What are fund decks?

Much like the founders of startups they invest in, GPs (general partners) of VC firms must pitch LPs (limited partners) to raise funds. Fund pitch decks are an instrumental tool for fund managers & partners in the process of securing LP backing. Typically, a fund deck (or instead, a tear sheet) is sent around to capture LP interest for pitch meetings.

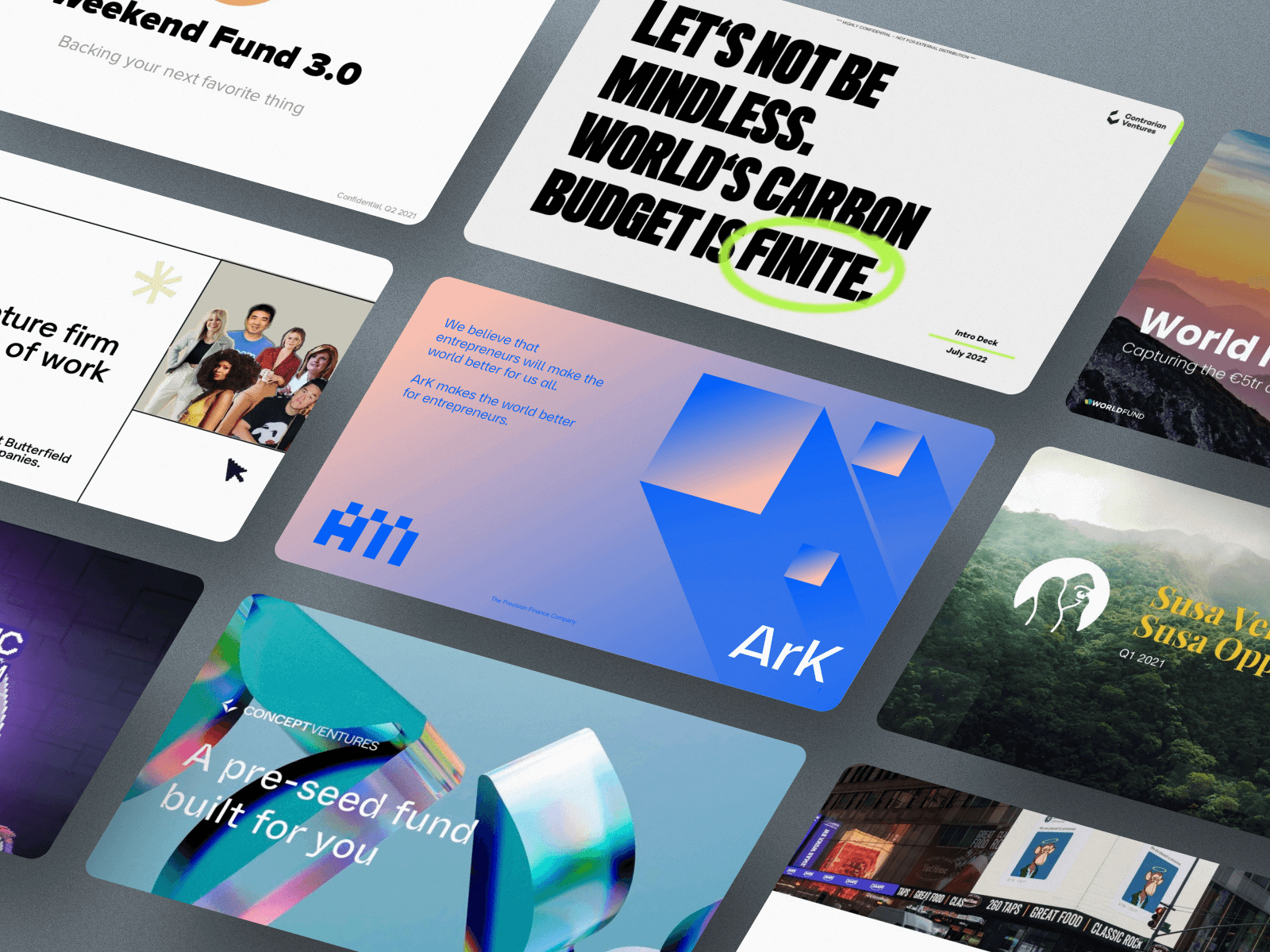

Starting any new fund starts with building a compelling pitch deck. To aid you in the process of doing so, below are a selection of fund deck examples that successfully secured LP funding for various different venture funds. You may notice that most fund decks follow a common formula, covering many of the same key topics (ie. thesis, dealflow, track record, etc.)

