What are SPACs?

A special purpose acquisition company (SPAC) is a company created solely to merge or acquire another business and take it public — essentially a faster alternative to an initial public offering. Also known as a “blank check company”, a SPAC is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public.

SPACs were created by David Nussbaum in 1993, but gained recent popularity after Chamath Palihapitiya espoused the concept as an “IPO. 2.0” on CNBC, podcasts, and social media. The trend took Wall Street by fire between 2020 to 2021, during which time several unicorn startups across industries went public via SPAC mergers.

Below are a few examples of pitch decks from successful SPAC mergers:

What are examples of successful SPAC pitch decks?

18+ pitch decks that helped close billions in SPAC deals:

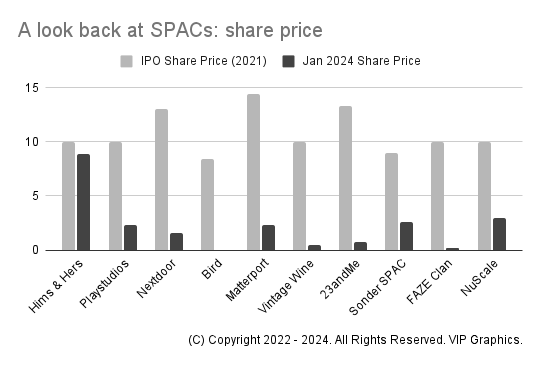

Below are the share prices as of the time of this writing (September 2022) vs. the price when the SPAC deal was initially closed and started trading on public markets:

1) Hims & Hers (NYSE:HIMS) — $10 (Jan ’21) → $5.98

2) Playstudios (NASDAQ:MYPS) — $10 (Jun ’21) → $3.39

3) Nextdoor (NASDAQ:MYPS) — $13 (Nov ’21) → $2.89

4) Circle Internet

5) Bird (NYSE:BIRD) — $8.40 (Nov ’21) → $0.45

6) Matterport (NASDAQ:MTTR) — $14.42 (Jul ’21) → $4.24

7) Vintage Wine Estates (NASDAQ:VWE) — $10 (Jun ’21) → $5.60

8) 23andMe (NASDAQ:ME) — $13.32 (Jun ’21) → $3.22

9) Sonder SPAC (NASDAQ:SOND) — $8.95 (Jan ’22) → $1.95

10) Leafly (NASDAQ:LEAFLY) $11 (peak: Apr ’22) → $4.02 (Jan ’24)

11) FaZe Clan (NASDAQ:FAZE) $13 (Jul ’22) → $0.19 (Jan ’24)

12) Virgin Galactic (NASDAQ:OPEN) $11.75 (Oct ’19) → $1.74 (Jan ’24)

13) Opendoor (NASDAQ:OPEN) $31.47 (Dec ’20) → $3.50 (Jan ’24)

14) Clover Health (NASDAQ:CLOV) $5.75 (Nov ’21) → $0.99 (Jan ’24)

15) SoFi (NASDAQ:CLOV) $20.15 (Jun ’21) → $7.88 (Jan ’24)

16) Arrival (NASDAQ:ARVL) $22 (Mar ’21) → delisted

17) Latch (NASDAQ:LTCH) $10.18 (Mar ’21) → delisted

18) NuScale (NYSE:SMR) $10.55 (Mar ’21) → $3.15 (Jan ’24)

As you can see above, many SPAC merger companies have taken a beating in the stock market since going public — partly due to the economic downturn in early 2022. The list below has 18+ pitch decks from leading SPAC mergers like Bird, Nextdoor and Sonder, or you can see them all here. These decks are perfect for learning more about what makes an effective pitch deck and how to create your own. When pitching your company to investors, your deck plays a vital role in your success. Use these winning pitch deck examples as inspiration when crafting your investor materials.

1. Hims & Hers Pitch Deck

Year: 2021 • Valuation: $272M • Stage: SPAC

Hims & Hers is a multi-specialty telehealth platform building a virtual front door to the healthcare system.

Hims was incubated at San Francisco-based venture-builder, Atomic by founder & CEO Andrew Dudum, along with Jack Abraham in 2017. They started hims & hers to eliminate stigmas around health and wellness issues and break down barriers for people when it comes to obtaining quality healthcare.

