AuditBoard was founded in 2014 by Daniel Kim and Jay Lee, two childhood best friends who sought to reshape the audit, risk, and compliance landscape. Daniel, an auditor by trade, had spent the eight years prior to founding AuditBoard running internal audit teams. Jay, who was working in private equity at the time, teamed up with Daniel to launch Soxhub, a tool for managing corporate Sarbanes–Oxley compliance.

In 2017, the team started to see a much bigger opportunity for the company beyond purely Sarbanes–Oxley compliance management. They realized that auditors had no purpose-built tool for their daily workflow. They were being left using governance, risk, and compliance tools that were built for a compliance buyer and needed to be repurposed for the unique needs of auditors.

Jay and Daniel envisioned a connected risk platform where controls updated in one functional area would flow through to all of the other groups across the enterprise. The company raised investment from Battery Ventures, rebranded from Soxhub to AuditBoard, and executed their vision of connected risk.

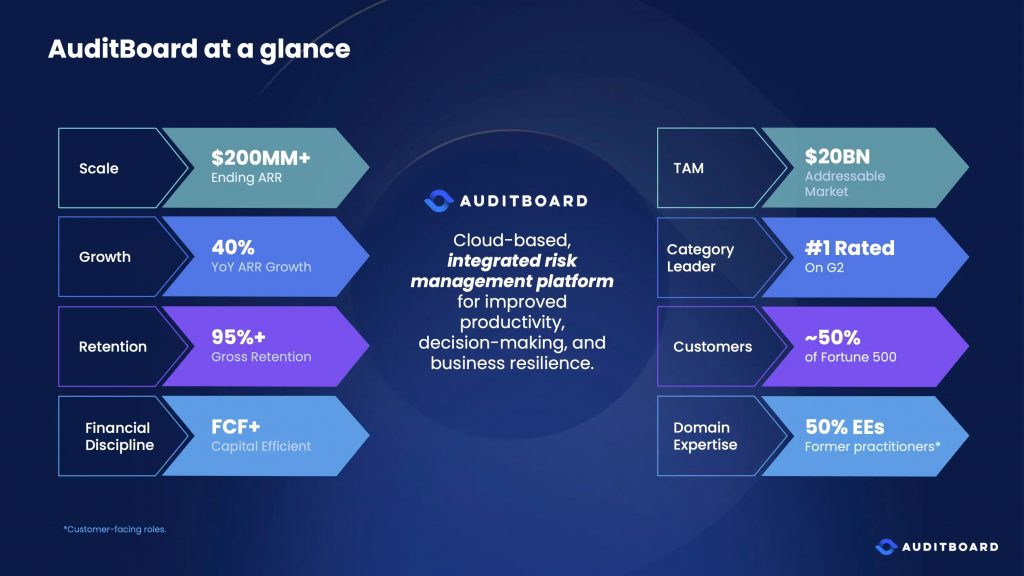

Today, the company boasts over eight product modules that work together as a suite, connecting controls and frameworks across audit, risk, and compliance teams. AuditBoard is used by over 2,000 enterprises, including nearly half of the Fortune 500. It’s been cash flow positive for a decade and was generating $200 million in annual recurring revenue in February 2024, Fortune reported.

In March 2024, AuditBoard was seeking potential IPO investors, when an inquiry from London-based Hg hit Scott Arnold’s, President & CEO of AuditBoard, email and opened the door to an outright sale.

“It was like getting an email that says, ‘I want to marry your daughter,'” said Arnold, who is a father. He added, “If somebody is serious enough to say that, I’m going to take the meeting.”

AuditBoard hired Goldman Sachs Group, one of the banks the company was considering for the potential IPO, to explore options. The company sought bids from buyers while still exploring an IPO, a common move for companies to ensure they and their shareholders get the best possible deal.

“We ended up with a crazy number of people that were bidding something with a three in front of it,” said Arnold, “And so the board was in a really cool decision dimension.”

Eventually, AuditBoard’s leaders and founders conferred and chose Hg’s offer. Hg was willing to sign an agreement within a day. And it provided certainty that it would get the deal done by agreeing to backstop the full amount, meaning the acquisition wasn’t contingent on Hg’s ability to secure debt financing.

Here’s the 19-slide pitch deck that AuditBoard used to court a $3 billion buyout from private equity.

What were the slides in the AuditBoard pitch deck?

Browse the exact example slides from the pitch deck that AuditBoard used in their $3 billion buyout by Hg.

1. Company overview slide

Pitch decks that are created for established companies looking to raise a later-stage round (e.g Series D) need a different narrative than companies who are just starting out and looking for angel or seed investment.

