Casual dining restaurant chain Red Lobster announced it filed for bankruptcy on Monday May 20, 2024 after abruptly closing several locations the previous week .

While most sensational headlines are quick to place the blame on an “all-you-can-eat shrimp deal” that caused >$11M in losses, the company’s financial woes began well over ten years ago.

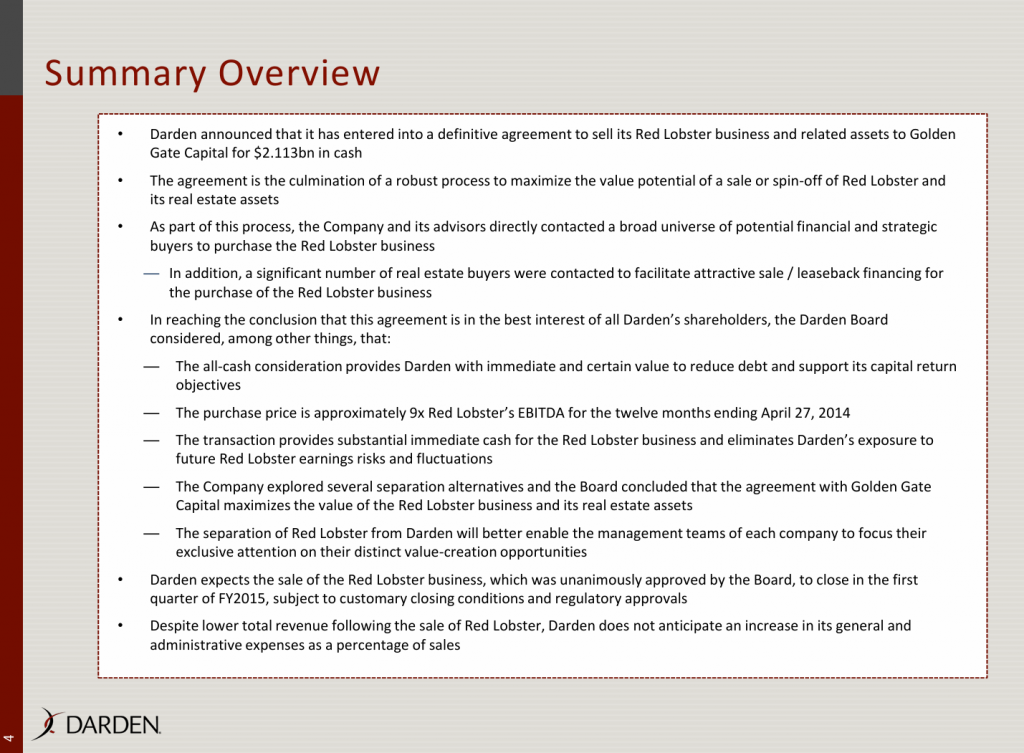

Red Lobster’s troubles started shortly before Darden sold the company for $2.1 billion in 2014 to San Francisco-based PE firm, Golden Gate Capital.

