Founded in late 2023, TensorWave provides a cloud platform designed specifically for AI workloads. Powered by AMD MI300X accelerators and an inference engine, TensorWave provides startups, enterprises, and researchers an accessible, cloud-based compute solution for AI workloads. AMD MI300X accelerators are specifically designed to deliver leadership performance for Generative AI workloads and HPC applications.

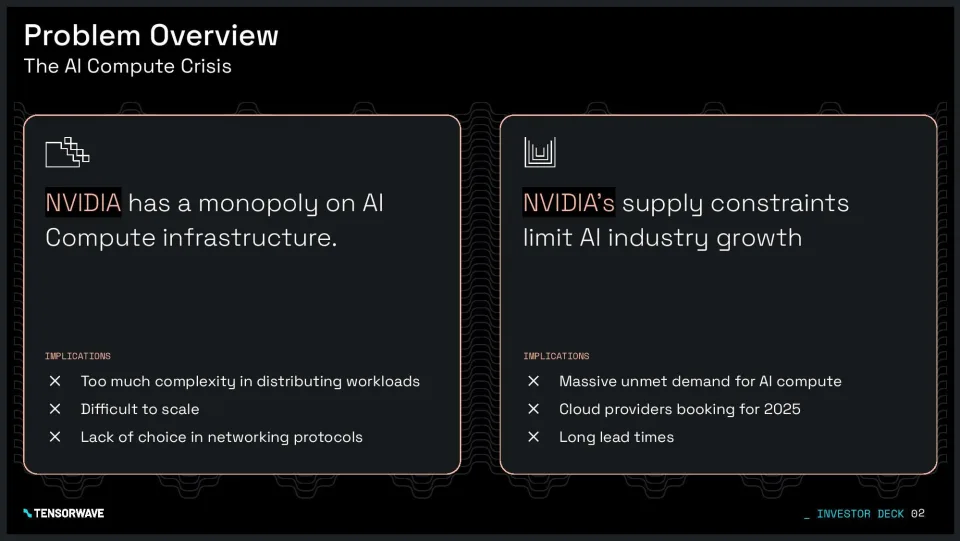

The startup was co-founded by Darrick Horton, Jeff Tatarchuk, and Piotr Tomasik. The trio saw a problem in the AI compute space wherein Nvidia had a monopoly and companies lacked a viable alternative.

“[…] we discussed the monopolistic grip on GPU compute capacity, which was leading to supply constraints,” Horton said in an interview. “This realization led to the formation of TensorWave.”

The company began onboarding customers late this spring in preview, and it’s already generating $3 million in annual recurring revenue. According to Horton, the company expects that this figure will reach $25 million by the end of the year; an impressive 800% leap within a year. TensorWave is planning to increase the capacity to 20,000 MI300Xs to achieve this goal.

“Pricing ranges from approximately $1 per hour to $10 per hour, depending on the bespoke requirements of the workload and the GPU configurations chosen,” Horton said.

In addition to public interest, TensorWave has announced partnerships with networking backbone provider Edgecore Networks and MK1, an AI inferencing startup founded by ex-Neuralink engineers.

“We are rapidly expanding our capacity, with multiple nodes available, and we are continually increasing capacity to meet the growing demands of our pipeline,” Horton said.

On October 8, 2024, TensorWave announced the closing of a $43 million SAFE funding round. This round, led by Nexus VP, marks the largest round of SAFE funding for any Nevada-based startup to date. Other investors in this round include Maverick Capital, Translink Capital, Javelin Venture Partners, StartupNV, and AMD Ventures.

“We are thrilled to have the support of such esteemed investors, partners, and the State of Nevada as we embark on this next phase of growth,” said Darrick Horton, CEO of TensorWave. “This funding allows us to significantly scale our team and deploy thousands of AMD Instinct AI accelerators to empower the startups and enterprises shaping our technological future. The future’s looking bright, and we’re excited to help bring it to life.”

Check out the 9-slide pitch deck TensorWave used to secure the $43 million funding.

What were the slides in the TensorWave pitch deck?

Browse the exact example slides from the pitch deck that TensorWave used to raise a $43M round led by Nexus VP.

1. Problem Slide

Many first-time founders envision ambitious dreams of achieving SDG goals or pioneering cutting-edge technology, but investors are generally looking for startups solves genuine problems for a large addressable market, in a repeatable, scalable, and defensible manner.

TensorWave is the perfect example: it solves a very genuine problem of “NVIDIA’s monopoly on AI compute infrastructure”, on a large scale, affecting a lot of people and companies of all sizes. The problem slide covers this perfectly for investors and explains how this monopoly is “limiting AI industry growth” and why addressing it is crucial. From the heading to subheading and the explanations, the slide remains concise and uses a clean, simple design to clearly convey the problem and its broader implications.

