Chipper Cash, the African fintech startup that once boasted a $2 billion valuation and the backing of Jeff Bezos, has been struggling to keep its head above water in 2023. The company, which offers cross-border payments and other financial services in several African countries, has terminated more than 40% of its workforce across four layoffs this year, including several top executives.

Where did things go wrong for Chipper Cash, and what can other fintech startups learn from the company’s recent challenges? In this article, we’ll take a look back at Chipper Cash’s first pitch deck, and the startup’s journey to this point:

How Chipper Cash went from unicorn to unstable in one year

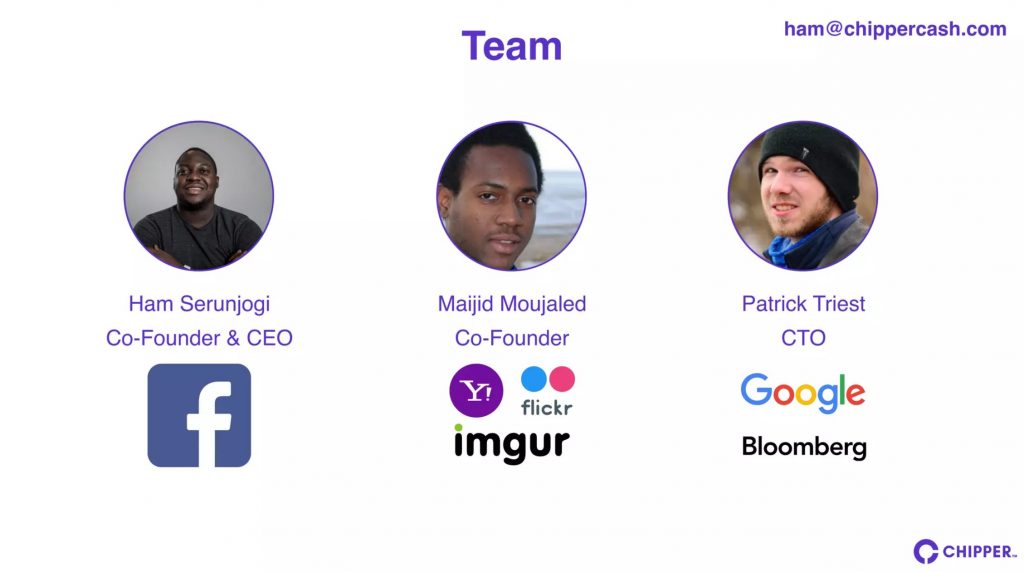

Chipper Cash was founded in 2018 by two Grinnell College alumni, Ham Serunjogi and Maijid Moujaled, who wanted to solve the problem of expensive and inefficient money transfers in Africa. They launched their app, which allows users to send and receive money instantly and for free, in Nigeria, South Africa, Ghana, Uganda, Rwanda, and Tanzania.

