Spotify CEO Daniel Ek has been under the fire as the company makes drastic changes in an attempt to finally turn a profit.

This year, Spotify started paying artists less, charging users more, and laid off thousands. To briefly summarize what’s been happening:

• Dec ’23: Spotify announces 17% layoffs (1,500 employees)

• Apr ’24: Spotify reduces artist royalties by ~$150M/yr

• June ’24: Spotify announces second price hike in one year

Spotify’s most recent investor deck tells us why they’re making these changes 👇

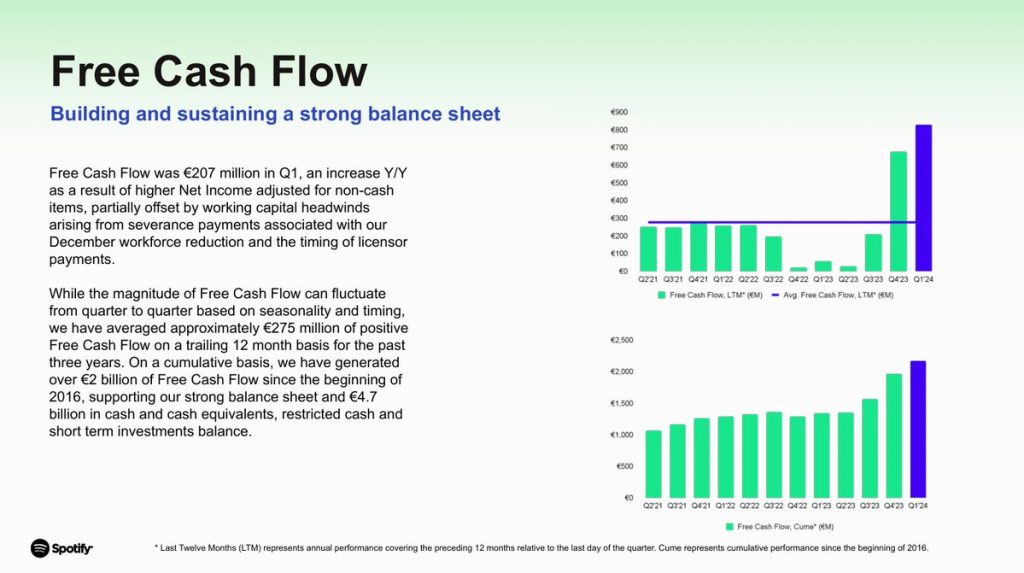

Like most companies in today’s post-ZIRP era, Spotify is focused on building free cash flow and achieving profitability

