A real estate investor memo is your key to effectively presenting an investment opportunity. It underscores the property’s value, financial projections, and unique selling points, helping investors understand why they should back your deal.

This guide breaks down the essential sections to include, ensuring your memo is professional, clear, and persuasive.

What is a real estate investor memorandum? What is its purpose?

A real estate investor memorandum is a detailed document that outlines a specific investment opportunity in real estate.

Its purpose is to provide potential investors with the information they need to evaluate the opportunity, such as the property’s attributes, the investment strategy, and projected financial returns.

By addressing all critical aspects of the project, the memo acts as a persuasive tool to build investor confidence and attract funding.

What slides should be in your investor memo?

Cover

The cover is your first chance to make an impression and set the tone for the entire investor memo. Include the property name, address, and project title in a clean, professional layout. Keep your branding subtle and consistent to create a polished and inviting first impression.

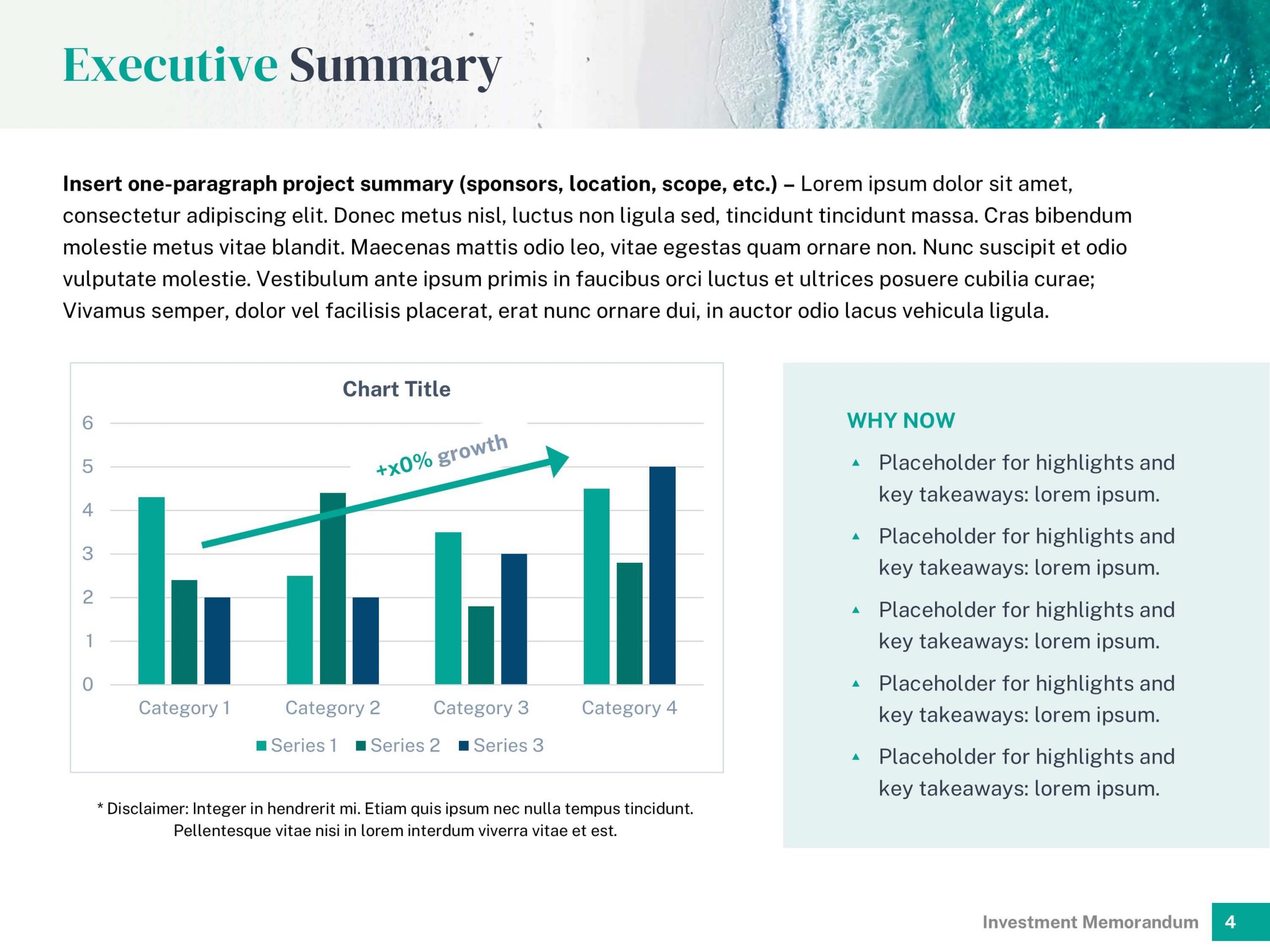

Executive Summary

Start your presentation with a clear and engaging summary of your project. This section should outline the property, your investment strategy, the project timeline, and market advantages.

- Project Summary: Summarize the property’s background: highlight the location, current status, and the vision for value creation through renovations, leasing, or repositioning.

- Key Metrics: Use a chart to present essential projections, such as NOI growth, IRR, or cash flow, to provide a visual snapshot of financial performance.

- Why Now: Emphasize the urgency by addressing favorable market trends, unique opportunities in the submarket, or time-sensitive benefits such as pricing or development cycles.

