Kora is developing the first grid-tied 4-in-1 home battery system that unifies a smart panel, hybrid inverter, and modular batteries under one app, with a built-in energy trading platform. The system gives residents an energy storage platform to help them cut their energy bills, and also sell excess energy generated from solar panels on the wholesale market.

“At Kora, we’re creating a home energy system that helps stabilize the grid, unlock clean power, and prepare every home for what’s next – a grid that’s cleaner, smarter, and powered by renewables,” says Greg Connolly, founder and CEO of Kora.

Greg is a veteran entrepreneur who established Trifecta into one of the largest e-commerce meal platforms, generating $500M in revenue during his reign as CEO. According to Greg, the idea of Kora was conceived after he tried several of the leading home energy systems. He found the user experience to be poor, the equipment expensive, and the functionality limited.

“We built Kora to bring the industry into the AI age with one system that gives homeowners real control, reliable backup, and lower bills automatically from day one.” said Greg.

The startup bills itself as a Tesla competitor because it offers a fully integrated stack that goes beyond Tesla’s Powerwall. While Tesla’s Powerwall is primarily a battery storage system designed for backup power, solar self-consumption, and peak shaving, Kora combines a smart electrical panel that allows circuit-level control during outages, a hybrid inverter, and modular battery storage with an energy-trading platform.

Greg seeded Kora with personal capital before hiring a world class team of engineers from Apple, Sonnen and IBM. The startup has now raised a $2.6 million funding round led by Moneta Ventures and Growth Factory Ventures.

“We invested in Kora because they’re not just building smarter hardware,” said Jeff Olyniec, partner at Moneta Ventures. “They’re reinventing how homes and the grid interact, unlocking unlimited opportunities in energy independence and resilience.”

With the fresh funding, the startup plans to focus on its research and development efforts, as well as test manufacturing.

Check out the 11-slide pitch deck Kora used to secure the $2.6 million early-stage VC funding.

What were the slides in the Kora pitch deck?

Browse the exact example slides from the pitch deck that Kora used to raise a $2.6M round led by Moneta Ventures and Growth Factory Ventures.