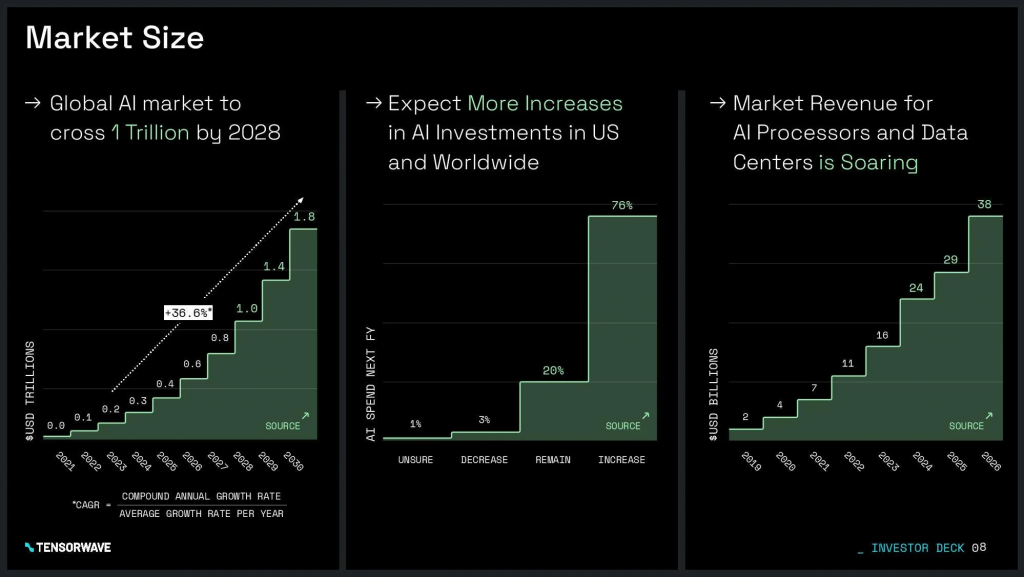

2. Market Slide

Founders put their sweat and blood into building products they are passionate about. But for VCs, it boils down to a numbers game. VCs invest in 10s to hundreds of companies within each fund / vintage, knowing very well most of their investments won’t succeed. But they only need one or two to hit it big to “make the fund” (generate enough return to offset all their other losses, and more). The thing is, VCs don’t win unless your company has potential to scale dramatically and exit. For this to happen, a large addressable market is the most fundamental requirement of any VC-backed starutp.

This is why VCs only invest in companies that are chasing a huge market size. Riding the AI hype, TensorWave doesn’t have a market size problem. The global AI market is projected to grow from $196.6 billion in 2023 to $1 trillion by 2028 according to Grandview. And much of this will be driven by the accelerating rate of AI research and innovation and the continuous expansion of AI product offerings. All of these require massive compute infrastructure – the core offering that TensorWave is betting on.

The TensorWave pitch deck’s market slide doesn’t need to try too hard as investors are already aware of ever-expanding AI market size. The slide uses simple bar charts and relevant facts & figures to effectively illustrate the growing market opportunity. However, it cites the source of all the claims to enhance credibility with potential investors. Overall, the slide’s design, featuring large, legible typography, results in a presentation that is both straightforward and impactful.

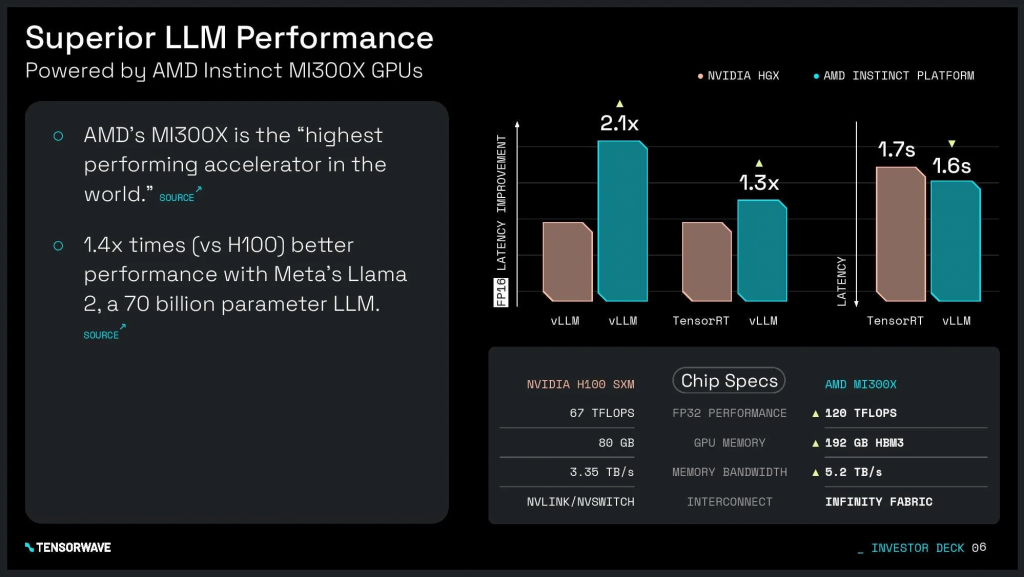

3. Competitive Edge Slide

TensorWare is competing (albeit using AMD’s equipment) against the accelerator performance of the world’s most valuable company, NVIDIA. When a startup is operating against competition with such deep pockets and high leverage, their pitch deck must demonstrate a clear and strong competitive advantage that investors can fully grasp.

To achieve this, your pitch deck must highlight the distinctive strengths or advantages that distinguish your offering from competitors. You can take into account various aspects including intellectual property, network effects, brand recognition, or proprietary technology. Additionally, if you’ve obtained proprietary data or insights on the market, be sure to share this information with investors.

TensorWare’s market slide does a great job of highlighting its competitive advantage. By directly comparing the performance of MI300X with NVIDIA’s H100 SXM, the competition slide leaves no room for ambiguity. With a mix of striking facts, bar charts, and head-to-head comparisons, the slide reinforces that their competitive advantage lies within their technology moat and “superior LLM performance.”

How-to create your own pitch deck like TensorWave

We hope you learned something from the TensorWave pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/tensorwave

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular AI Pitch Deck Template template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for startups seeking to raise Seed funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.