Founded in 2019 by Jennifer Smith and Aaron Podolny, Scribe provides an AI-powered tool for workflow documentation and knowledge sharing. The company has two flagship products: Scribe Capture and Scribe Optimize.

When someone completes a process or workflow, Scribe Capture generates a step-by-step guide using its browser extension and desktop app, along with text and screenshots. Those guides can be shared with colleagues or embedded in internal tools to reduce repeated questions, minimize errors, and expedite onboarding.

Scribe Optimize maps workflows across the enterprise to reveal where automation and AI will actually yield returns. Many companies are racing to adopt AI, but most still cannot answer a fundamental question: What should we automate first?

“AI can’t improve what it can’t see,” CEO, Jennifer Smith said. “You can’t just sprinkle AI into your business and expect that it’s going to magically make everything better. The missing ingredient is context and data.”

The company has documented over 10 million workflows across 40,000 software applications, serving more than 5 million users. Customers report saving 35 to 42 hours per person monthly and making new hires 40% faster using Scribe Capture. The startup also reports that teams within 94% of Fortune 500 companies use Scribe, and 78,000 organizations are paying customers, including New York Life, T-Mobile, LinkedIn, HubSpot, and Northern Trust.

“Users come to Scribe not because their boss tells them to, but because they want to,” Smith said. “It starts with the end user, and then goes up to their team lead, department lead, and then some kind of central function who are all interested in it for the question of, how do we scale, what we know, how to do, and how do we get better?”

In Dec 2025, the company announced that it had raised $75 million at a $1.3 billion valuation and achieved the unicorn status. StepStone led the Series C round, with participation from existing investors, including Amplify Partners, Redpoint Ventures, Tiger Global, Morado Ventures, and New York Life Ventures.

“Scribe Optimize is the promise of AI come to life because it’s tackling the missing piece of the workflow data layer in enterprise AI,” said Logan Bartlett, Managing Director at Redpoint Ventures. “With ubiquitous adoption, efficient growth, and a truly differentiated dataset, Scribe is uniquely positioned to help large organizations get more from their people and realize tangible returns from their tools and AI.”

Check out the 14-slide pitch deck Scribe used to secure the $75 million Series C funding.

What were the slides in the Scribe pitch deck?

Browse the exact example slides from the pitch deck that Scribe used to raise $75M from StepStone.