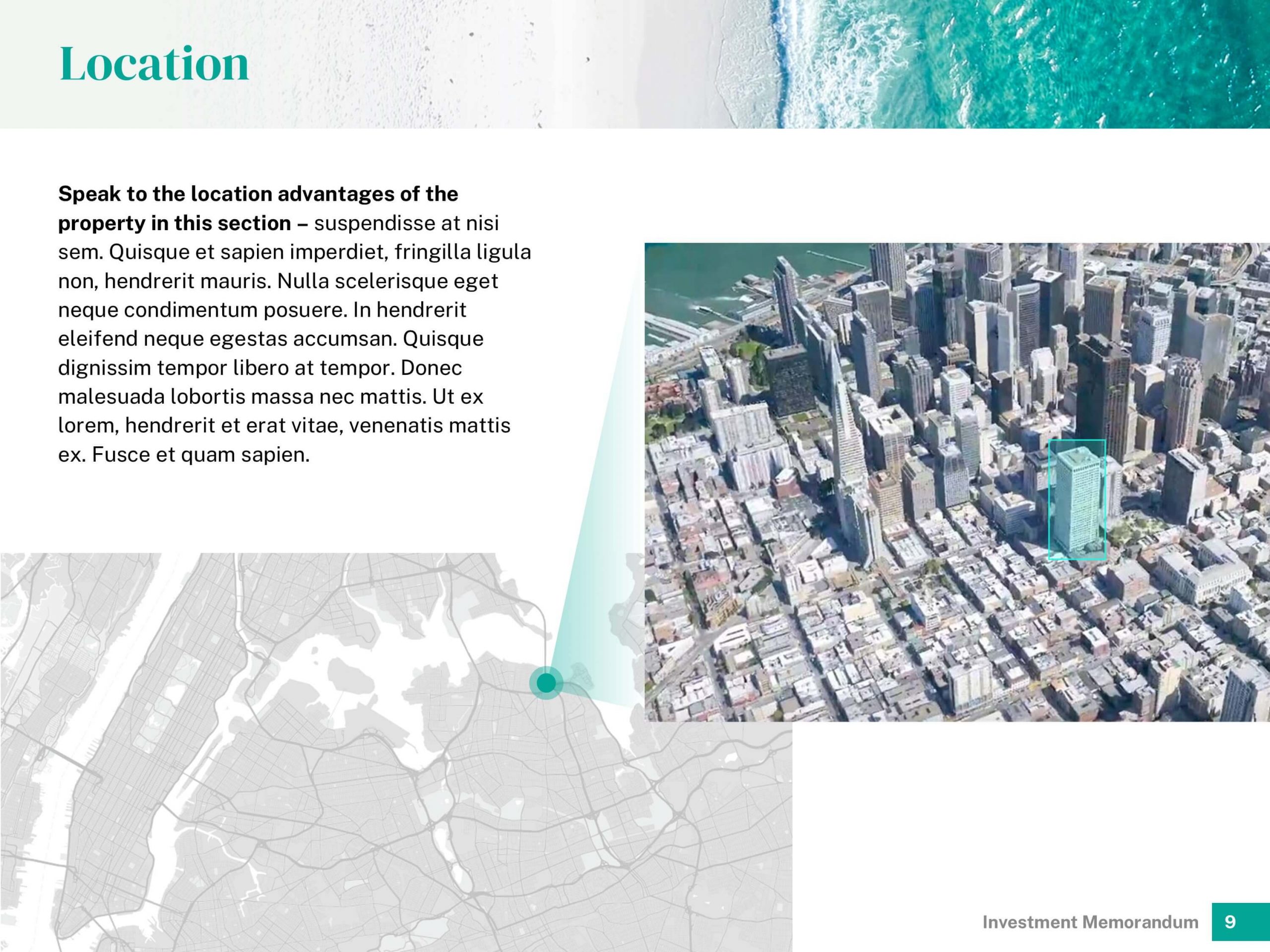

Location

Speak to the location advantages of the property in this section. Use the aerial image to showcase the property’s surroundings and demonstrate its proximity to key landmarks, infrastructure, or amenities. Pair this with a map to provide clear geographic context. Discuss factors such as accessibility, connectivity, and growth potential to effectively convey the strategic benefits of the location.

