After leaving Zillow, taking a year off, and buying a second home in Lake Tahoe, Austin Allison conceived Pacaso: a tech-enabled marketplace that buys second homes for investors who purchase fractional shares, share costs, and can stay in the properties periodically throughout the year.

“I wanted to make that second homeownership dream possible for more people,” he said while founding Pacaso in 2020 alongside Spencer Rascoff.

The company offers ownership shares ranging from one-eighth to one-half, paired with flexible financing, professional management, turnkey design, and full-service support that includes scheduling, maintenance, and resale assistance.

Pacaso operates in more than 40 top destinations across the United States, Mexico, and Europe. The company is further scaling to meet global demand with recently announced planned expansion into Italy and the Caribbean. In fact, Pacaso’s first Paris property sold out so fast that they purchased a second – on the same street.

“It’s a massive opportunity,” Austin said. “There are about a 100 million second homes around the world, and tens of millions of people aspire to own second homes.”

Since its launch, Pacaso has facilitated over $1 billion in transactions and service fees, and generated more than $110 million in gross profit. The company reached a $1 billion valuation just five months after launch, and at the time, it was the fastest startup in the US to hit unicorn status. Its current valuation is just short of $1 billion.

“Pacaso’s traction shows that there’s real demand for a new way to own and invest in luxury real estate,” said Austin.

On Oct. 2, 2025, Pacaso announced the close of its record-setting SEC-qualified Regulation A+ growth round, raising over $72.5 million from more than 17,500 individual investors. Pacaso’s raise is the largest real estate Reg A+ offering of 2025 and one of only a handful of companies in history to surpass $70 million, cementing the company as one of the most significant Reg A+ issuers to date. The milestone brings Pacaso’s total equity funding to more than $300 million.

“This raise was proof that thousands of people believe in a better, smarter way to own and experience a vacation home,” said Austin, “The overwhelming demand exceeded expectations, showing that co-ownership is more than a trend — it’s a movement.”

Check out the 24-slide pitch deck Pacaso used to secure the $72.5 million Reg A+ funding.

What were the slides in the Pacaso pitch deck?

Browse the exact example slides from the pitch deck that Pacaso used to raise $72.5M from small investors.

1. Mission Statement Slide

Founders often think that mission statements are useless things that end up somewhere in a business plan or on a forgotten page on the website. On the contrary, having a clear vision, mission, and core values is one of the most basic and influential aspects that determine a startup’s success. Jack Welch, who transformed General Electric into a global powerhouse, once said that “Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion.”

But why is a mission statement so important? It is not just a statement; it defines the present / future state & purpose of an organization and answers the four Ws:

- WHAT does the startup do?

- WHY does it do that?

- WHO does the startup do it for?

- HOW does the startup do it?

The answers to these questions impact every aspect of the business and how the employees and investors view the organization. As such, a strong vision and mission statement should be used in marketing, recruiting, sales, and fundraising to align with various stakeholders’ values.

We find a strong mission statement in the Pacaso Reg A+ deck, with a clean and modern design that feels authentic. The image of a couple sitting by their second home makes the slide emotionally engaging and adds warmth and relatability. Similarly, the layout is simple and the typography has a clear hierarchy between different elements.

However, the slide could use some minor design improvements: for example, the white text could benefit from stronger contrast against the bright sky. Additionally, the slide feels slightly bottom-heavy, and lowering the text block would create better balance.

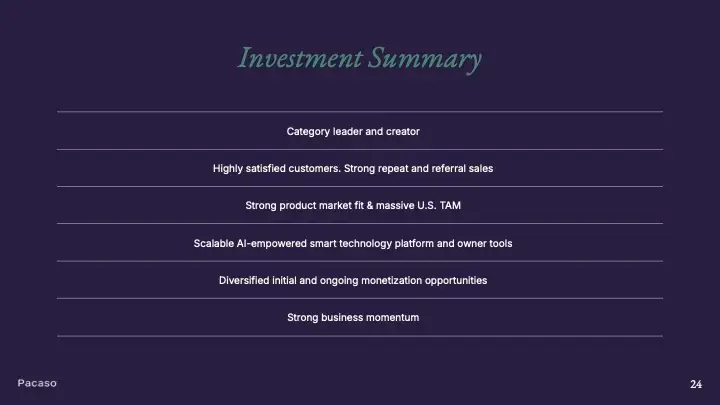

2. Investment Summary Slide

The goal of an executive summary is simple: persuade VCs to invest in your business by helping them check off all the boxes on their list. To create this summary, you’ll need to explain your business plan, your tech, product, market, future, and more in one slide. In order to keep this slide concise and focused, you’ll need to know what information you need to include and how you’ll prioritize the importance of each part.

You’ll also need to understand your audience and what they are looking for. Pacaso’s Reg A+ investment summary is created for individual investors rather than business-savvy VCs, so the objective is reassurance rather than technical depth. The slide focuses on signals that might resonate with retail investors; i.e. satisfied customers and repeat/referral behavior, a large U.S. market opportunity, scalable AI tech, and diversified income streams. There are no dense charts or jargon-heavy metrics and everything is presented in straightforward bullets.

The slide is visually simple, with minimal text that is quick to read and easy to comprehend. The typography is clear, readable, and consistent. The horizontal lines above and below each text block organize the content visually and give the slide rhythm. However, the slide could be even more engaging with the quick additions of subtle icons or small visual markers, as well as switching the heading to the deck’s standard white for better contrast.

3. Call-to-action slide

A Call to Action (CAT) is a prompt designed to encourage a specific response or reaction from the audience. These are important for many reasons such as directing audience attention, engagement, and interaction, creating a sense of urgency, and enhancing user experience. Usually clear, concise and eye-catching, call-to-actions are created with a message that motivates the audience to take the next step.

Crafting a call-to-action may seem simple, but the real challenge lies in understanding the psychology behind it. Only by understanding the principles behind CTAs can one create a slide that converts.

The first rule of crafting a call-to-action is to make it specific by using an active verb at the beginning like “download,” “subscribe,” etc. Pacaso’s use of “Become” in its call-to-action slide is a great way to get started.

When people click on a CTA button, they are only thinking about what they will get in return. If the offer isn’t attractive, investors will not take the next step. Although Pacaso’s CTA “Become an Investor” works, a more emotionally engaging version such as “Own a Stake in the Future of Real Estate” could resonate more deeply with the retail investors.

Design-wise, the best CTAs blend seamlessly with their environment. They should attract attention without clashing with the overall aesthetic. Pacaso’s slide achieves this balance by maintaining consistency with the pitch design and using a clean layout with the logo, clear headline, and direct contact email. The result is a simple, purposeful, and effective call to action slide.

How to create your own pitch deck like Pacaso:

We hope you learned something from the Pacaso pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/Pacaso.

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, the perfect pitch deck is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $2B+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular Proptech Pitch Deck Template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for Property & Real Estate tech startups seeking to raise funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.