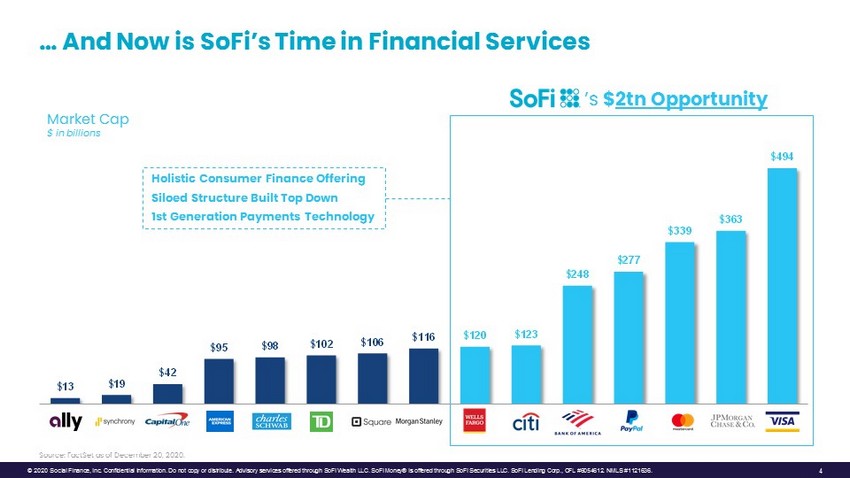

IPOE: SoFi $SOFI

🔻$20.15 (Jun ’21) → $7.88 (Jan ’24)

Neo-banking startup SoFi went public in 2021 raising $2.4B via SPAC merger. Compared to the performance of most SPACs (esp. Chamath’s), SoFi is arguably the most successful: share price is down less than 20% from IPO (vs 80% for most SPACs). The company reported its first profitable quarter in 2024 and is arguably one of the best performing SPAC stocks, alongside Hims & Hers ($HIMS).

See the full SoFi IPO deck here.

* * *

Nearly two years after retail investors lost billions to SPAC mania, the SEC has issued final rules for blank-check companies. The rules, intended to “enhance investor protection” include new disclosure requirements for IPOs and de-SPACs.

See more examples of SPAC pitch decks here, including names like Bird, Nextdoor, and Hims.