Real estate investor memorandums serve the same essential function for real estate developers and sponsors that pitch decks do for startup founders. Investor memos in the real estate industry serve as a strategic document to showcases investment opportunities to potential backers, typically underscoring the property’s value, financial projections, and unique selling points, providing investors the key details they need to make informed decisions about your deal. This guide will breakdown how to structure your real estate investor memo, and all the key information that should be included:

What is a real estate investor memorandum? What is its purpose?

Real estate investor memos are comprehensive documents (typically in the form of a slide deck / presentation) outlining a given investment opportunity to potential capital partners.

The purpose of a real estate investor memo is to provide investors with comprehensive information about the property, location, market conditions, and expected financial outcomes. Unlike many other asset classes, the real estate industry differs with longer holding periods and complex value-creation strategies that require clear explanation.

In recent years, investor memos used by successful sponsors have become increasingly data-driven, integrating both qualitative and quantitative analysis. The most effective memos balance technical analysis with clear storytelling.

What slides should be in your investor memo?

Cover

In any presentation (real estate investor memo or otherwise), the cover is your first chance to make an impression and set the tone for the entire investor memo. This slide is generally features a photo or 3D render / mockup of the property (especially for hotel and hospitality developers), so investors can visualize what you plan to build from the start. Often, the cover slide in real estate investor memorandums will also include the property address and/or sponsor contact information.