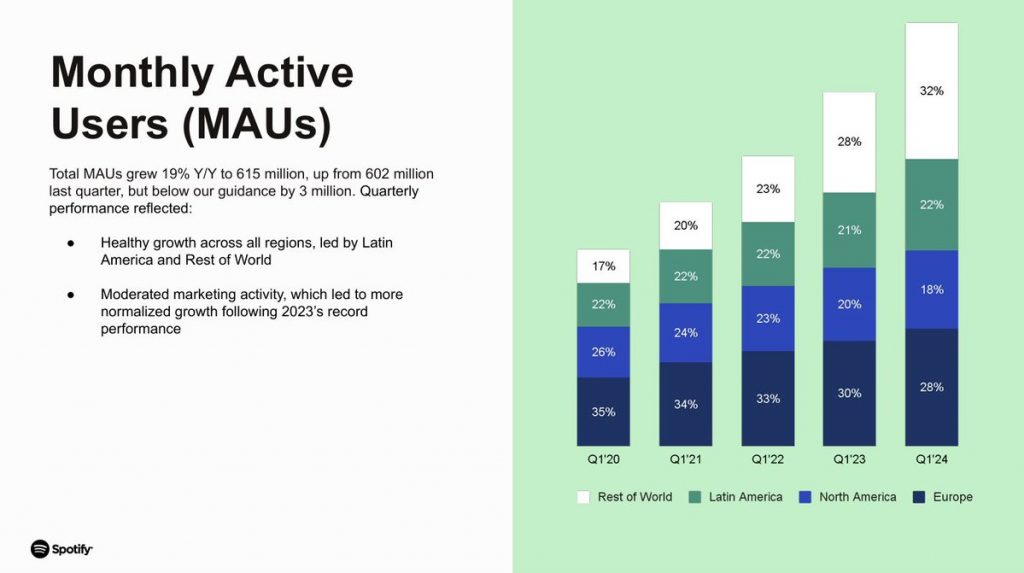

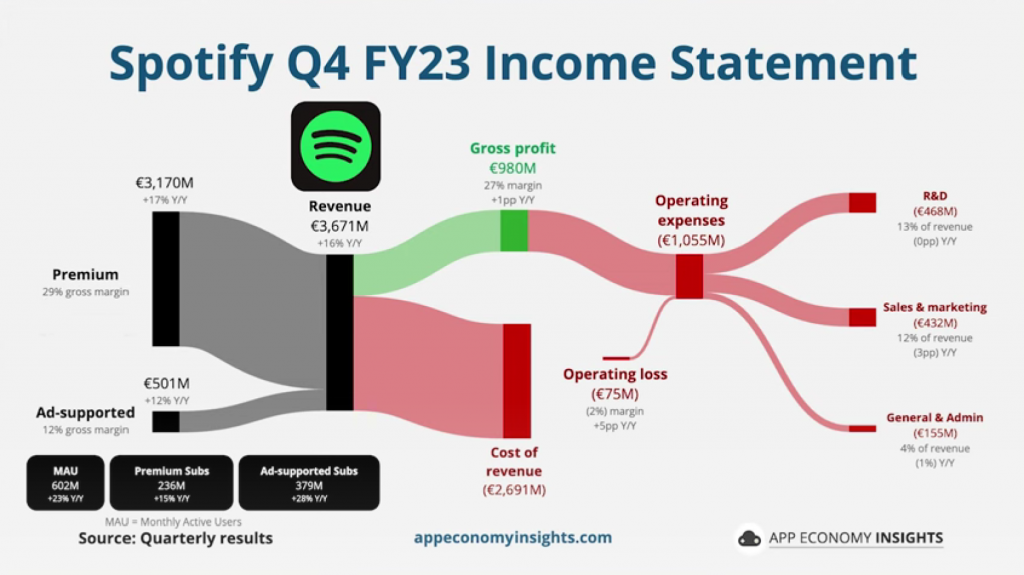

The simple fact is that Spotify is losing money, despite it’s consistently growing user base of 615M+ accounts.

The vast majority of Spotify’s revenue goes to their Cost of Revenue, and operating expenses exceed gross profits:

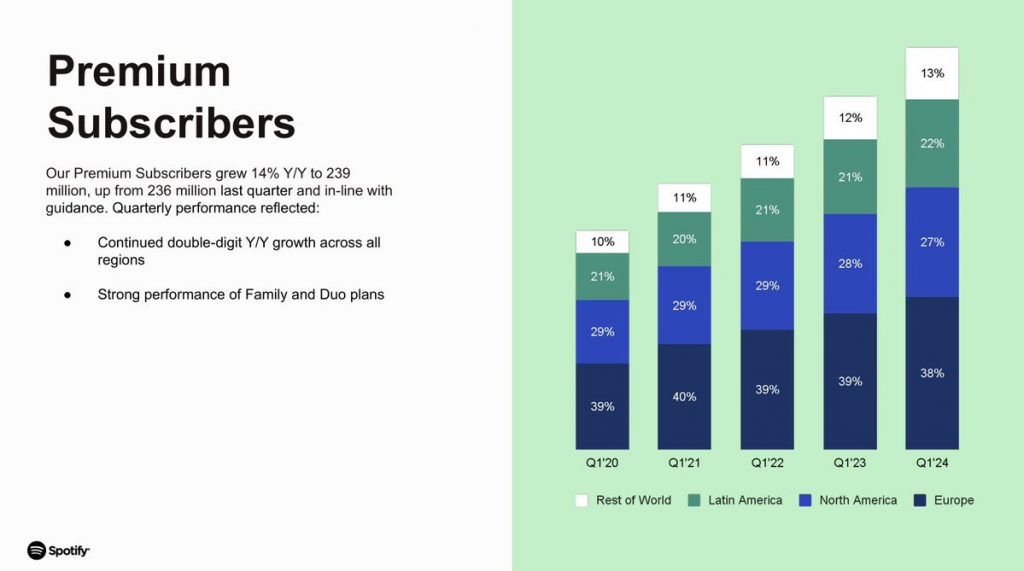

The most obvious remedy was to raise prices for their 230M+ premium subscribers — which Spotify has done twice in the last year. As of the most recent price hike (which goes into effect in June 2024), Spotify now costs more than competitors like TIDAL and Apple Music. Understandably, users are not happy…

Netflix made a similar move with their first price hike January 2022. In the following 5 months, $NFLX stock proceeded to crash from $500+ to under $200 (down nearly 50%), posting back-to-back quarterly subscriber losses. It took two years for the stock to recover. Some believe Spotify is poised to repeat history by making the same mistake.