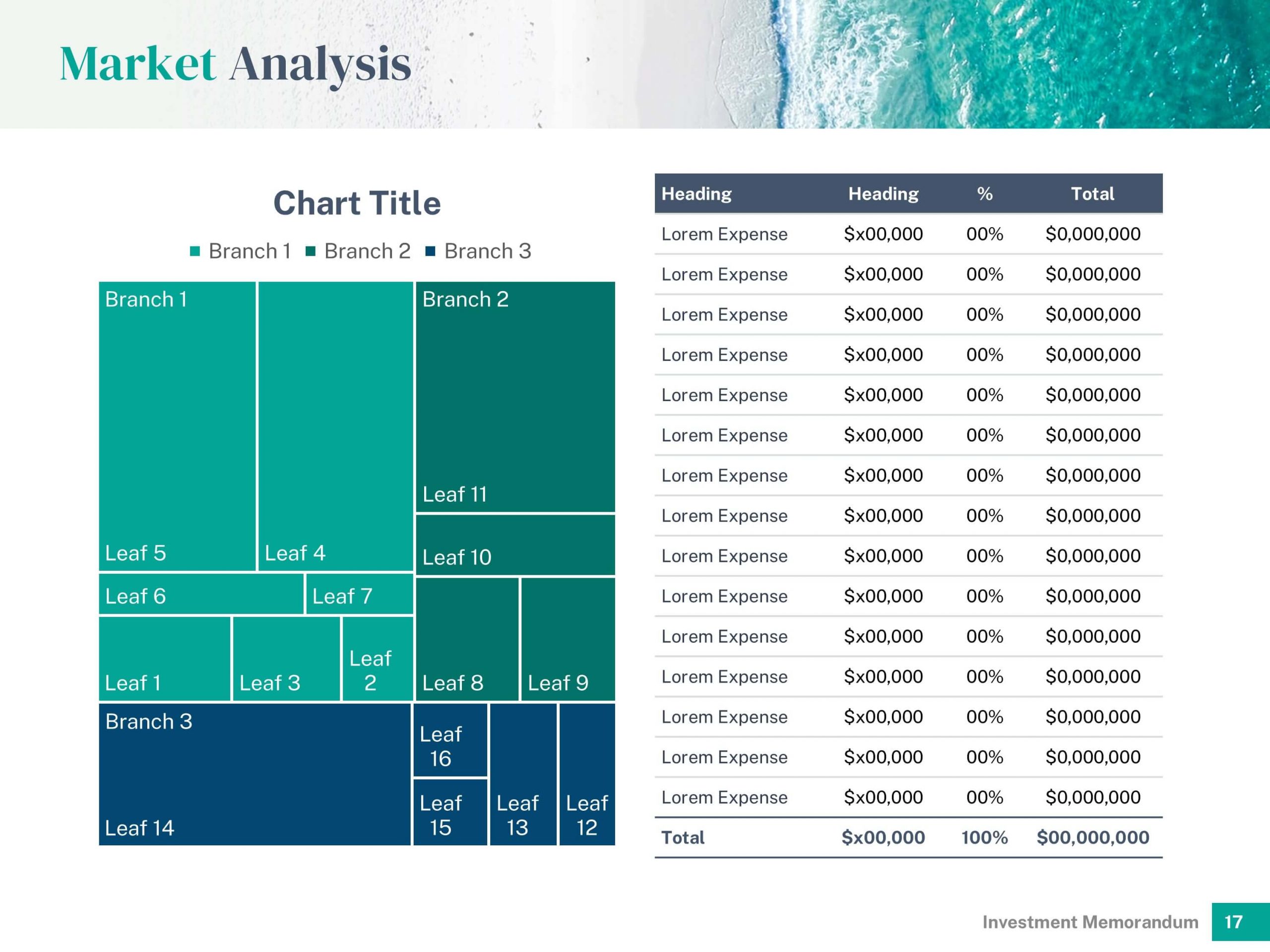

Market Analysis

A market analysis slide should provide a comprehensive view of the property’s position within the broader market. Use data visualizations to showcase key metrics such as market segments, competitive performance, or growth opportunities. Accompany these visuals with clear explanations that feature the market’s strengths, demand trends, and how the property aligns with these dynamics.

Competitive Set

This slide should compare the property to similar assets in the area to give investors a clear understanding of its market positioning. Highlight advantages such as price per square foot, unique amenities, or higher occupancy rates. This slide should demonstrate your understanding of the local market and how your property stands out from competitors.