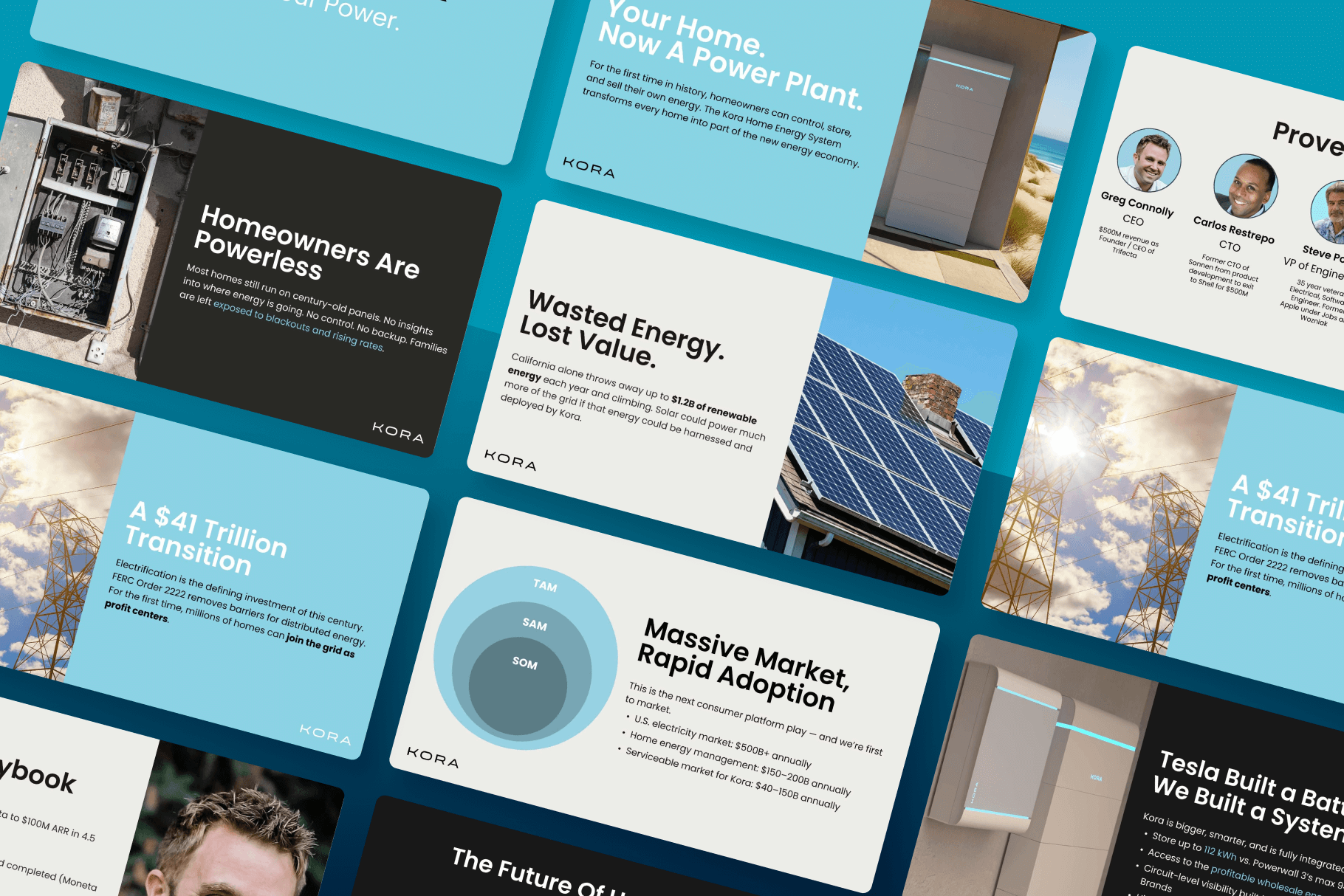

1. Value Proposition Slide

A value proposition is a short statement that communicates why buyers should choose a product or service. It’s more than just a product or service description — it’s the specific solution that a business provides and the promise of value that a customer can expect to be delivered.

It is important for founders to fully understand their value proposition before they can pitch it to customers. They should determine what market needs their product or service, and what separates their offering from others. Without this differentiation and definition of opportunity, a new business isn’t likely to succeed. A short, clear value proposition will stick in the minds of investors ensuring the business stands out in the sea of startups pitching to VCs.

Creating a value proposition is pretty straightforward: it contains a headline, sub-headline, and one small paragraph of text with a visual (ex. photo, hero image, graphics). The headline is the attention-grabbing element followed by a specific explanation of what is being offered, for whom, and why it’s useful. Finally the image is used to show the product and reinforce the main message.

Kora’s value proposition is built on these exact foundations. “You Home. Now A Power Plant.” is a catchy heading that communicates both the benefit and the vision in just a few words. The supporting copy is also not unnecessarily long and expands just enough to make the promise concrete. Overall, the copy is great because it positions Kora not just as a product, but as a shift in the energy economy.

On the design side, the slide is clean, and the simple layout balances a strong product visual with effective copy, making it immediately clear what’s being offered. The color palette as well as the photo reinforces the idea that Kora isn’t just a piece of tech—it’s part of a homeowner’s lifestyle and future.