The consumer telehealth and wellness brand’s annual revenue jumped 83% year-over-year to $272 million in 2021. Hims & Hers went public on the NYSE in January 2021 via a merger with special purpose acquisition company (SPAC) Oaktree Acquisition Corp. The deal, valued at $1.6B, brought the consumer telehealth and wellness company approximately $280 million in proceeds.

About Hims & Hers

- Industry: Healthcare

- Product Type: E-commerce

- Business Model: B2C

About the Hims & Hers Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $272M

2. Playstudios Pitch Deck

Year: 2021 • Valuation: $1.1B • Stage: SPAC

PLAYSTUDIOS is the developer and operator of award-winning free-to-play casual games for mobile and social platforms. They create play-to-earn mobile games such as myVegas Slots and myVegas Blackjack, with a loyalty program called playAwards where players can redeem points for rewards such as MGM accommodations and amenities.

PlayStudios offers players the chance to earn rewards from 95 partners and 290 entertainment, retail, travel, leisure, and gaming brands. The community has purchased over 11 million rewards worth $500,000 with playAwards loyalty points.

Acies, a blank-check firm started by former MGM Resorts International CEO Jim Murren, and Playstudios agreed to a merger in February 2021, listing on the Nasdaq under the ticker “MYPS.” The transaction valued the mobile games developer at $1.1 billion. Here is the investor presentation behind the PLAYSTUDIOS and Acies Acquisition Corp. merger.

About Playstudios

- Industry: Gaming

- Product Type: App

- Business Model: B2C

About the Playstudios Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $1.1B

3. Nextdoor Pitch Deck

Year: 2021 • Valuation: $4.3B • Stage: SPAC

Nextdoor is a hyperlocal social networking app that connects neighborhoods. Today, neighbors around the world turn to Nextdoor daily to share trusted information, help, and connections with those nearby.

The San Francisco-based company was founded in 2010 by social media veterans Sarah Leary, Nirav Tolia, Prakash Janakiraman & David Wiesen, and funded by Benchmark Capital and Shasta Ventures. By 2020, the company saw $123.3 million in revenue, a 49% increase from the year prior.

Nextdoor went public in November 2021 through a merger with a Khosla Ventures-backed SPAC in a deal that reportedly values the company at $4.3 billion.

About Nextdoor

- Industry: Real Estate

- Product Type: App

- Business Model: B2C

About the Nextdoor Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $4.3B

4. Circle Internet Pitch Deck

Year: 2021 • Valuation: $9B • Stage: SPAC

Circle is a crypto payment company that provides the infrastructure that enables businesses of all sizes to leverage the power of digital currencies and public blockchains for payments, commerce, and financial applications.

The peer-to-peer payments technology startup was founded by Jeremy Allaire and Sean Neville in October 2013, and is best known for being the issuer of the USDC stablecoin ($55 billion in circulation August 2022).

USDC is the heart of Circle’s ecosystem is a stable coin launched in 2018 by Circle and Coinbase (COIN).

The cryptocurrency operator went public via a SPAC merger deal valued at $9 billion with Concord Acquisition Corp (CND.N), a blank-check firm backed by former Barclays boss Bob Diamond. The Boston-based company terminated an earlier merger agreement with Concord, which had valued Circle at $4.5 billion.

About Circle Internet

- Industry: Cryptocurrency

- Product Type: Other

- Business Model: B2B

About the Circle Internet Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $9B

5. Bird Pitch Deck

Year: 2021 • Valuation: $2.3B • Stage: SPAC

Bird is a micromobility company that has distributed electric scooters designed for short-term rental to over 400 cities. Their vehicle sharing platform aims to provides affordable transportation solutions to communities across the world.

The company was founded by former Uber (and Lyft) executive Travis VanderZanden in September 2017. The Santa Monica company raised over $800M in total funding by the time it went public in May 2021 by merging with special purpose acquisition company Switchback II at an implied valuation of $2.3 billion.

Bird said it was able to raise $160M in private investment in public equity (PIPE), by institutional investor Fidelity and others, plus an additional $40M asset financing from Apollo Investment and MidCap Financial.

About Bird

- Industry: Ride Sharing

- Product Type: App

- Business Model: B2C

About the Bird Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $2.3B

6. Matterport Pitch Deck

Year: 2021 • Valuation: $2.9B • Stage: SPAC

Matterport heralds itself as “”the standard for 3D space capture””. Their web-based platform transforms real-life spaces into immersive digital twin models: Matterport empowers people to capture and connect rooms to create truly interactive 3D models of spaces.