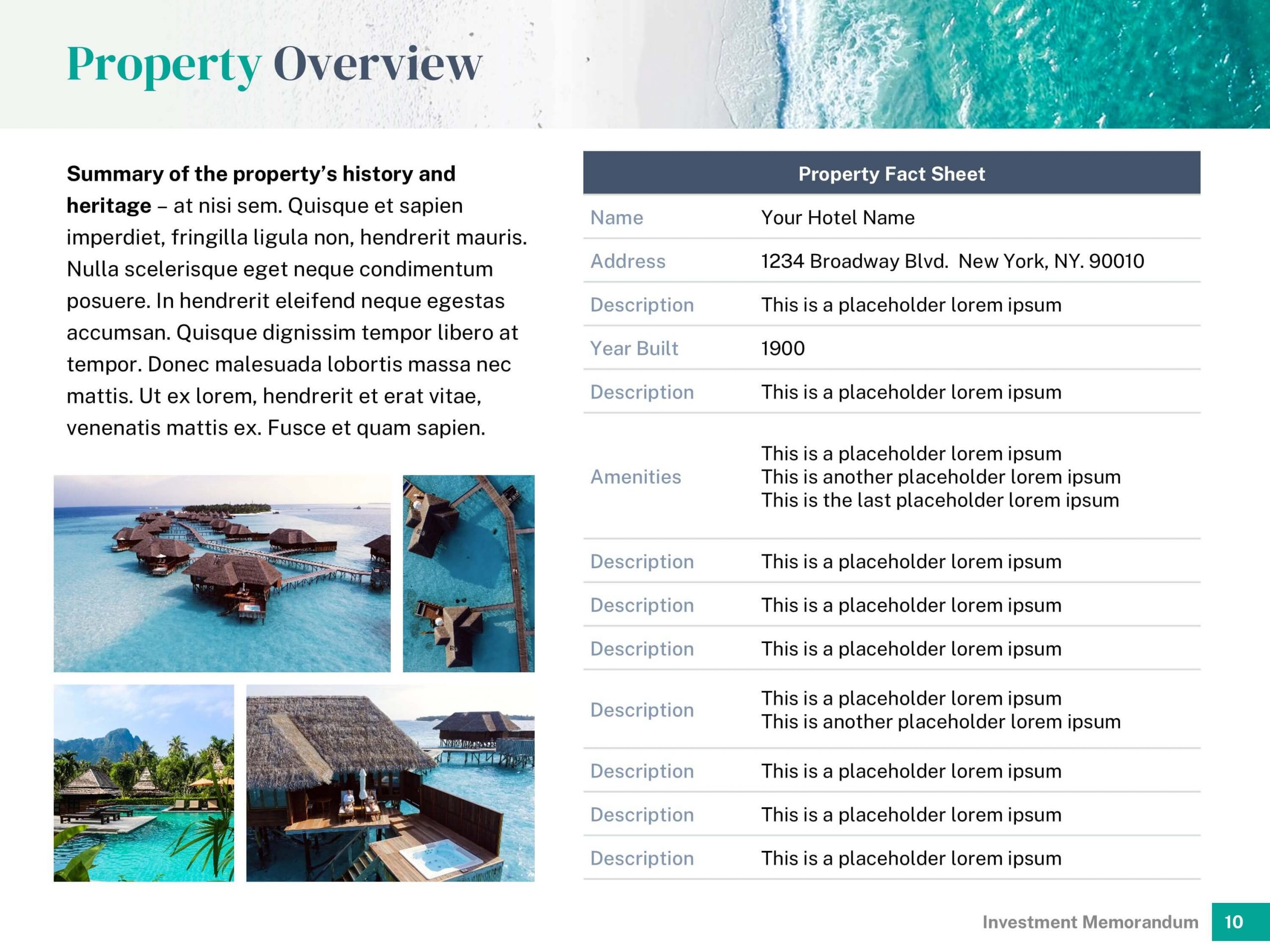

Property Highlights

Introduce the property to investors by summarizing its history, features, and current status. Focus on key details, as seen in the fact sheet of this sample slide, such as the property name, address, year built, and unique characteristics. Use visuals like property images or renders to showcase its design and appeal. This section should provide a snapshot of the property, offering context on what makes it a standout investment opportunity.

