Founded in 2017 by Michael Berthold, Knime is headquartered in Zurich and has additional offices in Berlin and Austin, Texas. The startup sells an enterprise software platform for data analytics, reporting, and integration. Its main product, KNIME Analytics, provides an open-source data science and AI platform that enables anyone – whether they come from a business, technical or data background – to intuitively work with data, every day.

“The initial goal was to create a modular, highly scalable and open data processing platform that allowed for the easy integration of different data loading, processing, transformation, analysis and visual exploration modules, without focus on any particular application area,” Berthold said. “The software was designed to be professional-grade and also serve as an integration platform for various other data analysis projects.”

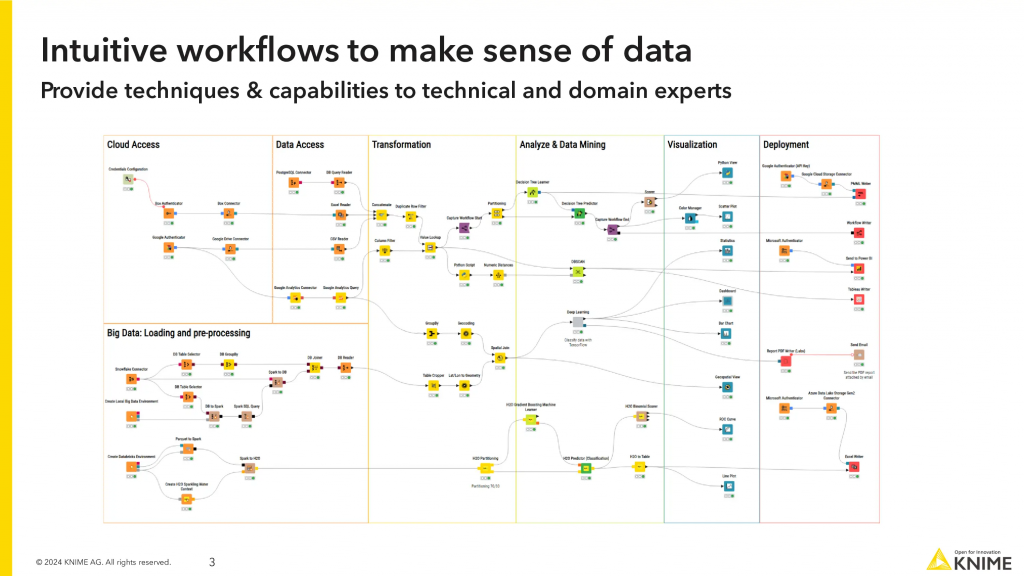

Knime’s software is built on visual, no-code workflows designed to integrate with an org’s systems of record. Users can tap Knime to build pipelines to transform data, turn data into reports and visualizations, or compare one set of data to another, regardless of where the data resides.

The company just released version 5.3, which brought, among other features, new generative AI capabilities. Like other data science toolmakers, Knime is embracing large language models not only as a computational tool for data scientists building GenAI applications, but to improve the product experience directly within Knime as well.

“Knime was built from the beginning to help with the continuous, safe deployment of data science processes in mind, so it was straightforward for us to add a customizable set of controls around GenAI. Knime provides a single environment for data scientists that balances innovation and control by giving data workers access to as much new GenAI functionality as possible while allowing them to control risk by putting the right governance mechanisms in place.”

Since 2017, Knime has grown revenue to €30M at a 30-40% annual growth rate, now serving nearly 400 customers such as ASML, Audi, AMD, Lilly, Novartis, Bayer, Sanofi, Genentech, the FDA, P&G, Mercedes-Benz, and others, with a team of 250 employees worldwide.

This week, Knime announced that Invus invested $30 million in its business to bring Knime’s total raised to $50 million. The proceeds will be put toward product development, expanding Knime’s team from 250 people today to 275 by the end of the year, and customer acquisition efforts across the U.S., Europe, the Middle East and Africa, Berthold said.

“Knime was close to profitability in 2024, but with the added investment, we’ve chosen to invest more and grow in the coming years,” Berthold said. “We’ve seen a slowdown in tech, mostly resulting in longer sales cycles and more difficult negotiations. In some cases, budgets were put on hold, but the open source analytics platform adoption has continued, positioning Knime well for the future.”

Check out the 15-slide pitch deck used to secure the latest funding.

What were the slides in the Knime pitch deck?

Browse the exact example slides from the pitch deck that Knime used to raise a $30M round led by Invus.

1. Value Proposition Slides

A strong value proposition is a critical component of any startup’s go-to-market strategy. Simply put, your value proposition is a simple statement (or a list of reasons) explaining why customers would choose your product or service over other solutions in the market.

Knime’s pitch deck effectively incorporates their value proposition into the platform introduction slides within the first quarter of the presentation. Meeting the conventional norm of a 30-second value proposition statement, Knime succinctly explains how they provide “intuitive workflows to make sense of data” on the very first slide.

Subsequent slides further elaborate on their target customers and the value creation process. The value proposition slides are designed with clarity and simplicity in mind. The straightforward layout ensures that abstract concepts are easily comprehensible at first glance. Combined with legible typography, these slides achieve a balance of visual appeal and substantive content.

Knime’s approach to presenting their value proposition demonstrates a strong understanding of investor expectations and effective use of visual communication. Although the flowchart used in this slide is fairly dense and nuanced, the design draws the reader’s eye to the headings of the section while the labels are very small to reduce cognitive load.

2. Market Slide

Andy Rachleff famously said, “when a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens”. This perspective helps explain why market size is a key consideration for many investors when evaluating startups.

VCs frequently encounter promising products that address real needs. However, if the market isn’t sufficiently large, these opportunities may not align with their investment criteria. This doesn’t necessarily mean these are poor business ideas, but rather that they might not achieve the scale required for significant returns for venture investors.

