The WNBA and its associated teams have achieved numerous significant milestones in recent years. Notably, the league saw a remarkable 16% year-over-year increase in viewership during the 2022 regular season, and the playoffs reached their highest viewership levels in two decades. Additionally, a groundbreaking event in February 2022 saw a record-setting $75 million investment, marking the largest capital raise ever recorded for a women’s sports property. Furthermore, there are plans to introduce a new franchise in 2025, further emphasizing the growth and development of the league.

Now the Association has hit another milestone with Seattle Storm selling minority stakes at the valuation of US$151 million. The sell of the minority stakes to 12 investor groups is estimated to be approximately 15 times more than previous sales prices for WNBA teams, per the Wall Street Journal.

“What we’ve actually done is curated a list of people who really care about the team. They care about the evolution of the WNBA. They care about women’s sports.” Said Lisa Brummel who, alongside Dawn Trudeau and Ginny Gilder, will continue as the Storm’s majority owner.

The minority stakes were sold in an effort to fulfil plans to build a 50,000-square-foot practice facility. The complex is estimated to cost $64 million with a design that includes two side-by-side basketball courts, the “Storm Team Center” with locker rooms, a lounge, a nutrition centre for the players, and strength and conditioning training spaces.

“We are excited to create a state-of-the-art training facility for our team and for our city. The Storm facility will provide our athletes with a dedicated space to support them holistically, from training to health and wellness,” said Lisa. “This facility reflects our franchise legacy, and our athletes’ success, and aims to promote and grow the women’s game and expand youth access to play.”

The Storm are one of the most successful franchises in WNBA history, with four WNBA titles, most recently in 2020. They also have had several franchise players — including Sue Bird, who retired in 2022 after 19 years in Seattle.

“Investors don’t go off of anecdotes. They go off of [comparables],” she told the Wall Street Journal. “So hopefully, we’ve just set the floor. We’ve set up a real-live floor. Not just the WNBA, but women’s soccer, women’s hockey, where women’s sports is going.”

Here’s the pitch deck Lisa and other co-owners prepared for investors about the Storm’s success on and off the court, the growth of women’s sports, and their goals for the new practice facility.

What were the slides in the Seattle Storm pitch deck?

Browse the exact example slides from the pitch deck that Seattle Storm used to raise $21M at a record $151M valuation from 12 investor groups.

1. Traction Slides

Traction serves as concrete proof that the business model is viable, thereby decreasing the perceived risk for potential investors. Businesses that have achieved strong traction indicate genuine demand for their product or service within the market. When a startup can demonstrate rising sales, user engagement, or revenue figures, it substantiates the presence of significant market demand for its offerings. This market validation provides a substantial level of confidence and reassurance for investors.

The Seattle Storm pitch deck’s traction slides follow a straightforward design, offering a visually appealing overview of the team’s accomplishments. Incorporating emotive images encourages investors to become part of the team’s success story. The slide utilizes bullet points and a data-driven approach, including metrics like ticket sales and partnership revenue, to offer tangible proof of the team’s advancement.

2. Market Size Slides

What is the scale of your target market? This is perhaps the most important question founders can expect from investors during the fundraising process. Assessing the potential market size is a crucial initial step in determining the feasibility of any project. This is because, even if your product is highly innovative or cost-effective, you won’t generate profits if your market is too small or competitive. This principle applies to investors as well; if the market size is restricted, they won’t see substantial returns on their capital.

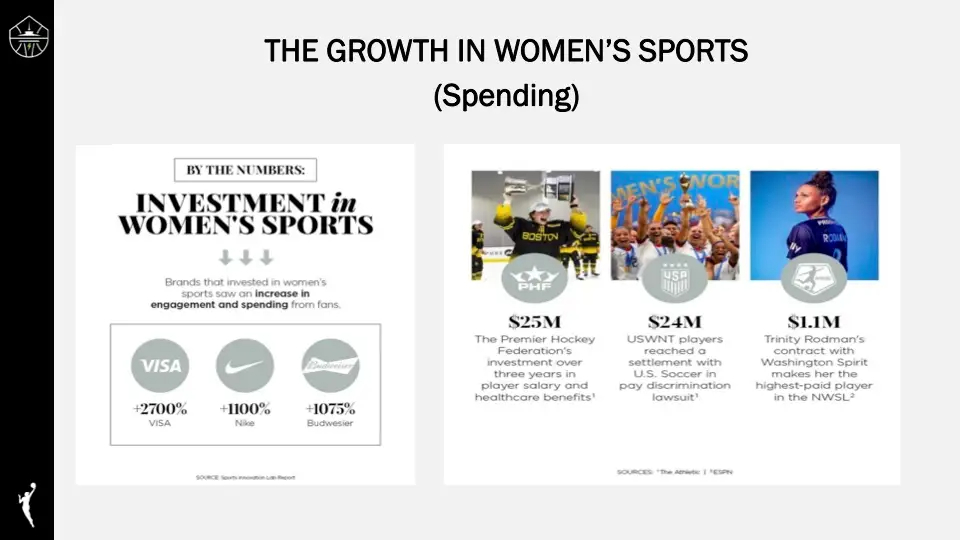

The Seattle Storm pitch deck includes several market size slides focused on various aspects of the women’s sports market, encompassing investment, expenditure, viewership, and audience demographics. These slides are characterized by a clean and straightforward design, featuring compelling visuals, pertinent statistics, and grayscale logos. The content is thoughtfully organized into easily digestible segments, with key points prominently emphasized for quick comprehension.

3. Use-of-funds Slides

Use-of-funds slide communicates to prospective investors that the company has a carefully devised strategy for deploying capital to enhance capabilities, maintain ongoing operations, stimulate expansion, and reach specific objectives. Furthermore, the projected allocation of funds serves to support the valuation established by the founders for the business.

Investors can assess whether the specified allocation aligns effectively with the suggested valuation. In the case of the Seattle Storm, this entails a privately-funded investment of $64 million for the construction of a cutting-edge, 50,000-square-foot practice facility located in Seattle’s Interbay neighborhood.

Within the Seattle Storm pitch deck, the use of funds slides showcase visual representations of the proposed facility, offering investors a means to conceptualize the project. However, it would be beneficial to provide additional details regarding how this facility will enhance team performance, generate revenue through hosting community-based events, or outline any other intended uses. Investors typically want to see capital allocation broken down by category or milestone somewhere in the deck.

How-to create your own pitch deck like Seattle Storm

We hope you learned something from the Seattle Storm pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/seattle-storm

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

Gaming & eSports Pitch Deck — You might be interested in the popular eSports Pitch Deck designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for Gaming and eSports sector.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.