What are some examples of successful VC fund pitch decks?

20+ fund decks that helped close $500M+ in LP backing for VCs:

If you have ever wondered what the pitch decks that VCs use to raise funds look like, here’s an inside peek at 20+ successful fund decks that closed over $900M in aggregate LP funding.

The list below includes 20+ pitch decks that successfully closed LP backing for venture funds like Notation Capital, Susa Ventures, & WorkLife Capital (or you can see them all here).

These decks are perfect for learning more about what makes an effective pitch deck and how to create your own. When pitching your company to investors, your deck plays a vital role in your success. Use these winning pitch deck examples as inspiration when crafting your investor materials.

1) Awesome People Ventures Fund 2

2) Earl Grey Capital Fund II

3) Long Journey Ventures Fund I

4) Not Boring Capital Fund I

5) Precursor Fund III

6) Shrug Capital IV

7) Spacecadet Ventures

8) WorkLife Fund 2

9) Not Boring Capital Fund II

10) WorkLife Fund 1

11) Susa Ventures IV

12) Todd and Rahul’s Angel Fund

13) Weekend Fund 3.0

14) Notation Capital Fund 1

15) Seedcamp Fund IV

16) Notation Capital Fund 2

17) Seedcamp Fund V

18) Concept Ventures

19) Contrarian Ventures

20) World Fund

1. Awesome People Ventures Fund 2 Pitch Deck

Year: 2021 • Amount: $20M • Round: Fund 2

Awesome People Ventures is an early-stage Web3 fund focused on how we live and work.

About Awesome People Ventures Fund 2

- Specialty: Tech

- Investing Stage: Early + Late

About the Awesome People Ventures Fund 2 Deck

- Fund Year: 2021

- Fund Vintage: Fund 2

- Funding Raised: $20M

- General Partners: Julia Lipton

2. Earl Grey Capital Fund II Pitch Deck

Year: 2022 • Amount: $20M • Round: Fund 2

Earl Grey Capital is an early stage venture fund run by Amit Vasudev, Matt Sornson, and Alex MacCaw (co-founders of Clearbit).

About Earl Grey Capital Fund II

- Specialty: Software

- Investing Stage: Early

About the Earl Grey Capital Fund II Deck

- Fund Year: 2022

- Fund Vintage: Fund 2

- Funding Raised: $20M

- General Partners: Amit Vasudev, Matt Sornson, Alex MacCaw

3. Long Journey Ventures Fund I Pitch Deck

Year: 2019 • Amount: $35M • Round: Fund 1

Long Journey Ventures is an SF-based early-stage venture capital firm focused on early and new investments, founded in 2019.

About Long Journey Ventures Fund I

- Specialty: Tech

- Investing Stage: Early Stage

About the Long Journey Ventures Fund I Deck

- Fund Year: 2019

- Fund Vintage: Fund 1

- Funding Raised: $35M

- General Partners: Lee Jacobs, Cyan Banister, Arielle Zuckerberg

4. Not Boring Capital Fund I Pitch Deck

Year: 2021 • Amount: $5M • Round: Fund 2

Not Boring Capital Fund is a venture capital fund founded & managed by Packy McCormick.