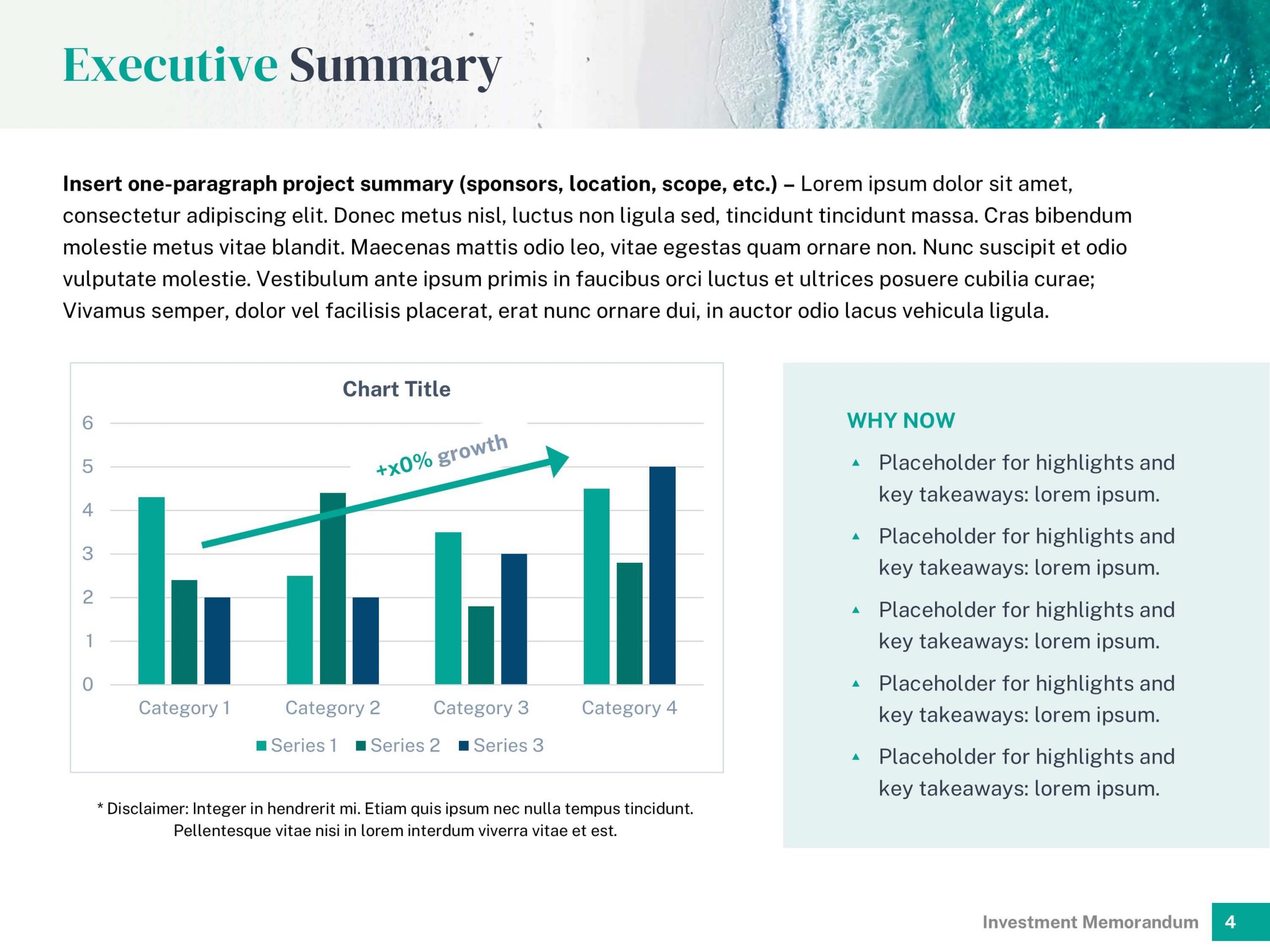

Executive Summary

Although convential wisdom generally suggests ending (not starting) with a summary, most real estate investor memos will begin with an overview of the key highlights in a presentation. The intention of the executive summary is to provide investors with the high-level details of the investment opportunity before diving into the details. Typically, this page will include a brief written summary of the location, sponsors, and development plan, along with key metrics (such as NOI growth, IRR, or cash flow). The most effective memos will include data to support “why now” is the right time, and create urgency by addressing favorable market trends, unique opportunities in the submarket, or time-sensitive benefits such as pricing or development cycles.