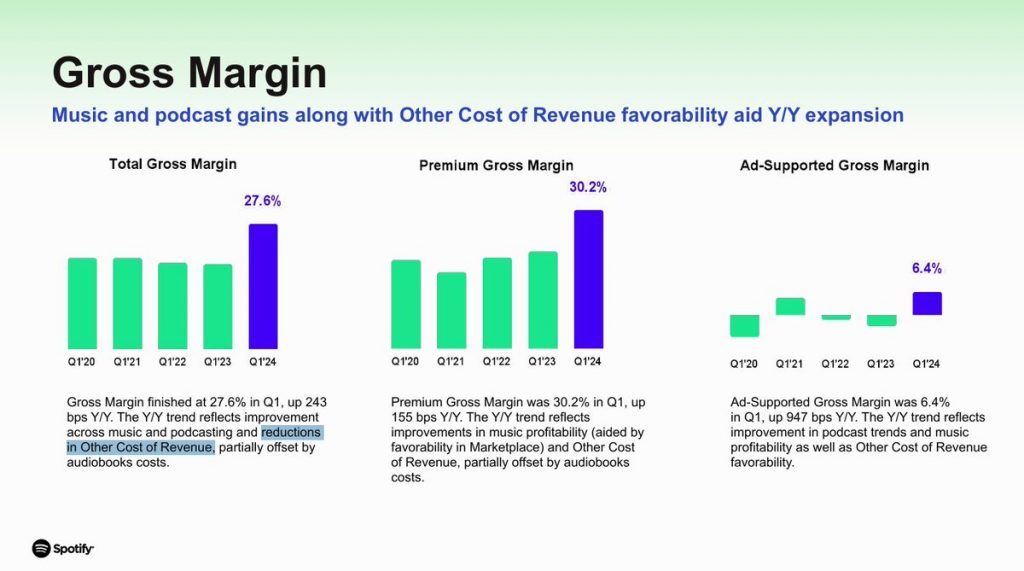

Reducing “cost of revenue” (ie. reducing royalty payments to artists) drove Spotify’s increase in Gross Margin last quarter. Spotify announced a slew of changes to their royalty payments structure (ie. increasing minimum track length, setting a minimum payout threshold) which is expected to reduce payouts to artists by $150M annually.

Multiple large publishing organizations have vowed to fight Spotify’s change to payments.

In 2022, the Copyright Royalty Board (CRB) accepted a (near) music industry-wide settlement known as ‘Phonorecords IV’ to improve songwriters’ streaming royalty rates.

National Music Publishers Association (which represents UMG, Sony, and Warner Music) said, “We will not stand for [Spotify’s] perversion of the settlement we agreed upon in 2022 and are looking at all options.”

A suit was already filed in New York federal court in May 2024, alleging Spotify underreported revenue to avoid paying millions in royalties.

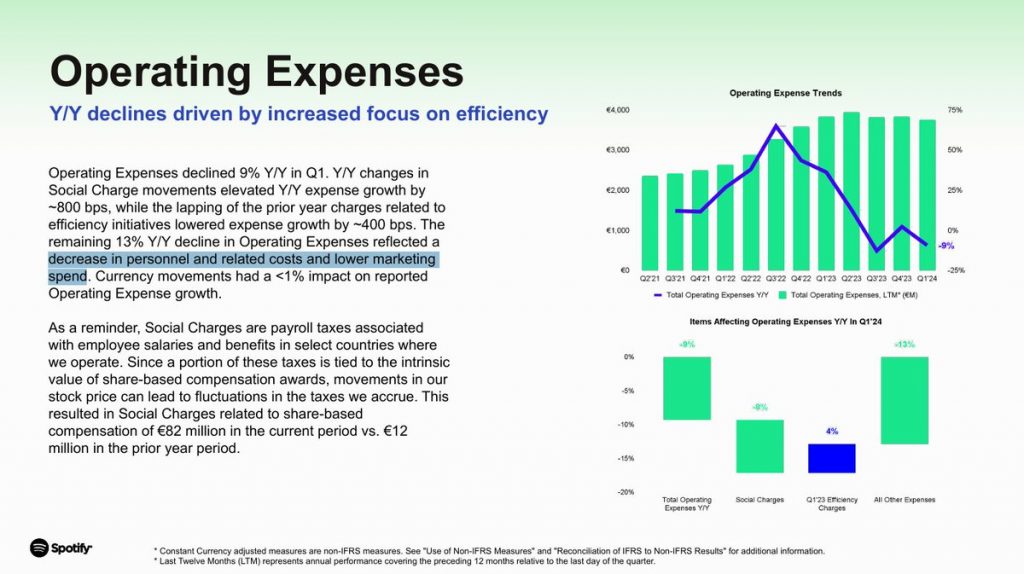

Meanwhile, layoffs accounted for virtually all of Spotify’s reported reduction in operating expenses:

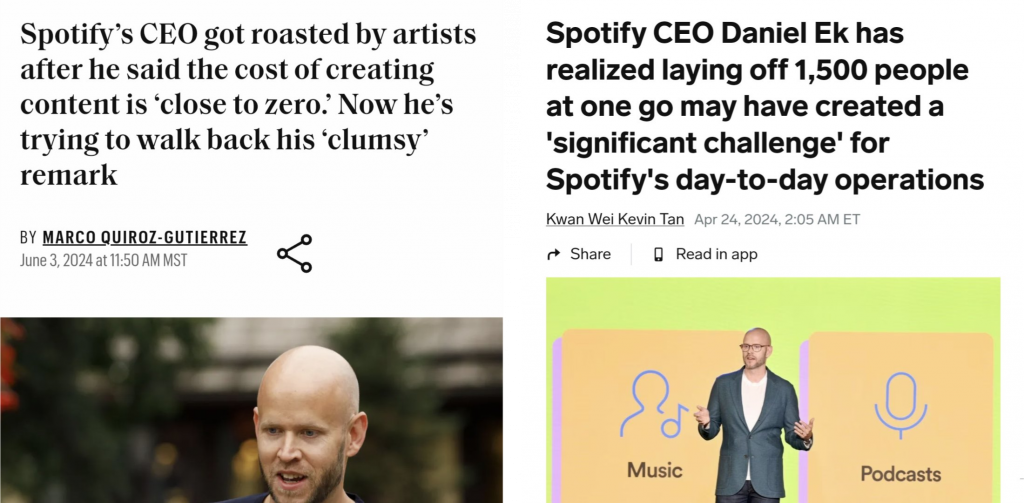

Spotify CEO Daniel Ek produced some spectacularly scathing headlines in trying to justify these decisions:

First, he told media that he “underestimated” the impact of the layoffs on Spotify’s operations. Then, the very day after the price hike, he (once again) caught the ire of artists by saying the cost of creating music is “close to zero.”

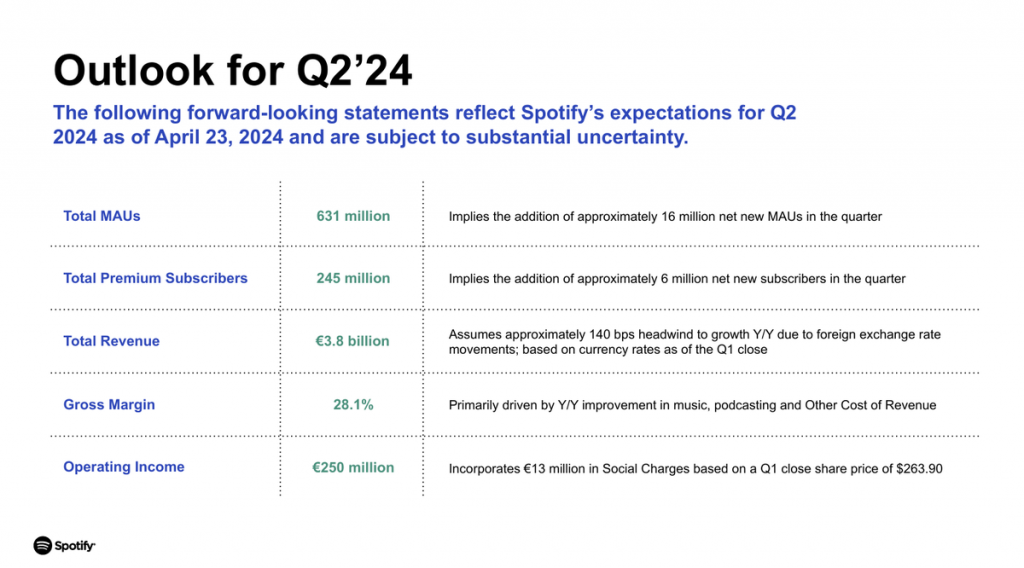

Despite the backlash, Spotify expects to continue seeing growth in premium subscriptions and operating income. $SPOT stock was up 5% on the price hike announcement on May 3.

With all these changes, where is $SPOT stock headed in the next year?

PS. Check out this 12-year-old presentation from Spotify for a nice throwback to better days!