About Not Boring Capital Fund I

- Specialty: Tech

- Investing Stage: Early

About the Not Boring Capital Fund I Deck

- Fund Year: 2021

- Fund Vintage: Fund 2

- Funding Raised: $5M

- General Partners: Packy McCormick

5. Precursor Fund III

Pitch Deck

Year: 2020 • Amount: $40M • Round: Fund 3

Precursor Ventures is a generalist firm that invests in known and unknown areas of software and hardware

About Precursor Fund III

- Specialty: Software

- Investing Stage: Early

About the Precursor Fund III

Deck

- Fund Year: 2020

- Fund Vintage: Fund 3

- Funding Raised: $40M

- General Partners: Charles Hudson

6. Shrug Capital IV Pitch Deck

Year: 2021 • Amount: $54M • Round: Fund 1

Shrug Capital is an SF-based venture capital firm that invests in consumer-based startups, founded in 2018.

About Shrug Capital IV

- Specialty: Consumer

- Investing Stage: Early + Late

About the Shrug Capital IV Deck

- Fund Year: 2021

- Fund Vintage: Fund 1

- Funding Raised: $54M

- General Partners: Niv Dror, Moshe Lifschitz

7. Spacecadet Ventures Pitch Deck

Year: 2021 • Amount: $15M • Round: Fund 1

Spacecadet is a new-age marketing-focused venture capital firm that uses the power of storytelling to invest in the better future of startups.

About Spacecadet Ventures

- Specialty: Software

- Investing Stage: Early

About the Spacecadet Ventures Deck

- Fund Year: 2021

- Fund Vintage: Fund 1

- Funding Raised: $15M

- General Partners: Wiz, Daniel Eckler

8. WorkLife Fund 2 Pitch Deck

Year: 2021 • Amount: $35M • Round: Fund 2

Worklife, founded by Brianne Kimmel, heralds itself as “the first creator-friendly venture capital firm” investing in tools and services for the modern workplace.

About WorkLife Fund 2

- Specialty: Software

- Investing Stage: Early

About the WorkLife Fund 2 Deck

- Fund Year: 2021

- Fund Vintage: Fund 2

- Funding Raised: $35M

- General Partners: Brianne Kimmel

9. Not Boring Capital Fund II Pitch Deck

Year: 2022 • Amount: $25M • Round: Fund 2

Not Boring Capital Fund is a venture capital fund founded & managed by Packy McCormick.

About Not Boring Capital Fund II

- Specialty: Tech

- Investing Stage: Early

About the Not Boring Capital Fund II Deck

- Fund Year: 2022

- Fund Vintage: Fund 2

- Funding Raised: $25M

- General Partners: Packy McCormick

10. WorkLife Fund 1 Pitch Deck

Year: 2019 • Amount: $10M • Round: Fund 1

Worklife, founded by Brianne Kimmel, heralds itself as “the first creator-friendly venture capital firm” investing in tools and services for the modern workplace.

About WorkLife Fund 1

- Specialty: Software

- Investing Stage: Early

About the WorkLife Fund 1 Deck

- Fund Year: 2019

- Fund Vintage: Fund 1

- Funding Raised: $10M

- General Partners: Brianne Kimmel

11. Susa Ventures IV Pitch Deck

Year: 2021 • Amount: $200M • Round: Fund 2

Susa Ventures is an SF-based seed-stage VC fund investing in founders building value & defensibility through data, network effects, & economies of scale.

About Susa Ventures IV

- Specialty: Enterprise

- Investing Stage: Early

About the Susa Ventures IV Deck

- Fund Year: 2021

- Fund Vintage: Fund 2

- Funding Raised: $200M

- General Partners: Leo Polovets, Chad Byers, Seth Burman

12. Todd and Rahul’s Angel Fund Pitch Deck

Year: 2020 • Amount: $25M • Round: Fund 2

Todd Goldberg (founder Eventjoy) and Rahul Vohra (founder Superhuman and Rapportive) have co-invested in over 100 startups (from pre-seed to Series C) via their angel fund.

About Todd and Rahul’s Angel Fund

- Specialty: Consumer

- Investing Stage: Early

About the Todd and Rahul’s Angel Fund Deck

- Fund Year: 2020

- Fund Vintage: Fund 2

- Funding Raised: $25M

- General Partners: Todd Goldberg, Rahul Vohra

13. Weekend Fund 3.0 Pitch Deck

Year: 2021 • Amount: $21M • Round: Fund 3

Weekend Fund is an early-stage venture capital and angel investing firm created by Product Hunt founder Ryan Hoover.