Matterport will started trading on Nasdaq in June 2021 under the symbol “MTTR” after it completed its merger with special purpose acquisition company (SPAC) Gores Holdings VI (Nasdaq: GHVI) at a $2.9B valuation.

The Sunnyvale, California-based company secured approximately $605 million in total cash as a result of the SPAC ($310 milion from Gores Holdings VI and $295 million in proceeds from a funding round led by institutional investors, including Tiger Global, Fidelity, Senator Investment Group, Dragoneer Investment Group, funds and accounts managed by BlackRock, Lux Capital, Miller Value Partners, Darlington Partners and Untitled Investments).

About Matterport

- Industry: Software

- Product Type: SaaS

- Business Model: B2B

About the Matterport Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $2.9B

7. Vintage Wine Estates Pitch Deck

Year: 2021 • Valuation: $690M • Stage: SPAC

Vintage Wine Estates (VWE) is a wine company owned by a group of vintner families with deep roots in the wine business.

Vintage Wine Estates built a portfolio of over 50 wine and spirits brands such as Viansa Sonoma and Napa Valley’s Girard from the California Wine County and the Pacific Northwest to grow into one of the largest U.S. wine producers. VWE’s portfolio spans wines of all kinds—luxury wines, award-winning wines, everyday wines, inspired classic wines and inventive new vintages.

VWE inked an agreement with a special-purpose acquisition company to become publicly trade witg n London-based Bespoke Capital Acquisition Corp. and the Santa Rosa-based porfolio that includes brands is valued at $690 million plus $50 million in future potential consideration.

About Vintage Wine Estates

- Industry: Food

- Product Type: Other

- Business Model: B2C

About the Vintage Wine Estates Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $690M

8. 23andMe Pitch Deck

Year: 2021 • Valuation: $3.5B • Stage: SPAC

23andMe is one of the most well-known consumer genetic DNA testing companies focusing on health and ancestry DNA testing.

Founded in 2006 by Anne Wojcicki, along with Linda Avey and Paul Cusenza, the mission of the company is to help people access, understand and benefit from the human genome.

Wojcicki built the world’s biggest genetic research database, and booked an estimated $475 million in annual sales, by selling 10 million consumers 23andMe genetic test kits. 23andMe earns most of its revenue by selling at-home DNA testing kits and selling consumer genetic databases to various healthcare organizations.

The at-home genetic testing kit company went public in Jun 2021, through a merger with a Richard Branson SPAC, VG Acquisition Corp., in a deal that raised near-$600 million and valued 23andMe at $3.5 billion.

About 23andMe

- Industry: Healthcare

- Product Type: Other

- Business Model: B2C

About the 23andMe Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $3.5B

9. Sonder SPAC Pitch Deck

Year: 2022 • Valuation: $1.9B • Stage: SPAC

Sonder manages short-term rentals, such as apartment hotels, with over 6,300 units in over 35 cities in 10 countries.

The next-gen hospitality brand went public in January 2022 via special acquisition (SPAC) merger with Gores Metropoulos II, trading on Nasdaq under the ticker SOND.

In the process, Sonder raised approximately $310 million in PIPE (private investment in public equity) capital from leading investors, including affiliates of Gores Metropoulos II, Fidelity Management & Research, BlackRock, Atreides Management,, and Senator Investment Group.

Following the closure of the SPAC, Sonder drew upon $165 million in a principal amount of Delayed Draw Notes to fund operations and support new and existing growth initiatives, with up to $450 million in cash in the trust account of Gores Metropoulus II.

As of October, Sonder was valued at $1.93B, which was downgraded from the initial $2.2 billion expected valuation.

About Sonder SPAC

- Industry: Hospitality

- Product Type: Marketplace

- Business Model: C2C

About the Sonder SPAC Deck

- Funding Year: 2022

- Funding Type: SPAC

- Funding Raised: $1.9B

10. Leafly Pitch Deck

Year: 2021 • Valuation: $162M • Stage: SPAC

Leafly was founded in 2010 and has grown into the leading cannabis marketplace and online resource. The company offers a deep library of content for cannabis consumers with detailed information about strains, retailers and current events along with a subscription-based retailer platform trusted by thousands of brand.