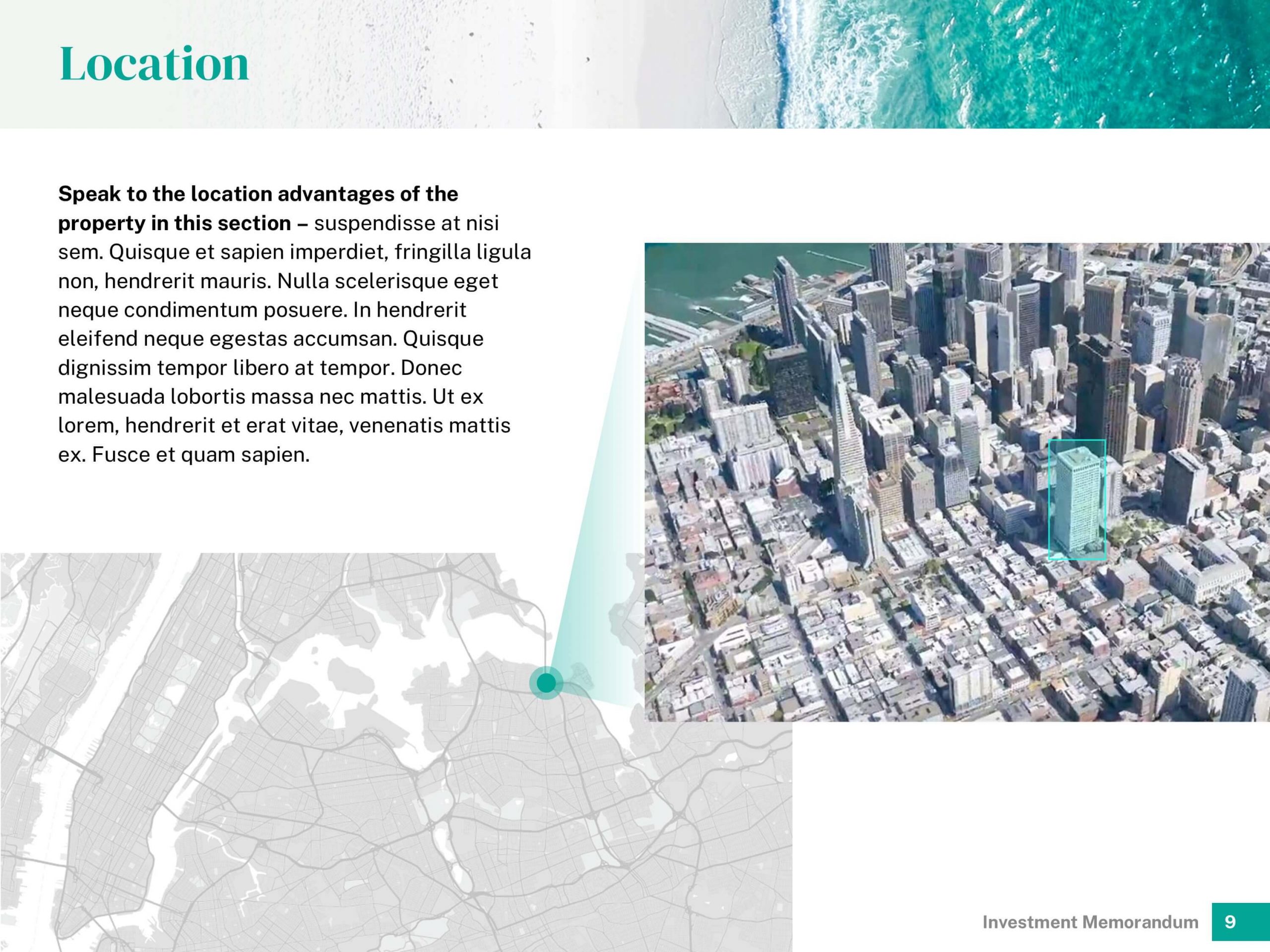

Location

One of the most important considerations in any real estate investment is where the property will be located. Investors will want to know the advantages of the property’s location: this slide is a great place to use maps and/or aerial imagery to showcase the property’s surroundings and demonstrate its proximity to key amenities, high-traffic streets, and shopping districts or neighborhoods. Even real estate investors who haven’t identified a specific location yet, this slide can describe the target region and criteria.