About Weekend Fund 3.0

- Specialty: Software

- Investing Stage: Early

About the Weekend Fund 3.0 Deck

- Fund Year: 2021

- Fund Vintage: Fund 3

- Funding Raised: $21M

- General Partners: Ryan Hoover

14. Notation Capital Fund 1 Pitch Deck

Year: 2015 • Amount: $8M • Round: Fund 1

Notation Capital is a Brooklyn-based venture capital firm focused on pre-seed investments in technical founders.

About Notation Capital Fund 1

- Specialty: Software

- Investing Stage: Early

About the Notation Capital Fund 1 Deck

- Fund Year: 2015

- Fund Vintage: Fund 1

- Funding Raised: $8M

- General Partners: Nick Chirls, Alex Lines

15. Seedcamp Fund IV Pitch Deck

Year: 2017 • Amount: £60M • Round: Fund 4

Seedcamp is a European seed-stage venture capital fund, headquartered in London, launched in May 2007 by Managing Partners are Reshma Sohoni and Carlos Espinal.

About Seedcamp Fund IV

- Specialty: Tech

- Investing Stage: Early + Late

About the Seedcamp Fund IV Deck

- Fund Year: 2017

- Fund Vintage: Fund 4

- Funding Raised: £60M

- General Partners: Saul Klein, Reshma Sohoni

16. Notation Capital Fund 2 Pitch Deck

Year: 2018 • Amount: $27M • Round: Fund 2

Notation Capital II is a pre-seed venture capital firm that work with technical founding teams.

About Notation Capital Fund 2

- Specialty: Software

- Investing Stage: Early

About the Notation Capital Fund 2 Deck

- Fund Year: 2018

- Fund Vintage: Fund 2

- Funding Raised: $27M

- General Partners: Nick Chirls, Alex Lines

17. Seedcamp Fund V Pitch Deck

Year: 2020 • Amount: £78M • Round: Fund 5

Seedcamp is a venture capital fund that supports startups in the pre-seed and seed stages with a typical check size of $0-$250K.

About Seedcamp Fund V

- Specialty: Tech

- Investing Stage: Early + Late

About the Seedcamp Fund V Deck

- Fund Year: 2020

- Fund Vintage: Fund 5

- Funding Raised: £78M

- General Partners: Saul Klein, Reshma Sohoni

18. Concept Ventures Pitch Deck

Year: 2022 • Amount: £50M • Round: Fund 1

Concept Ventures is the UK’s largest pre-seed fund, founded in 2018.

About Concept Ventures

- Specialty: Tech

- Investing Stage: Early

About the Concept Ventures Deck

- Fund Year: 2022

- Fund Vintage: Fund 1

- Funding Raised: £50M

- General Partners: Reece Chowdhry

19. Contrarian Ventures Pitch Deck

Year: 2022 • Amount: £101M • Round: Fund 1

Contrarian Ventures, founded in 2017, writes checks between 1.5 to 2 million euros to seed-stage companies building climate tech solutions.

About Contrarian Ventures

- Specialty: Sustainability

- Investing Stage: Early

About the Contrarian Ventures Deck

- Fund Year: 2022

- Fund Vintage: Fund 1

- Funding Raised: £101M

- General Partners: UiPath, Molten Ventures, Grantham Foundation

20. World Fund Pitch Deck

Year: 2022 • Amount: $365M • Round: Fund 1

World Fund claims to be Europe’s biggest climate-tech VC firm, with a €350 million fund for startups reducing emissions.

About World Fund

- Specialty: Investing

- Investing Stage: Early + Late

About the World Fund Deck

- Fund Year: 2022

- Fund Vintage: Fund 1

- Funding Raised: $365M

- General Partners: Anchor LP: PwC

How-to create your own VC fund deck:

Are you interested in creating a winning pitch deck to raise your own fund? If so, you may be interested in our popular Fund Pitch Deck template, designed by experts specifically for fund managers seeking LP backing. Otherwise, you may want to read through our free guide on how-to create a winning fund deck here. →