Leafly went public via SPAC merger with Merida Merger Corp. I in August 2021. The deal was valued at ~$532 million and expected to generate proceeds of up to $161.5 million, including Leafly’s recent capital raise of $31.5 million from investors, including Merida Capital Holdings.

About Leafly

- Industry: Cannabis

- Product Type: SaaS

- Business Model: B2B

About the Leafly Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $162M

- Investor Type:

11. FaZe Clan Pitch Deck

Year: 2022 • Valuation: $725M • Stage: SPAC

FaZe Clan is a professional esports and entertainment organization founded in May 2010, as FaZe Sniping.

Since then, the group has grown into one of the most popular and influential esports organizations in the world, with over 510 million followers across social media platforms. In addition to its esports division, FaZe Clan also has a successful apparel line, merchandise store, and talent agency.

FaZe Clan went public through a merger with SPAC, B. Riley Principal 150 Merger Corp. The deal valued FaZe Clan at $725 million, down slightly from initial third-party valuations that priced the combined company at about $1 billion.

After two years of poor stock performance, FaZe was acquired by GameSquare ($GAME) for cents on the dollar, at a mere $17M valuation.

About FaZe Clan

- Industry: Gaming

- Product Type: Other

- Business Model: B2C

About the FaZe Clan Deck

- Funding Year: 2022

- Funding Type: SPAC

- Funding Raised: $725M

- Investor Type:

12. Virgin Galactic Pitch Deck

Year: 2019 • Valuation: $450M • Stage: SPAC

Virgin Galactic was founded in 2004 by British entrepreneur Sir Richard Branson (founder of Virgin Group and the Virgin Atlantic airline). Virgin Galactic’s commercial spacecraft provide suborbital spaceflights to space tourists

Virgin Galactic Holdings (NYSE:SPCE) was originally IPOA, the first of so-called “”SPAC King”” Chamath Palihapitiya’s SPACs. The SPAC merger listing raised $450M through a SPAC merger listing which valued the company over $2.4B. At the time, the company claimed to have over 600 customer reservations and ~$80M in total collected deposits.

After commercial service was delayed again in August 2022, Virgin Galactic stock price tumbled >80% from IPO to under $2 as of January 2024.

About Virgin Galactic

- Industry: Aerospace

- Product Type: Other

- Business Model: B2C

About the Virgin Galactic Deck

- Funding Year: 2019

- Funding Type: SPAC

- Funding Raised: $450M

- Investor Type:

13. Opendoor Pitch Deck

Year: 2020 • Valuation: $1B • Stage: SPAC

Online real estate marketplace Opendoor was founded in March 2014 by Keith Rabois, Eric Wu, JD Ross. The comany began operations after raising a $9.95M VC round led by Khosla Ventures that May (see the deck they used here). By 2019, the company was valued over $3.8B on the heels of a $300m in a funding round led by General Atlantic, and reportedly sold over 18,000 homes for nearly $5B in revenue that year.

In early 2020, the company laid off 600 employees (35% of its team) and temporarily suspended home buying activity, citing COVID-19 pandemic challenges. Months later, OpenDoor went public with the ticker $OPEN (originally IPOB) through a SPAC merger led by Chamath Palihapitiya that valued the company at $4.8 billion.

Since then, the company has struggled with mounting losses. Ahead of its 2020 IPO, the company’s market cap was around $18 bn; in early 2023 it was just above $1 billion.

About Opendoor

- Industry: Real Estate

- Product Type: Marketplace

- Business Model: B2C

About the Opendoor Deck

- Funding Year: 2020

- Funding Type: SPAC

- Funding Raised: $1B

- Investor Type:

14. Clover Health Pitch Deck

Year: 2021 • Valuation: $1.2B • Stage: SPAC

Clover Health was founded in 2014 by Vivek Garipalli and Kris Gale. The company started with Medicare Advantage plans in New Jersey and has since expanded our coverage to 6 other states.

Clover Health operates as a next-generation Medicare Advantage insurer, leveraging the company’s flagship software platform, Clover Assistant, to provide America’s seniors with affordable, quality healthcare plans. In 2020, the company inked a $3.7B deal with Chamath Palihapitiya to go public via SPAC merger, in what was originally called IPOC. The SPAC elivered $1.2 billion in gross proceeds, including $400M in PIPE funding.