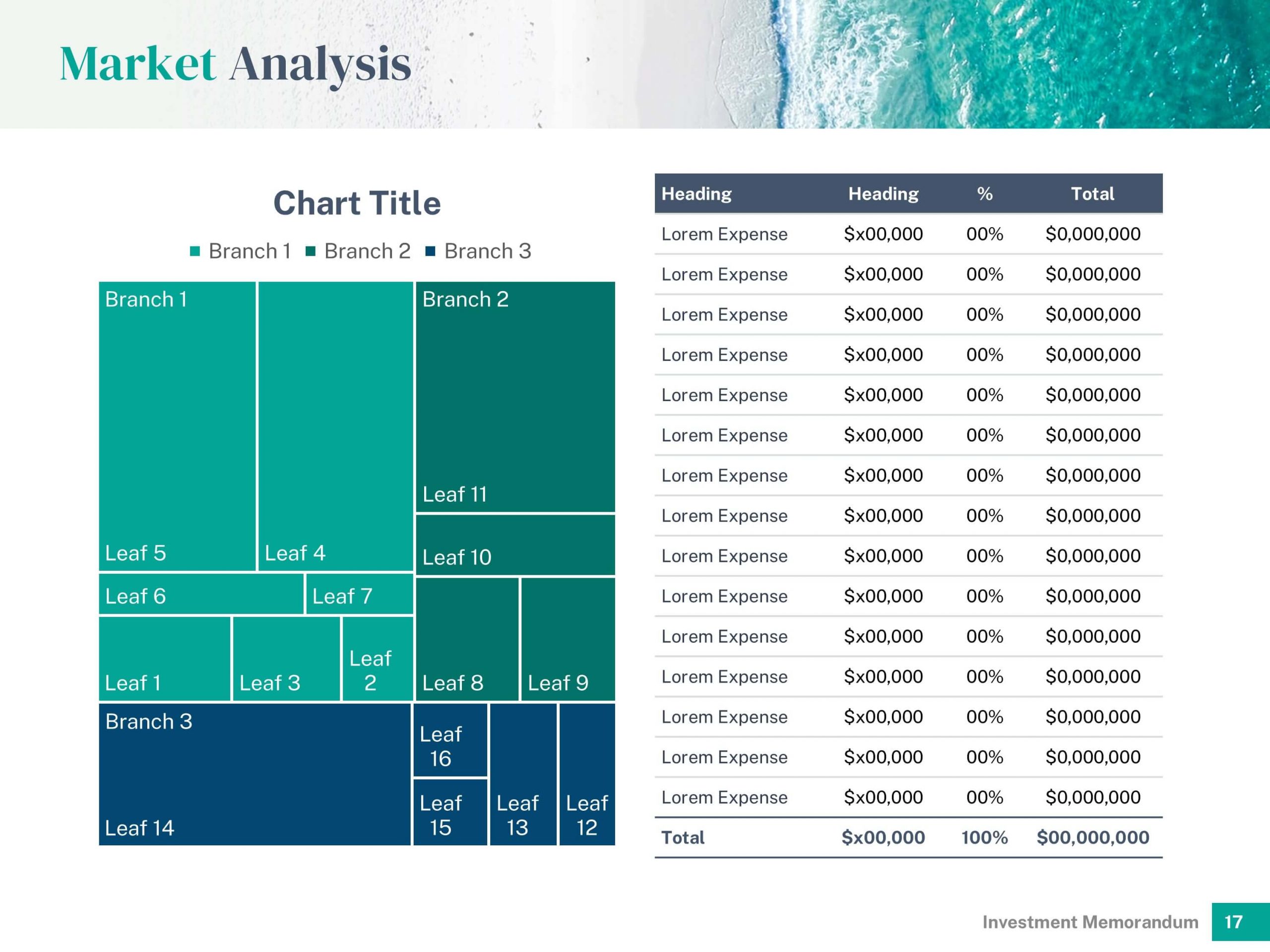

Market Analysis

The market overview in a real estate investor memo provides insights on the real estate market where your building is located. Common metrics presented on this slide include local population demographics and consumer preferences, spending patterns, historical performance, and growth trends.

Competitive Set

Following the market slide, most real estate investor memos will include a deep dive into property to similar assets in the area. This slide generally includes data on price points (rents, sales price per square foot, ADR, etc.), occupancy, and supply analysis. The goal is to demonstrate your understanding of the local market and how your property stands out from competitors. At the same time, don’t think of this strictly as a “Competition” slide — it can also double as a “Comparables” page, demonstrating validation of demand in the chosen location.