For example, the pitch deck for a seed round might start with the problem slide or the team slide (in case it has a very strong team), whereas the deck for a company that is looking to be acquired or going for IPO should begin by providing a comprehensive overview of the company. One school of thought is that the summary should be placed at the end of pitch deck, but that’s a debate for another time.

Since the overview is a snapshot of the company, it must be as concise as possible to arouse interest without introducing any element of confusion. Each highlight should capture a reason why investors should consider the firm as an investment opportunity. The best highlights are the ones that include numbers and other non-subjective content. They should establish clear differentiation by articulating the firm’s strengths and opportunities.

AuditBoard’s acquisition deck’s company overview slide is the perfect example of what a summary slide should be. It covers all of the major points (customers, growth, market size, etc.) that investors may be interested in, while remaining brief, succinct, and factual. The slide clearly conveys the core of the entire organization with the bold “integrated risk management platform” text.

2. Market size slide

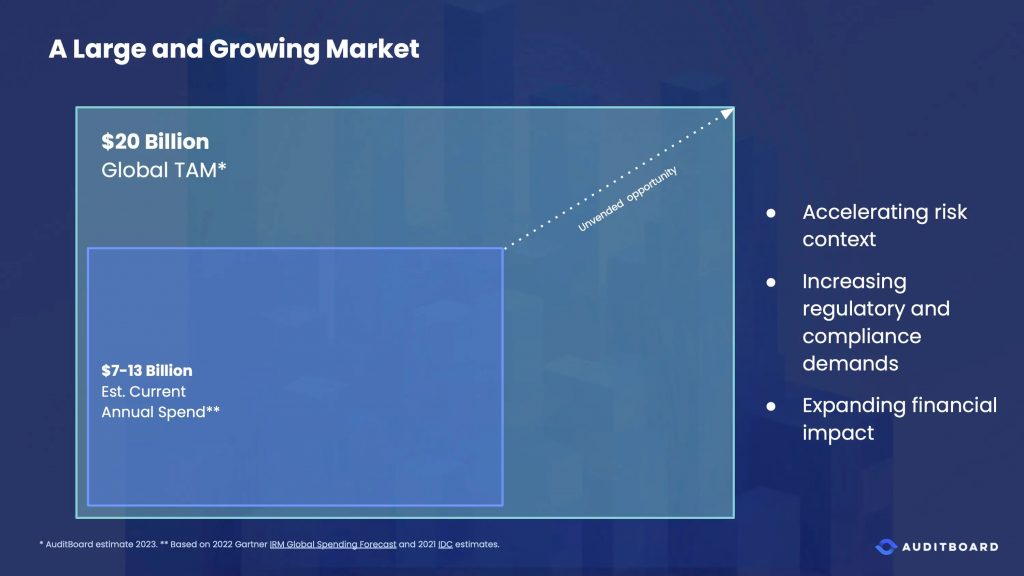

One thing that doesn’t change from an early-stage startup to an established company is the importance of market size. For founders, market size is more than just a theoretical quantity — it is a base that guides decisions on product development, pricing, and marketing strategies. For investors, it determines the return on their investment.

As such, the market slide should clearly convey the precise, legitimate size of the market opportunity. AuditBoard’s market slide cleverly starts with a large market number, which can be particularly effective as an opening data point because people tend to anchor to whatever number they hear first.

Additionally, rather than relying on vague claims like “Leader in a large market driven by powerful trends”—which can frustrate investors—the slide pinpoints specific forces shaping the industry, such as “increasing regulatory and compliance demands.”

The design is clean and easy to digest, featuring bold figures and minimal yet impactful text. The result? A slide that reassures investors that AuditBoard operates in a growing, high-potential market.

3. Customers slide

According to a study by CB Insights, 42% of startups fail due to a lack of market need. Validation of a business idea acts as a safety net for both investors as well as founders. For founders, it can help them avoid the pitfalls of investing too much into an untested concept. For investors, it saves them from investing money into something that may not sell.

That’s why investors look for proof that a company is gaining traction. Whether it’s revenue, user growth, or product milestones, they want to see tangible progress.

AuditBoard’s pitch deck customers’ slide proudly highlights that the company’s customers include Fortune 500 companies. The slide doesn’t have to complicate things to prove that AuditBoard is “Trusted by the World’s Largest Enterprises”—the slide just showcases logos of its customers. But what makes this slide even stronger is how it categorizes customers by industry, reinforcing that AuditBoard has credibility across multiple sectors. It’s a simple yet powerful way to build investor confidence.

How-to create your own pitch deck like AuditBoard

We hope you learned something from the AuditBoard pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/AuditBoard

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure their vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular Investment Banking Presentation Template template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for financial professionals in private equity.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.