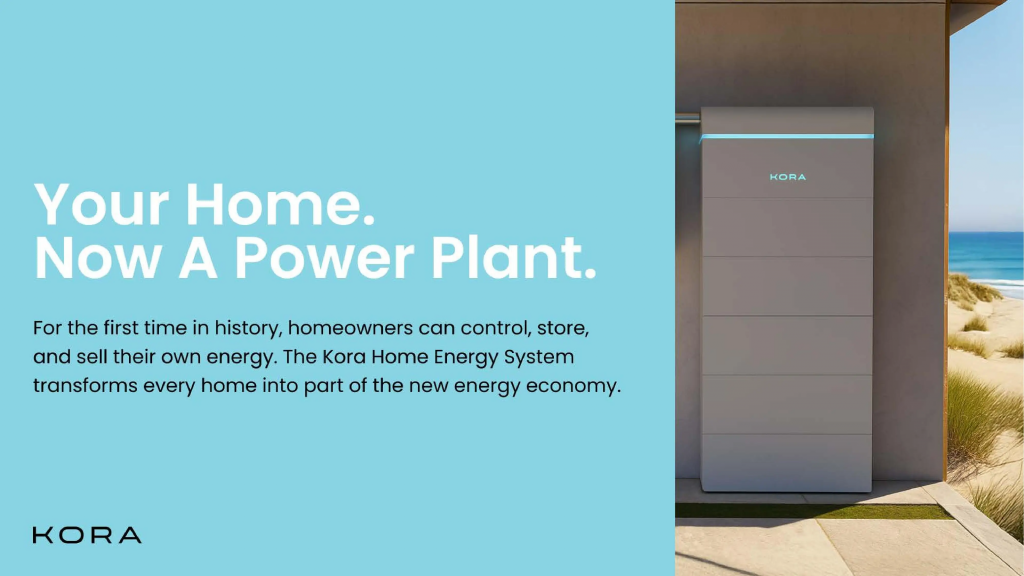

2. Market Size Slide

A pitch deck that doesn’t cover market size is likely to be sent packing by any potential investor. In fact, it is impossible to create a viable business plan without understanding the market size of a product or service. As a founder, understanding your market gives you a clearer path to growth, helps attract the right investors, and prevents you from investing in dead-end strategies.

As an investor, not understanding the market can lead to poor strategic decisions, missed opportunities, or wasted resources. This is why market size is almost always the very first factor they examine when evaluating the potential of a startup. By approaching the question of market size early and thoroughly, founders can not only align themselves with the perspective of investors, but also build a stronger foundation for their company.

One of the most common misconceptions about market size is think it refers to the overall population of a country. Market size is not simply “everyone who could possibly use the product,” but rather the portion of the market that is realistically relevant. For example, the average U.S. household consumes about 10,500 kilowatt-hours of electricity per year, making the electricity market worth $500 billion annually. However, a large portion of this market isn’t the right fit for Kora, hence, it can’t be present as the market size for Kora.

Instead, market size is estimated by calculating the total addressable market ($500 billion total electricity market), serviceable addressable market (~$200B home energy management segment), and serviceable obtainable market (actual market Kora is going to target). The slide uses the classical market size circle to clearly distinguish proportions, so they are quantified accurately and don’t mislead the audience. However, one thing the slide lacks is supporting data / sources which can reduce credibility.

Overall, while the layout is simple and uncluttered, the slide could benefit from stronger evidence-based messaging.

3. Founder Experience Slide

For early-stage startups, the founding team can either be the root of failure or the key to success. For investors, the ability to recognize whether a founding team has the necessary skills to create a successful business is as, if not more, important than conducting financial or technical diligence. If the founder has no track record to assess, then it is quite difficult to determine if they have the grit and resilience to push through the unforeseen struggles.

The founders’ experience becomes even more important in the case of companies like Kora that are just launching its first product and don’t have traction. These companies will inevitably pivot, face unexpected challenges, and navigate uncertain markets. The original business plan or product rarely survives the first iteration and will look a lot different in coming years. What remains constant through these evolutions is the founding team’s ability to adapt, persevere, and execute effectively despite obstacles.

By highlighting his experience of taking Trifecta to 100M ARR, Kora pitch deck’s founder slide argues that Greg Connolly has the experience it takes to build a successful direct-to-consumer business. The large photo grabs attention, humanizes the pitch, and builds credibility. The bold headline “Proven Playbook” is strong, concise, and instantly communicates that he has successfully built businesses before.

The slide could be improved by reducing the size of the image, because it dominates the slide and leaves the text cramped. An addition of simple graphics or metrics (e.g., ARR growth timeline, investor logos), would make this slide more compelling and pop instantly.

How to create your own pitch deck like Kora:

We hope you learned something from the Kora pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/Kora

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, the perfect pitch deck is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $2B+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular Cleantech Pitch Deck Template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for Cleantech startups seeking to raise funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.