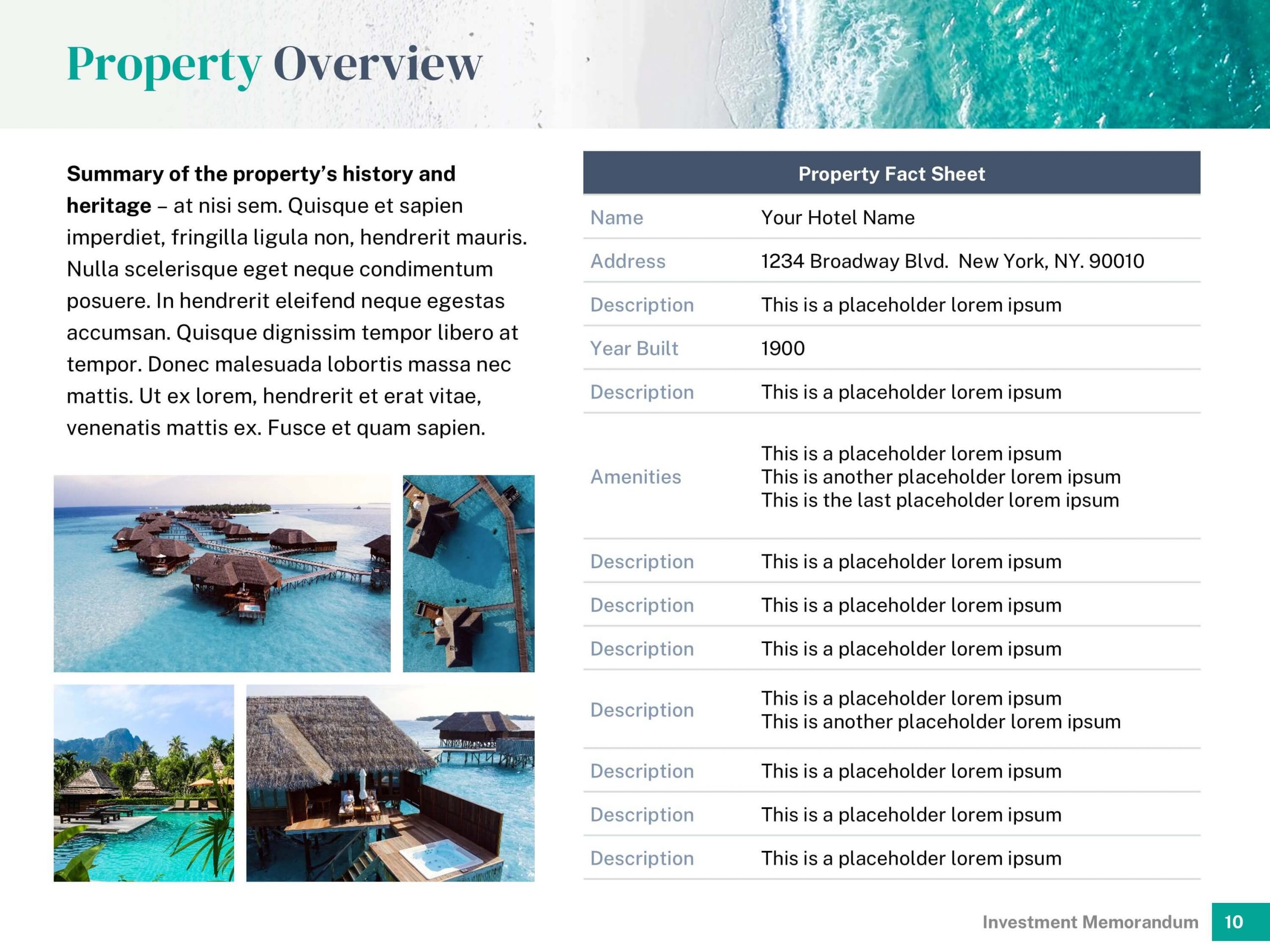

Property Overview

At the crux of your memo lies the Site / Property Description: a detailed summary of key features and amenities. This slide acts as snapshot of the property, summarizing all key context in one place, usually supplemented by property images or renders. Pitches for historic properties may include a description of the site’s heritage and history.