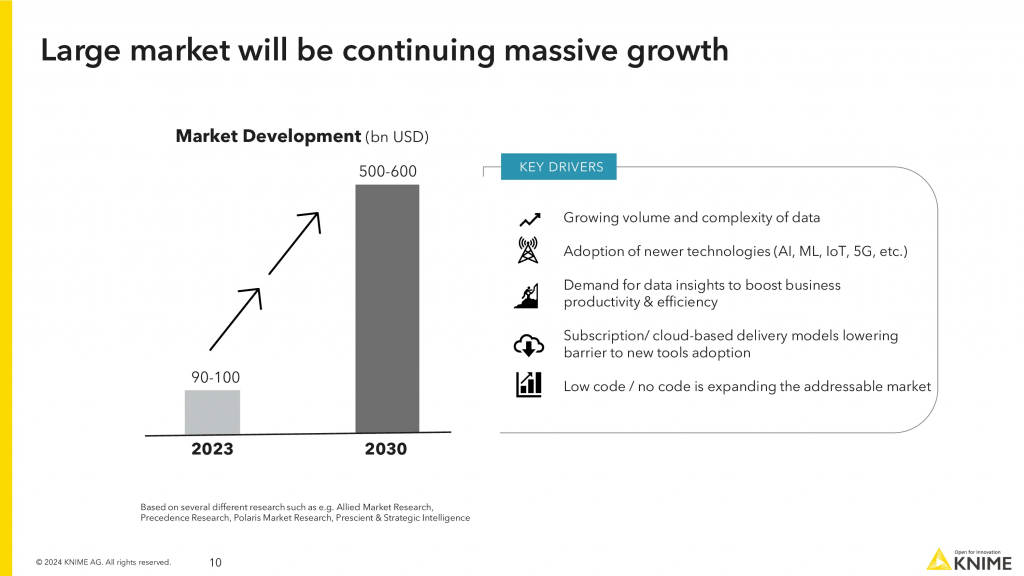

As such, it’s crucial that your pitch deck effectively demonstrates the market’s size and growth potential. The market slide in Knime’s pitch deck addresses these points well. It begins with a clear, concise heading “Large market will be continuing massive growth” that captures investor attention, followed by data to support its claims.

The slide employs a minimalist bar chart to illustrate potential market growth of 600% over six years, showcasing this is not only a large market, but one that is growing rapdily. Outlining the key drivers expected to contribute to this growth sends a clear signal that the founders understand the market and are ready to take advantage of it. Put together, these elements constitue a flawlessly-designed market sizing pitch, highlighting both market size and growth drivers.

3. Team Slide

Any startup’s founding team plays a critical role in how well the business does, no matter how good the idea may be. Looking at who’s running the show helps investors get a feel for how the company might grow, handle changes, and whether it’s the right team to execute on the opportunity. Many serial founders will open their seed-stage pitch decks with the team slide (instead of the typical Problem, Solution, Market flow espoused by most pitch deck recipes) if the company is pre-product or pre-revenue, as team experience can be an effective substitute for traction at the early stages.

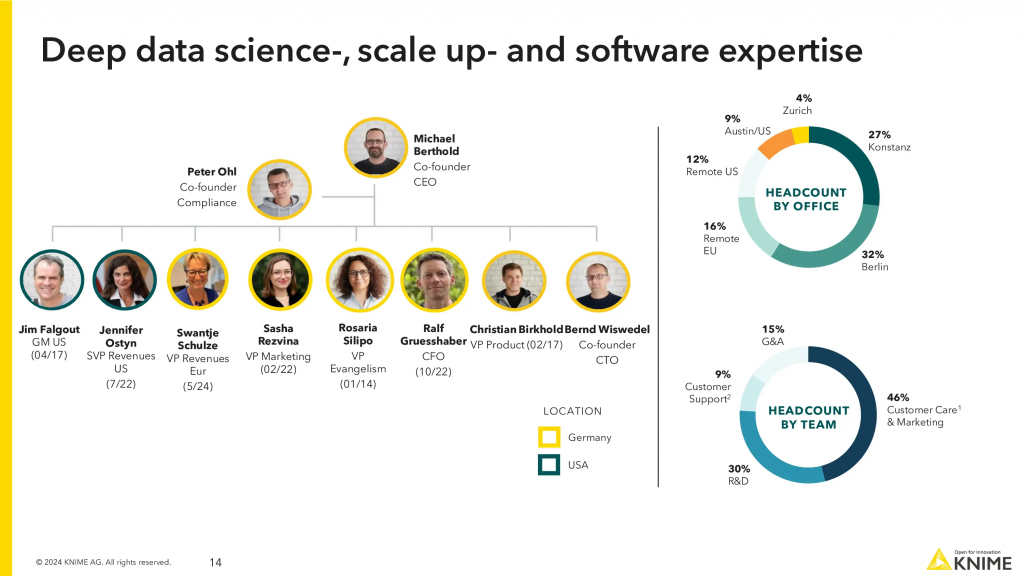

The Knime pitch defck’s team slide is laid out in a simple way that shows who’s who in the company. Interestingly, they also highlight where team members are located and a rough “org chart” style structure, along with the usual details like headshots, names, and job titles.

One thing that’s missing, though, is information about what the team members and founder’s past experience. Without this, it would be hard for investors to tell if this is a really great team or if they have the experience it takes to handle tough competition. Adding some background info on the team would give investors a better idea of what they’re capable of.

How-to create your own pitch deck like Knime

We hope you learned something from the Knime pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/knime

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular Tech Startup Pitch Deck Template template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for startups seeking to raise Seed funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.