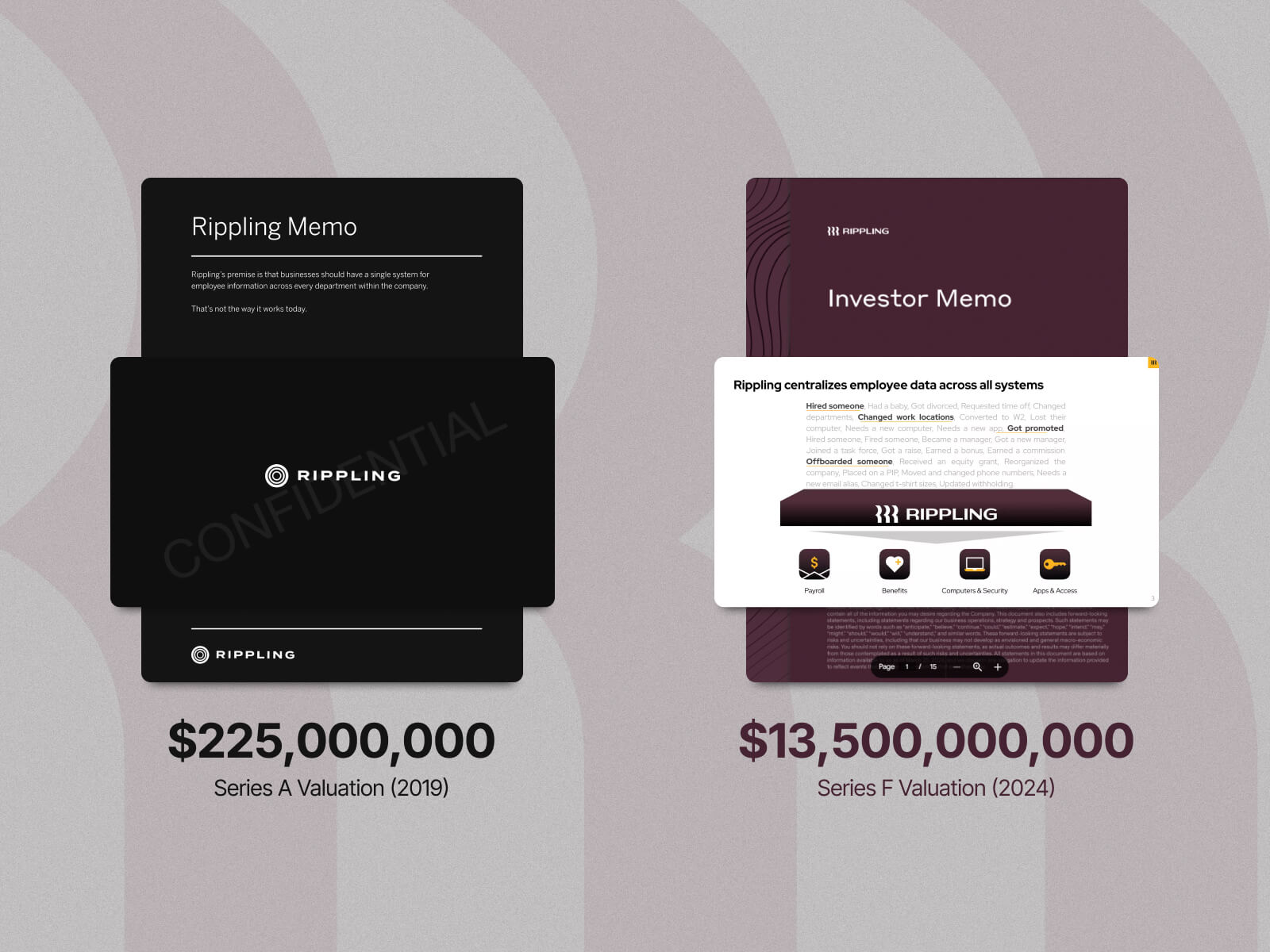

HRTech startup Rippling just announced they raised $200M in Series F funding (following a $500M Series E last year), catapulting the company’s valuation to a whopping $13.4 billion. The round was led by Coatue, joined by Founders Fund, Greenoaks, Dragoneer and other investors. Rippling also signed agreements with investors to repurchase up to $590M of equity from current employees, former employees, and early investors.