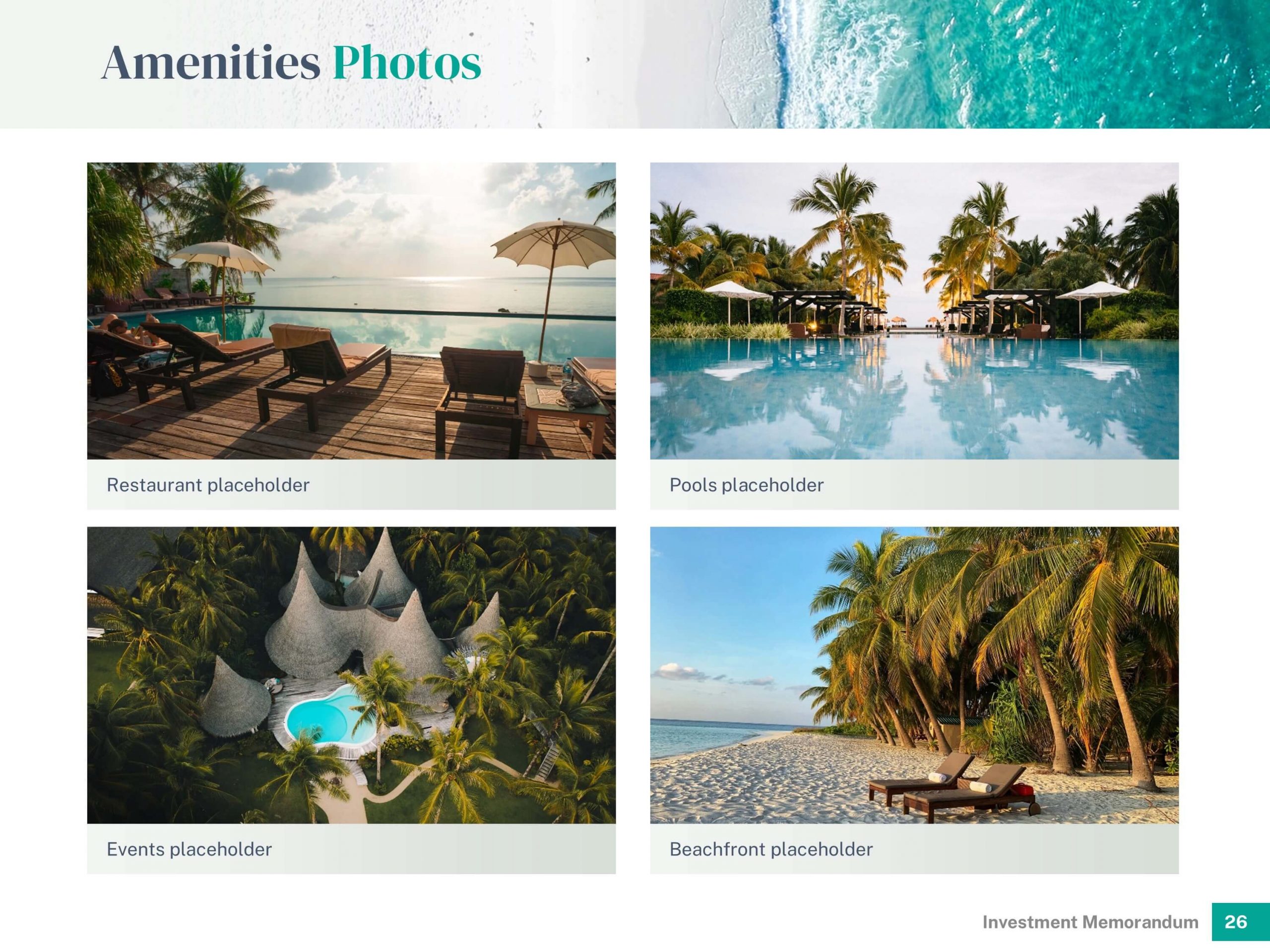

Amenities

The amenities slide should outline on the property’s standout features, such as restaurants, event centers, pools, or green spaces. It’s critical to incorporate high-quality images to make these features feel tangible and desirable. Don’t just list amenities, dive deep into special features and maximum occupancy. Some memos will include entire pages featuring collages of photos and renders, so investors gain a mental image of what the realized vision would look like.