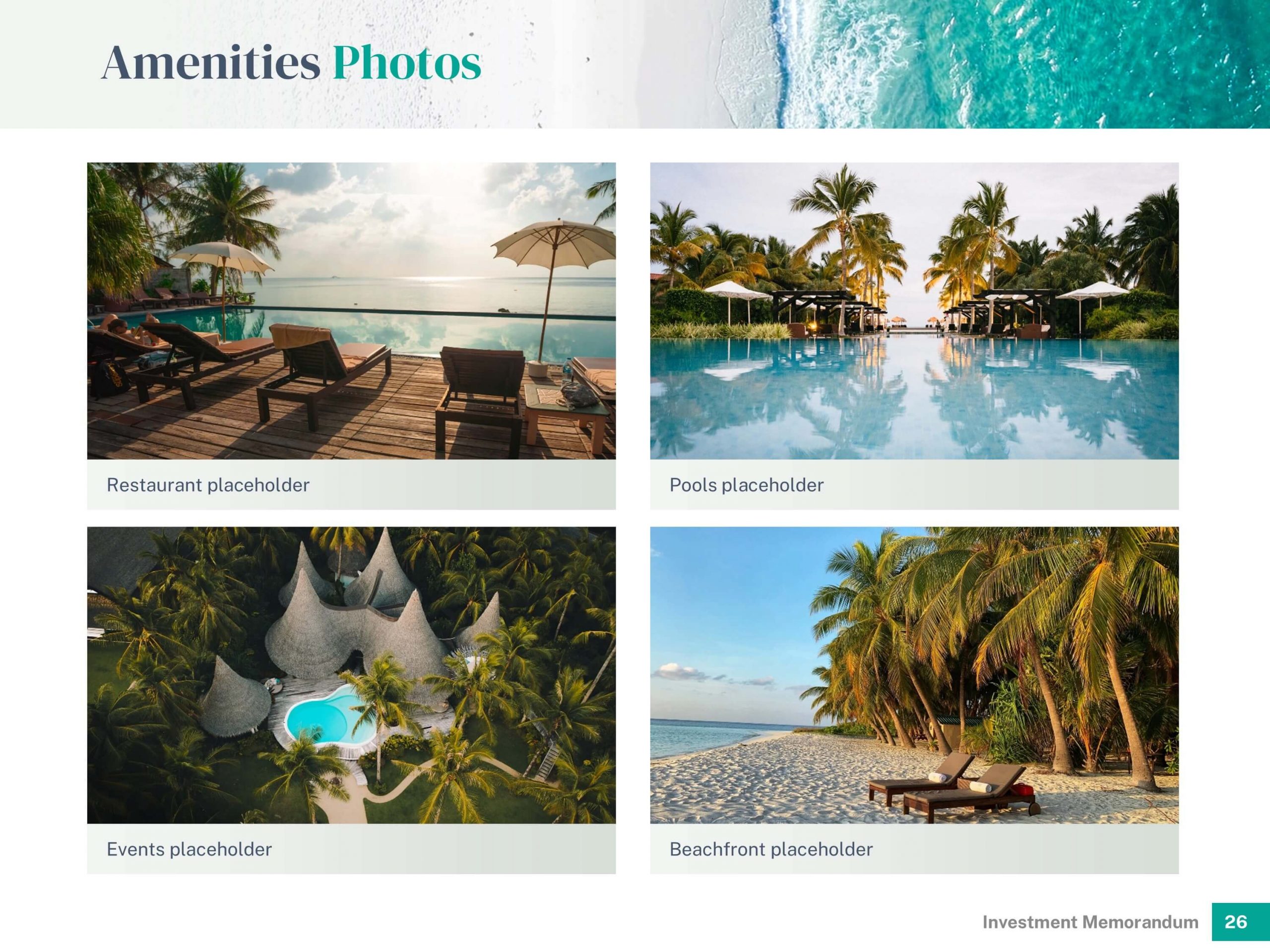

Amenities

The amenities slide should focus on the property’s standout features, such as restaurants, event centers, pools, or green spaces. Incorporate high-quality images and descriptions to make these features feel tangible and desirable. This slide is particularly important for properties aiming to attract premium tenants or buyers.

Investment Strategy

Explain in this slide how you plan to maximize returns,whether through development, renovation, or rental income. Use market data and projections to support your approach. A clear and well-reasoned strategy will help reassure investors of the project’s viability.

Transaction Summary

The transaction summary slide should outline key details of the acquisition, including the purchase price, closing costs, and other transaction specifics. This slide should provide an overview of the deal’s structure and financial requirements.

Financial Analysis

The financial analysis slide should present detailed financial projections, including income, expenses, and cash flow. It should provide a clear breakdown of projected financial metrics, such as occupancy, ADR, and RevPAR, along with operational expenses and NOI projections. These details are essential for illustrating the financial viability of the investment and supporting the overall business case.

Timeline

A detailed timeline provides investors with a roadmap of the project’s key milestones. For this slide, use a graphical timeline or Gantt chart to outline important dates, such as acquisition, construction, leasing, and stabilization. Each milestone should be clearly labeled and aligned with the investment strategy to provide a cohesive picture of the project’s progress.

Risk Analysis

Transparency about risks is essential to earning investor trust. This slide should identify potential challenges, such as market volatility, construction delays, or tenant risks, and offer clear mitigation strategies. Providing data or scenarios that demonstrate preparedness to handle these risks will reassure investors that you have thoroughly evaluated potential pitfalls.

Pro Tip: The analysis should strike a balance between honesty and confidence in the project’s resilience.