The company ended its first day on public markets (January 8, 2021) with a $7B market cap. Two years later, $CLOV was trading under $1 per share, with a market cap below $500M.

About Clover Health

- Industry: Healthcare

- Product Type: Other

- Business Model: B2C

About the Clover Health Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $1.2B

- Investor Type:

15. SoFi Pitch Deck

Year: 2021 • Valuation: $2.4B • Stage: SPAC

SoFi, short for Social Finance Inc., was founded in the summer 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady (all students at the Stanford Graduate School of Business). The San Francisco-based personal finance company and online bank provides financial products such as student loan refinancing, mortgages, personal loans, credit card, investing, and banking.

The neo-banking startup went public in 2021 raising $2.4 billion via a Chamath Palihapitiya sponsored SPAC merger, but as of 2024 has yet to earn a profit. That said, compared to the performance of most SPACs (esp. Chamath’s), SoFi is arguably the most successful. As of January 2023, share price is down less than 20% from IPO, as compared to more than 80% average decline in share price for SPACs.

About SoFi

- Industry: Fintech

- Product Type: SaaS

- Business Model: B2C

About the SoFi Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $2.4B

- Investor Type:

16. Arrival Pitch Deck

Year: 2021 • Valuation: $400M • Stage: SPAC

Arrival was founded to make electric vehicle production “radically more efficient.” After raising around $1B from names like Hyundai, BlackRock, and UPS, Arrival went public via SPAC at a $5.4B valuation (which raised another $400M in PIPE funding anchored by Fidelity). The stock crashed 99% to a mere $20M market cap in the following 15 months. During that period, the company went through four layoffs, slashed production targets, and faced potential delisting after missed SEC filing deadlines. The SPAC deck promised automated microfactories that would simultaneously produce electric vans for UPS, cars for Uber and buses for the UK, Italy and California

About Arrival

- Industry: Auto

- Product Type: Other

- Business Model: B2C

About the Arrival Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $400M

- Investor Type:

17. Latch Pitch Deck

Year: 2021 • Valuation: $453M • Stage: SPAC

Latch (now known as Door.com) is a company that provides keyless security systems for people living in apartment-style buildings. It was founded by Brian Jones, Luke Schoenfelder, and Thomas Meyerhoffer.

The 200-employee company was valued at $454M in 2019, before going public in 2021 through a SPAC listing that raised $453M and valued the company at over $1.5B. As part of the SPAC deal, Latch received ~$510M in cash, including $190M from investors such as Chamath Palihapitiya, BlackRock, D1 Capital and Fidelity.

After going public, Latch has been mired in controversy and was delisted in August. The stock crashed 80% from its highs after missing revenue projections (reporting a $166M loss), multiple rounds of layoffs, and audits following alleged manipulating of bookings. The CEO was forced out in January 2023 and replaced with former Ring founder & CEO, Jamie Siminoff, who sold the smart doorbell company to Amazon for billions.

About Latch

- Industry: PropTech

- Product Type: Other

- Business Model: B2B, B2C

About the Latch Deck

- Funding Year: 2021

- Funding Type: SPAC

- Funding Raised: $453M

- Investor Type:

18. NuScale Pitch Deck

Year: 2022 • Valuation: $1.9B • Stage: SPAC

NuScale was founded in 2007 based on research funded by the United States Department of Energy (DOE), and has since made significant progress towards commercializing America’s first small modular reactor (SMR). The company made history as the first of a new generation of nuclear energy startups to win regulatory approval of its reactor design in 2022.

In May 2022, NuScale went public via merger with the special-purpose acquisition company (SPAC), Spring Valley Acquisition Corp, raising $380 million of investment. The following year would prove challenging, and NuScale would layoff more than half of its workforce.

About NuScale

- Industry: Sustainability

- Product Type: Other

- Business Model: B2B

About the NuScale Deck

- Funding Year: 2022

- Funding Type: SPAC

- Funding Raised: $1.9B

- Investor Type:

How-to create your own M&A / IPO pitch deck:

Are you interested in learning how to write and design a winning pitch deck to take your startup public or get acquired? If you’re building a mature startup seeking acquisition, IPO or late-stage financing, you may be interested in our popular M&A Pitch Deck or Investent Bank Presentation templates. If not, you’ll probably at least want to read through our free guide: check out our article on how-to create a winning pitch deck here. →