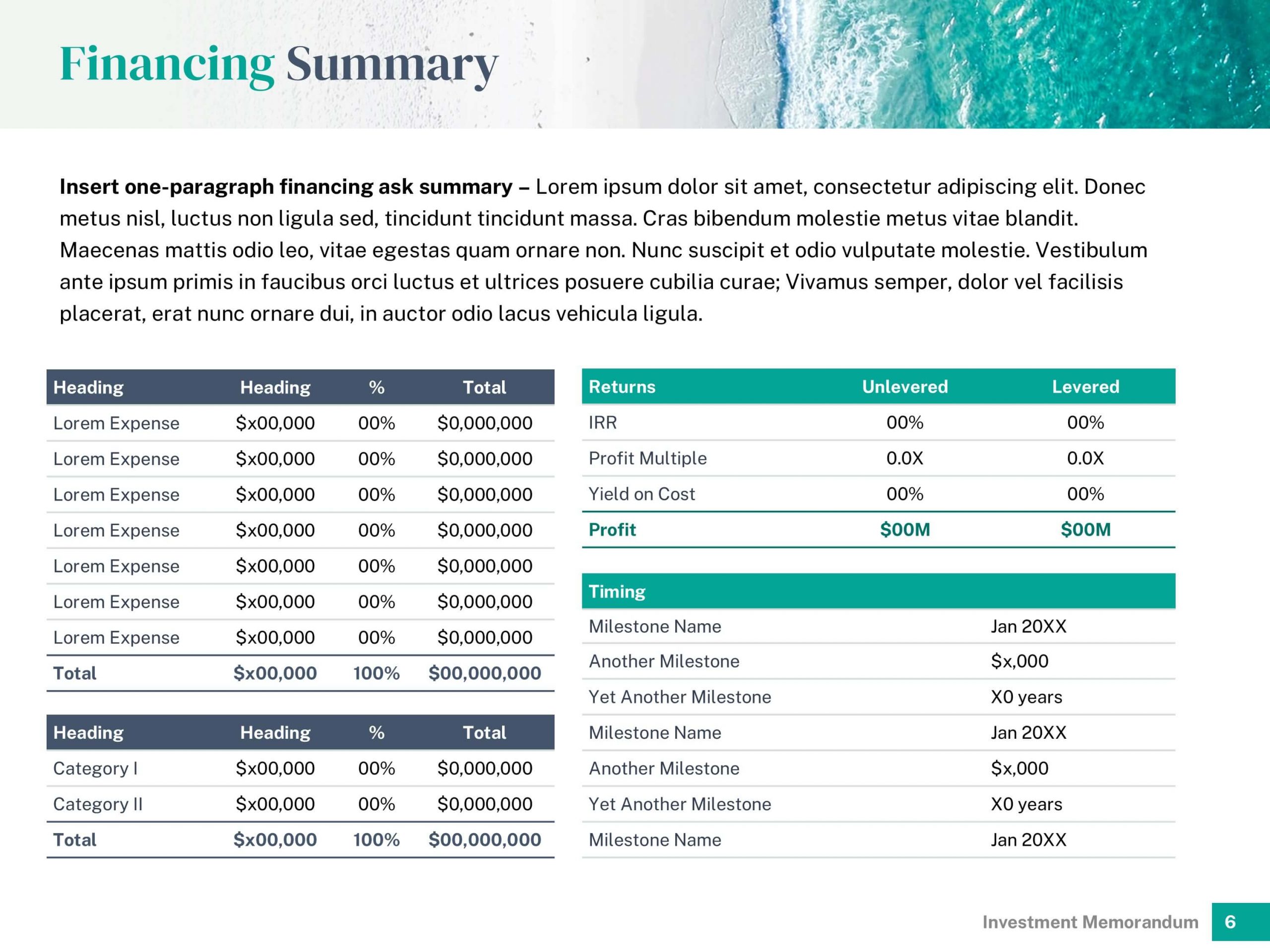

Transaction Summary

The transaction summary is generally a numbers-focused slide, outlining both key expenses (such as purchase price and closing costs project) and return metrics (such as levered and unlevered returns, IRR, equity multiple, net profit, cash-on-cash yield, etc.) This slide should provide an overview of the deal’s structure and financial requirements, but typically doesn’t include investment terms (which are discussed in a later slide).