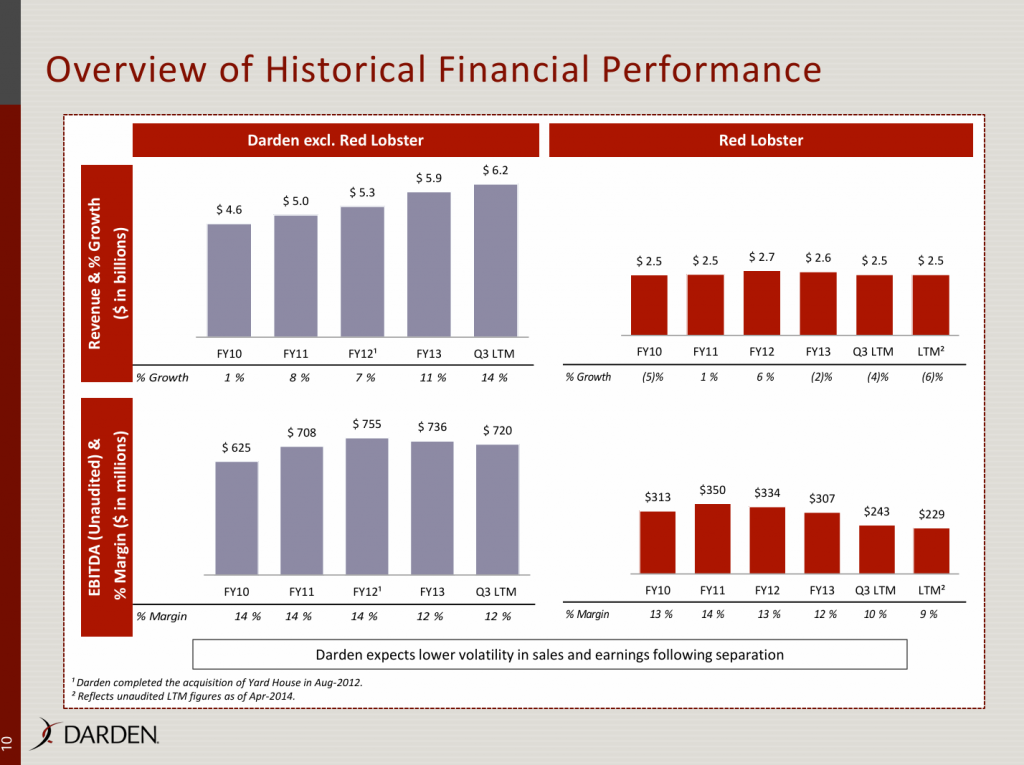

Darden Restaurants (NYSE:DRI) is a multi-brand restaurant operator with over 1800 locations, best known for owning Olive Garden. Darden sold Red Lobster to Golden Gate Capital in 2014 at a 9x EBITDA multiple, after facing growing operational challenges. “Darden stopped investing in Red Lobster. Things slowly deteriorated,” said Les Foreman, Director of Ops and VP at Red Lobster from 2002 to 2022.

Some shareholders (like Starboard LP) viewed this as a “hurried, reactive” decision that could “result in permanent destruction of shareholder value.” Starboard Value LP, which owned 5.5% of Darden at the time, was seeking a special shareholder meeting for a vote on its proposal to halt Darden’s Red Lobster separation.

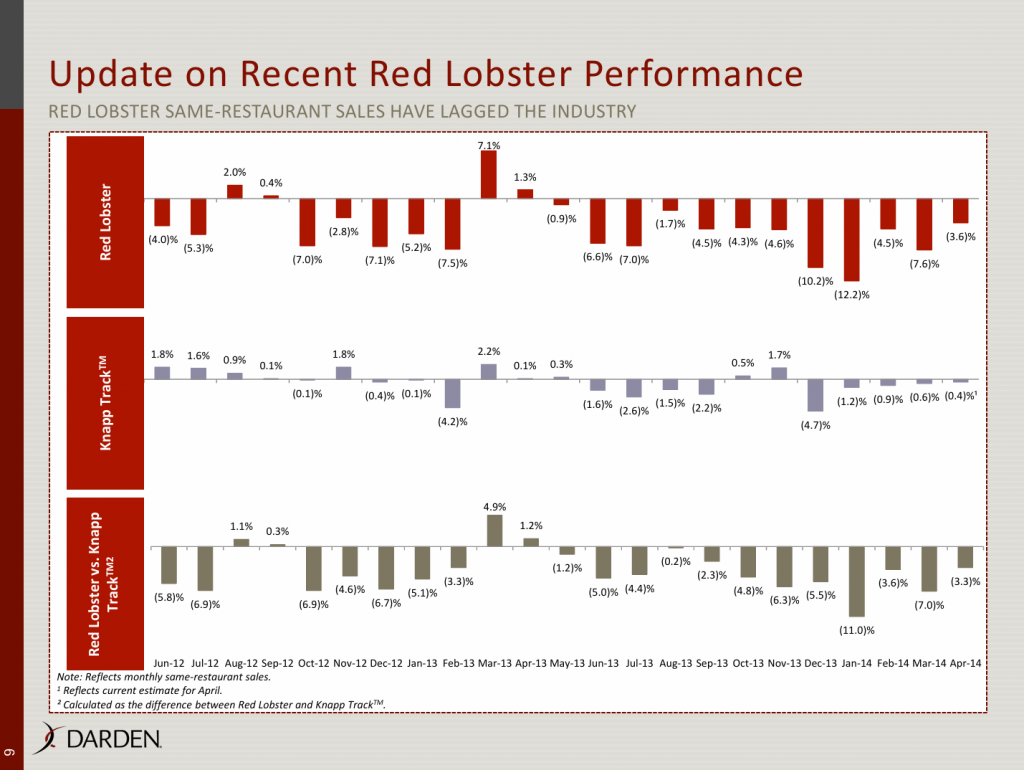

Ten years later, Starboard’s prediction seems prescient. Even back in 2014, Red Lobster’s sales lagged the industry. In order to finance the deal, Golden Gate sold off Red Lobster’s real estate to another entity named American Realty Capital Properties (now called Vereit) and then immediately leased the restaurants back, effectively stripping the company of some of its most valuable assets.

Darden expected lower volatility in earnings after the separation. A year after the sale, Thai Union (a top supplier of shrimp to Red Lobster for more than 20 years), took a $575 million minority stake in the brand. Thai Union “didn’t have any idea about running a restaurant company in the United States,” according to Les Foreman; they drove drastic cost-cutting measures which led to several executives leaving the company.

Red Lobster has now filed for bankruptcy protection to restructure its debt and shed some of its 650 US locations. You can see the full Red Lobster sale presentation here, as well as Starboard LP’s 2013 presentation via SEC archives.