In the world of venture capital, tear sheets play an important role. Whether you’re a startup founder of VC firm partner, it’s crucial to understand what a tear sheet is and how to create an effective one for your fund or company.

What is a tear sheet?

In the world of venture capital, a tear sheet, or “fact sheet,” is a one-page update for investors. The term comes from an old practice in which S&P stockbrokers would tear a sheet out of their summary books to give to investors in the pre-internet era. The tear sheet (although it is no longer physically torn) is still an essential piece of collateral for anyone working in VC. Tear sheets are generally sent every quarter or month to help LPs understand how their investment is performing.

How to create a tear sheet

There’s no reason to overcomplicate or get overly creative when designing a tear sheet — simply provide the high-level information that LPs need to model scenarios & understand the state of your business. Below are the typical fields expected to be included in (most) tear sheets:

The fields to include will slightly differ for investment firms vs. portfolio companies. Although you don’t have to include every field listed below (depending on the nature of your business), this should serve as a guideline for the fields that LPs will be looking for:

For (ie. VC & PE firms, quant funds), a tear sheet should include….

- Overview of the fund: a brief description of your fund (the origin, story, founders, etc.)

- Investment thesis: generally a one-sentence statement describing your investing paradigm

- Investment strategy: elaborate on the top-level criteria that dictates your investing strategy

- Financials: performance overview graph &/or table

- Fund summary: summary of terms (ie. minimum investment, management fees)

- Portfolio: breakdown portfolio composition by category/industry

- Team: who are the people behind your fund (founding & general partners)

On the other hand, for startups & portfolio companies:

- Overview of the company: a brief description of your startup (the origin, story, founders, etc.)

- Mission statement: generally a one-sentence statement describing your core vision

- Investment highlights: elaborate on the top-level

- Financials: performance overview graph &/or table

- KPIs overview: summary of quantitative data (ie. sales, headcount, ACV, NPS)

- Team: who are the people behind your startup (founders & directors)

Catherin Chen of Lightspeed Venture Partners offers some sage advice for a successful tear sheet:

“You don’t want to start with open floodgates that give them too much information upfront,” she warns. “When you try to take information away, people will definitely say something. It’s easier to add later on than it is to delete.”

How to create a tear sheet:

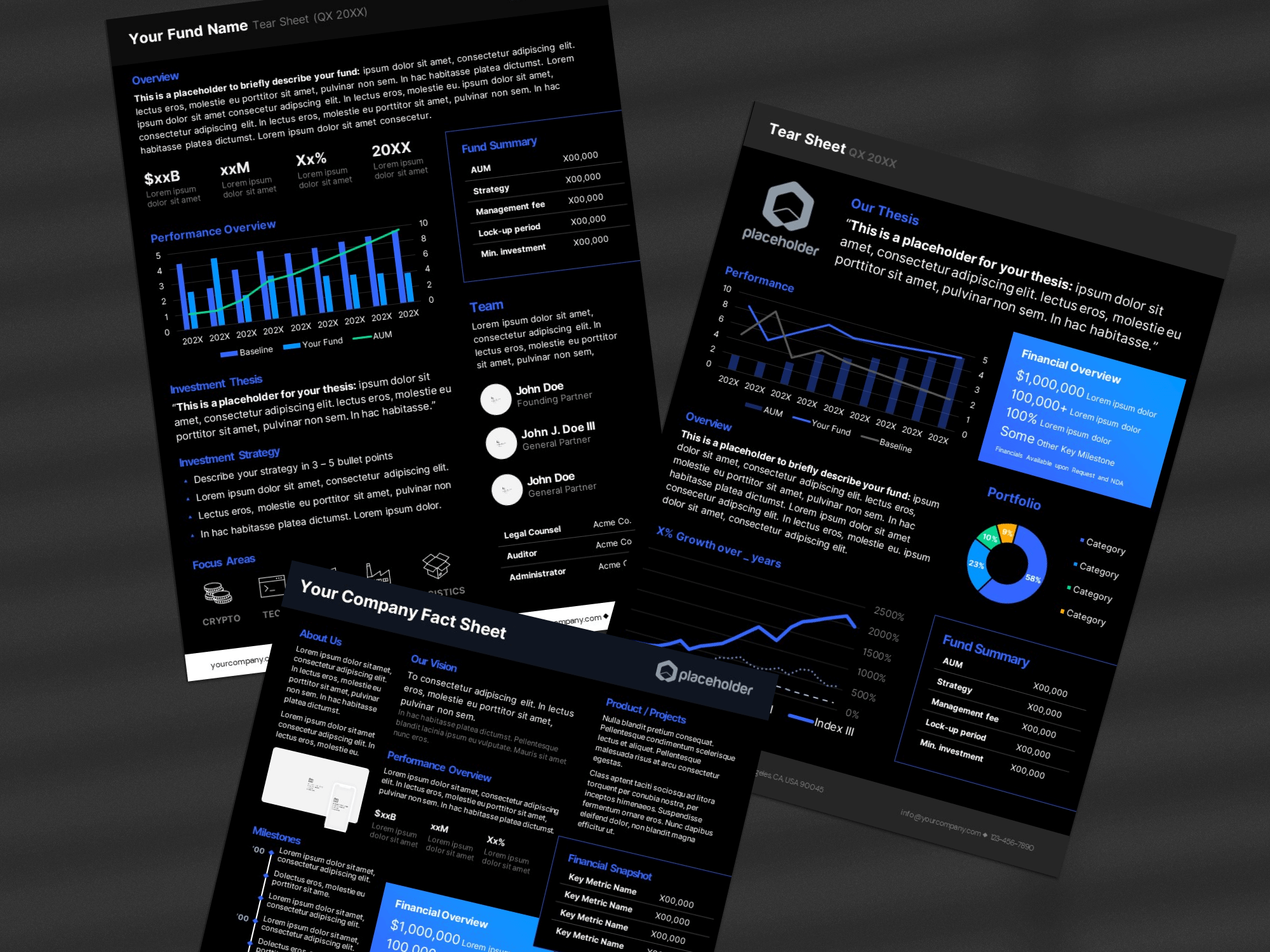

A tear sheet is a crucial tool for VCs & startups to keep LPs informed & secure capital commitments from investors. You might be interested in the popular Tear Sheet Template (.PPT) designed by our pitch deck experts. Our team has created pitch collateral that has closed billions from leading investors. Create a professional-grade tear sheet in just a few minutes with this template — check it out here. Alternatively, check out our collection of one-pager templates for startups: everything from executive summaries to factsheets!