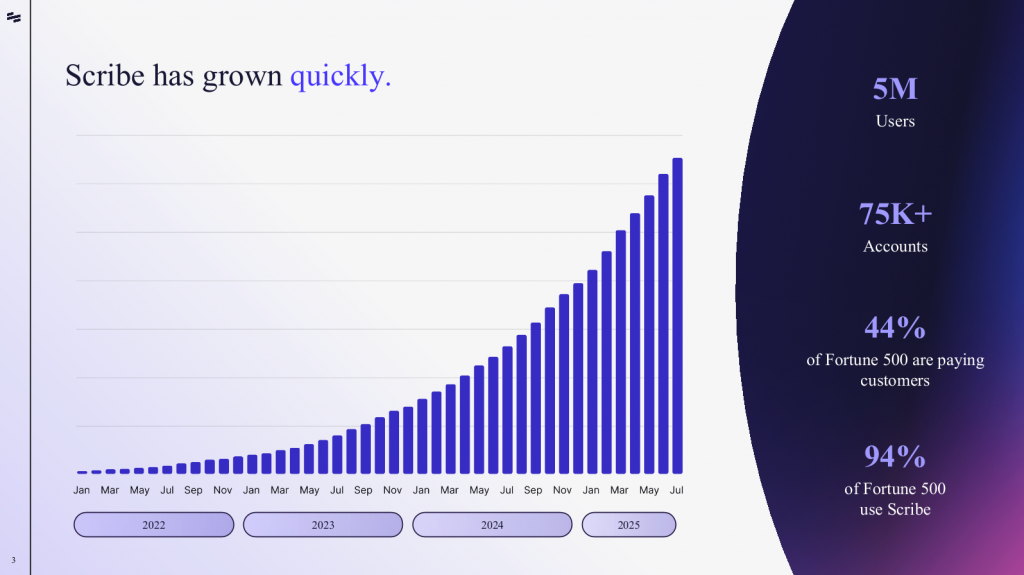

1. Growth Slide

From a venture capital perspective, it is not an easy task to evaluate the numerous opportunities that come across their desks everyday. Most startups only have a limited financial history, making it tough to judge their financial performance and how consistent it will be. On top of that, it’s exponentially harder to evaluate startups that are creating entirely new markets with very few comparable companies like Scribe is. VCs use various KPIs to measure a startup’s traction and determine if it is really headed in the right direction.

One of the most obvious KPI is user growth. If a startup is growing its customer base, that’s always a great sign. Depending on the type of startup, user growth will look different. For example, if it’s a social startup, investors want to see a considerable number of users on the platform. On the other hand, if it’s a B2B startup, VCs would look at the number of paying customers and the customers’ size and importance in their respective industries.

Most importantly, investors look at what the growth trajectory looks like. Did that company grow users 60% last year and only 30% this year? Clear user growth and the quality of user growth are the most important factors.

Scribe’s user growth slide tells investors that in addition to a lot of users (5M) and high quality of users (Fortune 500 companies), the user growth is sustainable and consistent throughout the years. The slide should’ve mentioned year-over-year percentage growth to clearly demonstrate consistency and to prove that it’s not spreading cumulative growth across multiple years which can be a big red flag for investors.

The slide’s design can also be considered indifferent. It could be made interesting by showing the user count progression leading up to 5M. The logos of Fortune 500 companies could also have been used to showcase the quality of their customers. Overall, the underlying message is solid, but the execution leaves room for improvement.

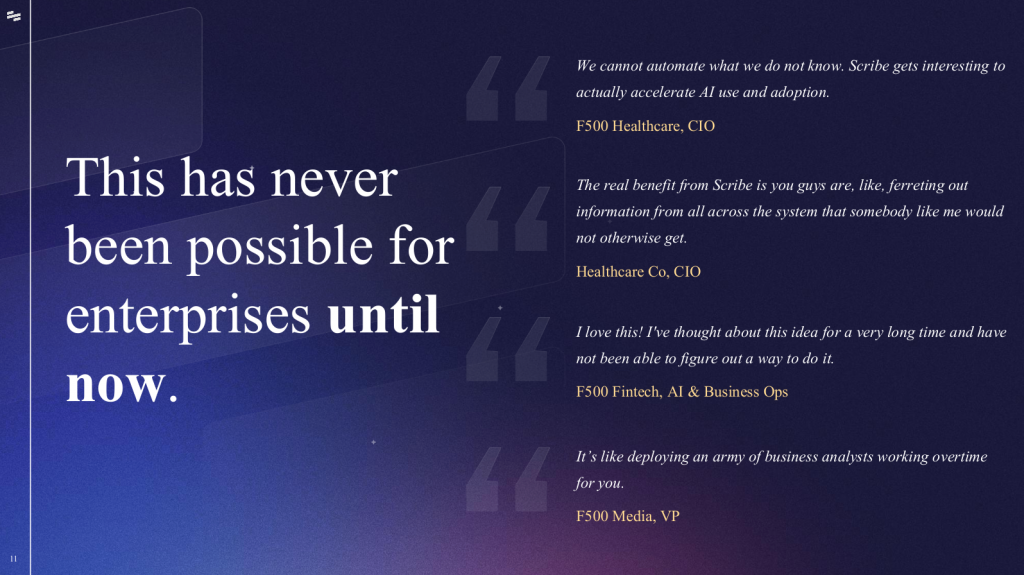

2. First Mover Advantage Slide

The idea of being first to market aka first-mover advantage argues that if you can get a new concept out before anyone else, you’ll be able to build a brand and a following while everyone else is asleep. By the time competitors enter the picture, you’ll have a huge head start and enjoy market leader status for years to come.