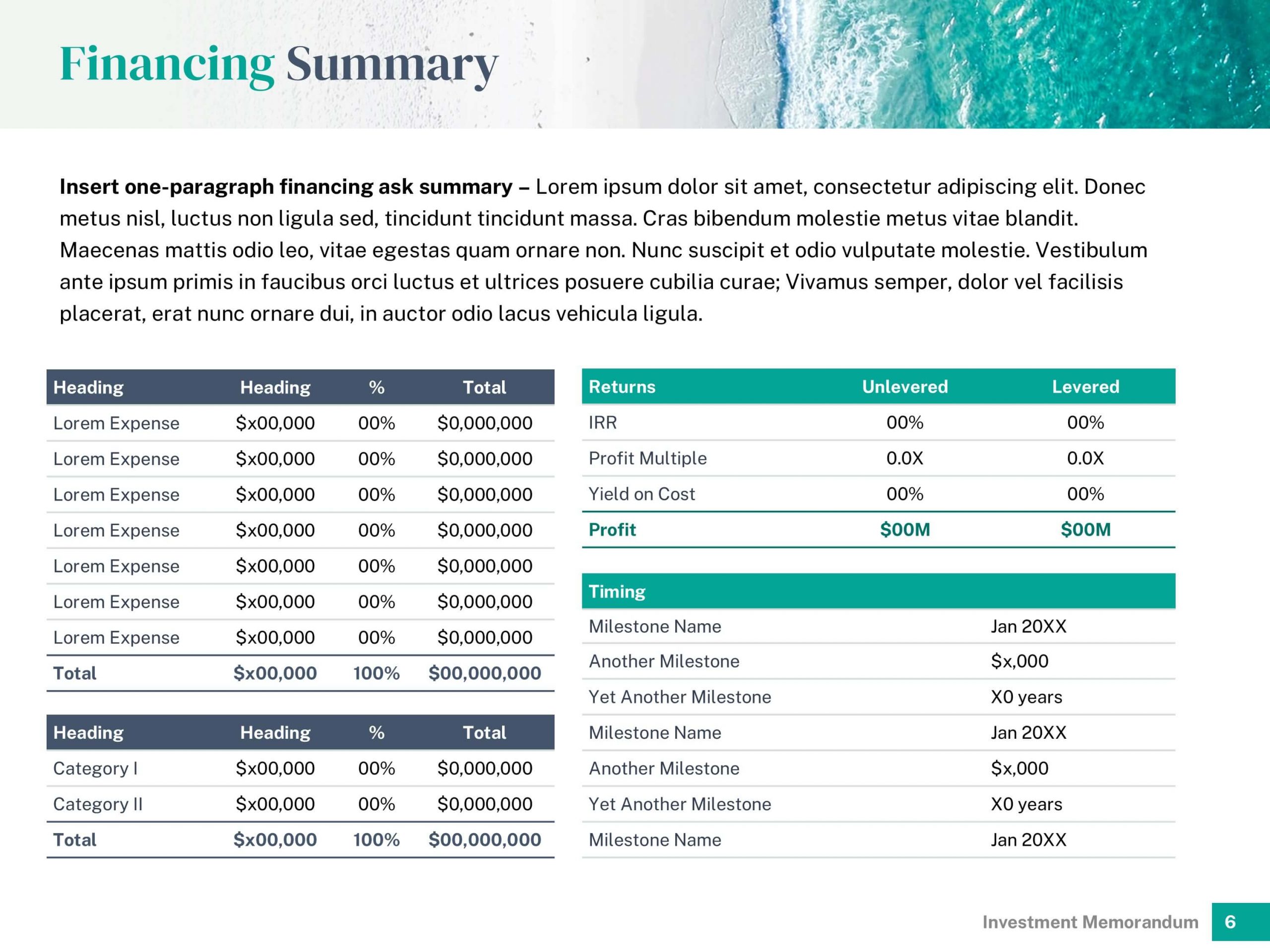

Investment Terms / Sources & Uses

In this slide, detail how funds will be allocated and clarify the terms of the investment. Use a narrative to explain the breakdown of sources and uses of capital, supported by a visual like a pie chart to enhance understanding. Clearly define key terms such as minimum contributions, preferred returns, and equity stakes. Ensure that the structure is easy to follow and leaves no ambiguity about the financial arrangement.

Sponsor Overview (About the Team)

The sponsor overview helps build credibility by showing the team’s experience and success. Provide detailed profiles of the key team members, including their roles and relevant accomplishments. Past successes, particularly in similar projects, should be emphasized to instill confidence in the team’s ability to deliver results. Consider adding professional headshots and contact details for a polished touch to this section.

Contact

The contact slide should provide all necessary information for investors to reach out. Include phone numbers, email addresses, and links to your website and social media profiles. This slide ensures that interested parties can easily follow up.

Appendix

Use this slide for additional data and resources that support your memo. Include supplemental charts, property reports, or technical analyses that provide deeper insight into the project. Organize the appendix with a table of contents for easy navigation, ensuring that investors can quickly find the information they need.

Tips for designing a winning real estate investor memo

- Use visuals to “make it feel real”: Incorporate high-quality photos, conceptual renderings, or even comparison images if original visuals are unavailable.

- Don’t avoid risk analysis: Show that you’ve considered all potential pitfalls and have robust plans to address them.

- Maintain a professional design: Use consistent fonts, colors, and layouts that align with your brand identity.

- Prioritize clarity and conciseness: Avoid overloading slides with text; use bullet points and charts where appropriate.

Ready to elevate your investment presentation?

The real estate investment memorandum is a crucial tool for showcasing your property to potential investors and securing funding for your project. You might be interested in the popular Real Estate Investment Memo Template by VIP Graphics: expertly crafted slides that have helped secure millions in funding for top-tier real estate projects. Creating a professional-grade investor memo is quick and easy with this template — check it out here.