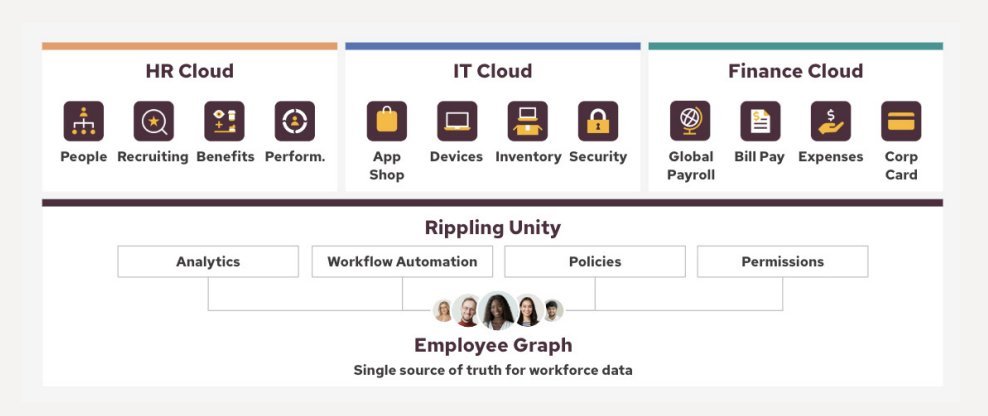

Founded in 2017 by Parker Conrad, Rippling’s workforce management platform combines HR, IT, and Finance apps on a unified data platform. In three short years, the company rocketed to a billion-dollar “unicorn” valuation. As of this financing, Rippling has raised $1.4B in total from investors.

What is particularly remarkable is how Rippling achieved this astronomical success by defying conventional startup wisdom. Here’s a closer look at their fundraising journey and the unorthodox strategies that have paid off in spades.

The investor memo: a departure from pitch decks

In 2019, when Rippling was gearing up for their $45 million Series A round led by Kleiner Perkins, they took an unconventional route. Instead of crafting a typical pitch deck, they opted for an investor memo.

Rippling’s 11-page memo deviated from the norm, starting with an overview of the company’s strategy and product. Rippling’s bold move challenged the traditional pitch deck formula and paved the path for other companies like Airbase and Mistral to raise millions with memos.

See the full Rippling Series A investor memo here →

The metrics deck: metrics >>> fluff

Accompanying Rippling’s Series A investor memo was a succinct “metrics deck.” Instead of drowning potential backers in verbose slides, Rippling zeroed in on key performance indicators (KPIs) and financials. This no-nonsense approach resonated with investors who appreciated the clarity and transparency.

See the full Rippling Series A metrics deck here →

Unicorn speed-run: billion-dollar valuation in 3 years

By 2020 (just three years after the company was founded), Rippling achieved a billion-dollar valuation after raising $145 million in their Series B round, led by Founders Fund. Their pitch remained concise, beginning with a 5-slide overview followed by metrics. Rippling’s consistent strategy and success over the last five years has certainly played a big part in their raising successful follow-on investment from blue-chip VC funds.

See the full Rippling Series B pitch deck here →

Compound startups: doing “more than one thing”

Rippling’s philosophy diverged from the prevailing VC wisdom that startups should focus on doing “only one thing.” They positioned themselves as a compound startup, emphasizing a holistic approach. Their vision has remained the same since their 2019 memo: “Businesses should have a single system for employee information across every department within the company.”

Five years later, Rippling’s Series F memo continues to highlight the success of their commitment to the compound startup model:

The memo spends several pages speaking to the advantage of compound startups, which is the crux of the investment thesis for their company. Throughout their pitch materials, Rippling makes an effort to streamline later stages of due diligence for prospective investors (ie. providing metrics upfront).

See the full Rippling Series F investor memo here →

By breaking the rules, Rippling raised a staggering $1.4 billion in total funding and built an industry-leading platform. The company’s contrarian, no-nonsense strategy permeates every level of their business strategy. When recently asked about Rippling’s AI strategy, Parker Conrad responded “I’m always very skeptical of things that are…super trendy in Silicon Valley…I’m super skeptical about these chatbots.”

Rippling’s journey serves as a beacon for other startups, proving that sometimes, the road less traveled leads to the greatest rewards. For more inspiring investor memos, pitch decks, and success stories, check out bestpitchdeck.com

Want to create your own investor memo like Rippling

We hope you learned something from the Rippling investor memo, and you are able to use these insights for your own business. If you’d like to, you can bookmark the following:

- Rippling’s Series A Pitch – bestpitchdeck.com/rippling

- Rippling’s Series B Pitch – bestpitchdeck.com/rippling-series-b

- Rippling’s Series F Pitch – bestpitchdeck.com/rippling-series-f

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

For instance, you might be interested in the popular Investor Memo Template designed by the experts at VIP Graphics. This easy-to-customize template for Microsoft Word or Google Docs offers you ready-made elements & all the essential sections to streamline your pitch.