We’ve seen this play time and time again. Hoover came out with the first mass-produced vacuum in 1908 and dominated the market for decades. Sony came up with the Walkman and ruled the market all the way until the iPod. Amazon created the first online bookstore and has never looked back.

However, the notion that just being first to the market will automatically make you the market leader is misleading. In fact, late-movers have many advantages over first-movers e.g. they understand the demand exists, the heavy lifting of defining a brand-new product category is already done, they have the luxury of cherry picking the best features, and the path to monetizing the category is well-beaten. We’ve seen many examples of first-movers failing while competitors who enter the space much later succeed.

Ultimately, it’s not only who is first to market, but also who is best to market. Scribe’s First Mover Advantage slide argues that not only are they enabling companies to optimize their workflows by providing a real-time view into how work actually happens, but they do so in a way that’s better than any potential competitors so they’re more likely to retain their first mover advantage.

The slide has a polished aesthetic with a cohesive color palette and typography. The headline is short and eye-catching. That said, the slide leans too heavily on text. Since the deck already includes a dedicated testimonials slide, this one would be stronger if it focused on a single clear message rather than repeating social proof.

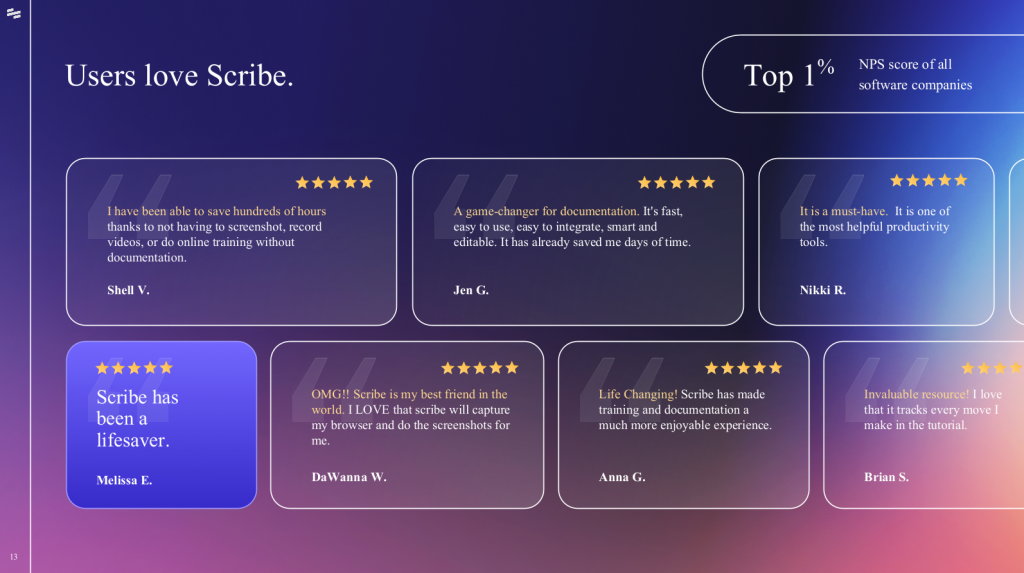

3. Testimonial Slide

When looking for investment, founders are often confused about what kind of traction they should have in their pitch deck. To make things simpler, it’s helpful to think of traction as ‘validation’. What kind of validation can you show investors to prove your idea is worth investing in? The short answer is that you should show as many forms of market validation as you can. Showcasing customer validation goes a long way towards convincing investors that you’re the right horse to back.

Scribe’s pitch deck has multiple validation slides, including a user growth slide, a traction slide with customers logos, a value proposition slide with real-world results, and to top it all off, a testimonial slide. The testimonial slide’s solid design and gradient background create visual depth without distracting from the content. Typography is well-chosen and legible and testimonial cards are neatly aligned. This creates a structure that’s orderly and easy to digest. Finally, the “Top 1% NPS” callout is a powerful credibility that adds a measurable metric.

How to create your own pitch deck like Scribe:

We hope you learned something from the Scribe pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/Scribe.

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, the perfect pitch deck is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $2B+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular AI Pitch Deck Template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for AI tech startups seeking to raise funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.