Financial Analysis

The financials slide should present detailed financial projections, including both cash flow (income and expenses) as well as underlying metrics, such as occupancy, ADR, and RevPAR, along with operational expenses and NOI projections. Ensure you include the assumptions that support your projections, such as sale / rental prices, growth rates, unit count, occupancy rates, and other debt terms. This slide should present a compelling business case for the financial viability of the investment.

Timeline

In real estate, timing is of the essence, and timelines from investment to grand opening can span months to years (depending on the scope of the project). This slide should break down through the development process with target dates for all key milestones (such as acquisition, construction, leasing, and stabilization). Often, real estate investor memos utilize a timeline or Gantt chart to present this in a visually-approachable manner.

Risk Analysis

Any investment (including in real estate) poses various risks. It may seem counter-intuitive to discuss risks in an investor pitch, but transparency about risks (and how you plan to mitigate them) is essential to winning investors’ confidence. The risk analysis slide should identify potential challenges (ie. market volatility, construction delays, or tenant risks), and offer thoughtful and actionable mitigation strategies. Providing supporting data or comparables can will reassure investors that you have thoroughly evaluated potential pitfalls and have prepared adequately to handle these risks .

Investment Terms / Sources & Uses

No investor memo is complete without describing the investment terms and use of funds. Some memos will dedicate a separate slide to defining the terms of the investment (such as minimum contributions, preferred returns, and equity stakes), but it can be helpful to show the funding and sources and uses of capital side-by-side. Investors will want to see a comprehensive how you will utilize their capital; common categories include purchase price, closing costs, acquisition fee, and working capital.

Sponsor Overview / Team

The Sponsor Overview (or Team slide) in an investor memo showcases your leadership’s experience and past success. This slide should provide detailed profiles of key team members, including their roles and relevant expertise / accomplishments. Past success, particularly in developing similar projects, should be emphasized to instill confidence in the team’s ability to deliver results. Professional headshots are a great way to give this section a professional touch.

Contact

Every successful presentation should end with a clear call-to-action: for real estate investor memos, this is the contact slide. This page is self-explanatory: provide all necessary information so investors and interested parties can easily reach out to your team. Include multiple points of contact (phone numbers, email addresses) and links to your website or additional documents & information.

Appendix

Like most investor pitch decks, real estate investor memos often include appendices to provide supplemental data & materials, which would otherwise disrupt the flow of the core presentation. This is the place to present supporting data and more detailed financial statements. Often, sponsors will include supplemental charts, property reports, or technical analyses that provide deeper insight into the project in the appendix.

Tips for designing a winning real estate investor memo

- Use visuals to “make it feel real”: Incorporate high-quality photos, conceptual renderings, or even comparison images if original visuals are unavailable.

- Don’t avoid risk analysis: Show that you’ve considered all potential pitfalls and have robust plans to address them.

- Maintain a professional design: Use consistent fonts, colors, and layouts that align with your brand identity.

- Prioritize clarity and conciseness: Avoid overloading slides with text; use bullet points and charts where appropriate.

Ready to elevate your investment presentation?

A well-designed and comprehensive real estate investment memorandum is critical to securing potential investors and funding for your project or property. You might be interested in the popular Real Estate Investment Memo Template by VIP Graphics: expertly-crafted slides that have helped secure millions in funding across commercial real estate (CRE), residential real estate, and hospitality (hotels and vacation rentals). Creating a professional-grade investor memo is quick and easy with this expert-made template — check it out here.