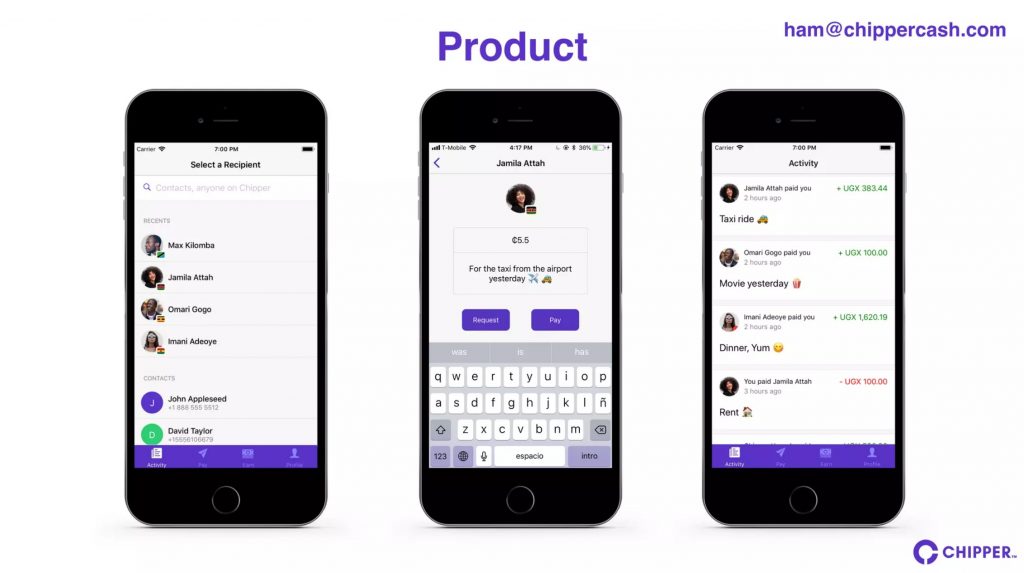

The app quickly gained traction, as it offered a simple and convenient way to send money across borders, without the need for a bank account or a card. Chipper Cash also added other features, such as Chipper Checkout, a merchant payment service, and Chipper Savings, a micro-savings platform.

Chipper Cash attracted the attention of several prominent investors, such as Bezos Expeditions, the personal investment arm of Amazon founder Jeff Bezos, FTX, a cryptocurrency exchange, and SVB Capital, the venture arm of Silicon Valley Bank. The company raised over $300 million in venture capital funding, and became Africa’s seventh unicorn (a popular term for a startup valued at over $1 billion) in 2021.

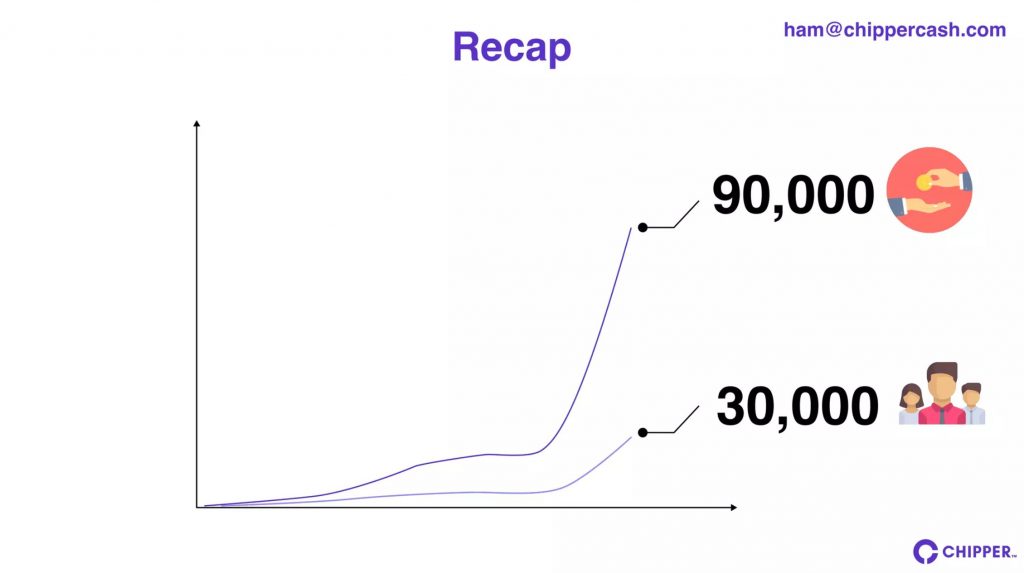

Chipper Cash processed $1.5 billion in quarterly volume for its 5 million users in 2021, up from just 90,000 transactions for 30,000 users in 2020 (per the company’s first pitch deck). At its peak, Chipper Cash employed almost 450 people.

The company was valued at $2B in a $150M round led by FTX in 2021, which was cut to $1.25B in a $30M SAFE round a year later. Chipper Cash initiated a series of layoffs in 2022 which continued late into the following year. Later in August 2023, news surfaced that the company reportedly cut its valuation by 70% in failed talks for an acquisition by Zepz (formerly known as WorldRemit).

That said, Chipper also announced it had secured 40 money transmitter licenses in the US on the heels of the fourth round of layoffs, so 2023 has not been all bad for the African fintech startup. See the full Chipper Cash pitch deck from 2020 here →

🚨BREAKING: African fintech unicorn, Chipper Cash has laid off employees for the fourth time in 2023.

Despite exponential growth, Chipper Cash has laid off more than 40% of its workforce this year, including several C-suite executives.

Here's a look back at the deck Chipper… pic.twitter.com/6xeL6ftp8i

— Pitch Decks (@pitchdecks) December 11, 2023