Founded in June 2021 by Spendesk co-founders Jordane Giuly, Morgan O’hana, and Marc-Henri Gires, Defacto specializes in offering loans and credit to small companies through its API-based product. This innovative solution allows third parties, including marketplaces and e-commerce platforms, to seamlessly integrate Defacto’s products directly into their own offerings.

“Cash flow and access to liquidity are once again reasons for concern due to inflation, repayment of state COVID loan and rising interest rates. Traditional banking caters less to SMEs and processes are too slow,” explained O’hana. “We are building a product for builders, not bankers. Access to capital should be fair and instant. Banks rely on data that is at least 18 months old and then take 4 months or longer to process loan applications. We move in real-time.”

Small and Medium-sized Enterprises frequently face challenges accessing financial services from traditional institutions due to the associated costs of sourcing and underwriting smaller companies within the low-margin lending landscape. Defacto aims to address this gap by collaborating with fellow fintechs, such as Pennylane and Qonto, with the goal of reducing costs and streamlining administrative processes for smaller businesses.

“Businesses are interacting more and more with digital platforms. Those interactions generate a large amount of data in real-time, which Defacto is leveraging to redefine how underwriting should be done. Banking institutions will never have the right information systems to process this flow of alternative data, to reach real-time and tailored lending offers.” co-founder and CTO Marc-Henri Gires explained.

In July 2023, Defacto successfully concluded a securitization fund, securing €167 million in collaboration with Citi and Viola Credit. Citi served as the senior lender for the fund, and Viola Credit reaffirmed its confidence in Defacto by continuing its role as a mezzanine lender. This strategic initiative has provided Defacto with a robust financial foundation, supporting its ongoing exponential growth. With an annual funding capacity of up to €1 billion, this facility positions Defacto for sustained expansion and success in its operations.

“We are delighted to secure this facility with Citi, one of the largest banks in the world, and having Viola Credit renewing its trust in Defacto’s team, strategy and product. In the current macro environment, this is an important milestone for enabling our growth with both existing and new partners and answering the financing needs of thousands of SME.” said Jordane.

Over the last two years, Defacto has successfully deployed over €250 million in small business financing. The company takes pride in its remarkable efficiency, boasting an average quote-to-capital time of less than 27 seconds. Building on this solid foundation, Defacto is now strategically pivoting its focus towards personalized lending. The aim is to provide small businesses with proactive recommendations on optimal timing for taking on debt, demonstrating a commitment to enhancing and customizing its financial services to better meet the unique needs of its clients.

To achieve this goal, Defacto has raised a 10 million euros, $10.8 million, Series A extension. The earlier Series A round was led by Northzone, with additional backing from previous backers Headline and Global Founders Capital. The $10.8 million in additional funding comes from Citi Ventures.

“Finance needs to shift towards real-time data and processes. Small and medium businesses make for 99% of all European businesses. Yet traditional banking is increasingly shy in supporting them. Defacto’s Capital by API provides entrepreneurs with forms of credit that not only scale with their needs but are also more fair and transparent. It’s an engine for growth. I have rarely met a team so customer-focused and achieving so much in one short year.” Jonathan Userovici, a Partner at Headline said.

Check out Defacto’s 20-slide Series A extension pitch deck below:

What were the slides in the Defacto pitch deck?

Browse the exact example slides from the pitch deck that Defacto used to raise a $10M Series A round led by Citi Ventures.

1. Problem Slides

The primary objective of any startup is to address challenges that remain unresolved or are currently addressed inadequately. In an industry largely dominated by large institutions and banks, survival and growth for fintech startups like Defacto hinge on the ability to tackle issues overlooked by these incumbents. Defacto exemplifies this approach by delivering a unique solution: quick and flexible short-term loans to small and medium-sized enterprises to extend their working capital.

The objective of the problem slide is to efficiently convey to investors both the nature of the challenge at hand and the corresponding opportunity it presents. Defacto’s pitch deck adeptly addresses the essential components of an effective problem slide, with both a comprehensive overview of the issue at hand and a clear explanation of its impact. The decision to incorporate multiple problem slides helps create a cohesive narrative and storyline, enriched by supporting statistics.

Furthermore, the design of the slides is very eye-catching, aligning with both the 10/20/30 rule advocated by Guy Kawasaki and the distinctive branding of the company. Using yellow as the primary accent color is no easy task, and Defacto pulls it off flawlessly. This not only enhances the overall pitch deck’s visual appeal but also ensures alignment with established presentation principles and brand identity.

2. Traction Slides

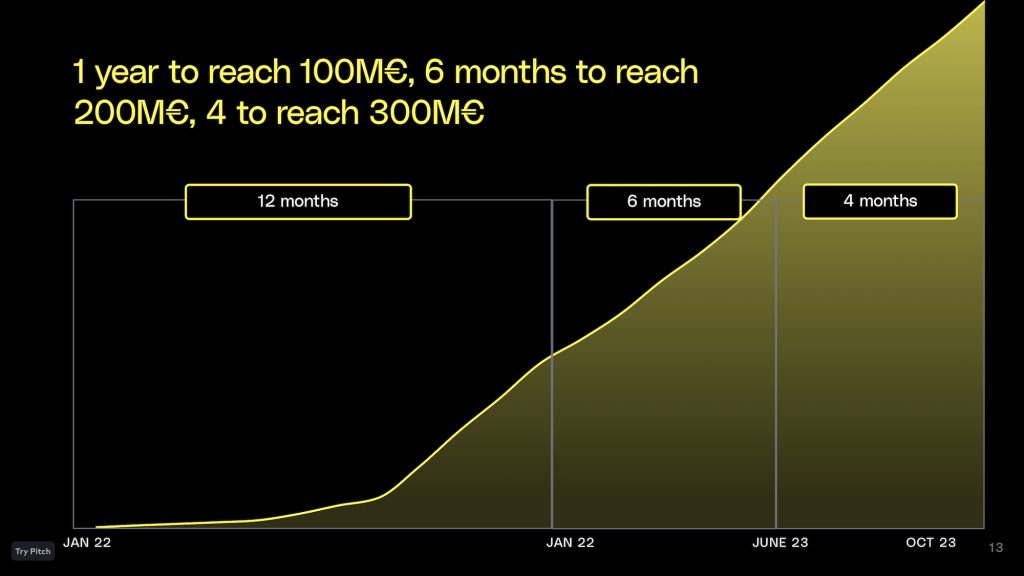

The role of the traction slide varies depending on the business stage: in pre-seed and seed rounds, the slide is designed to showcase advancements made toward validation. For Defacto’s Series A deck, the emphasis of the slide shifts to highlight the tangible, real-world progress achieved by the company.

Defacto’s pitch deck avoids a common pitfall associated with traction slides, where statistics are presented devoid of a coherent narrative. Instead, the deck maintains a well-structured flow thats shows growth and velocity, rather than static figures without context.

Notably, the presentation avoids the mistake some founders make by overemphasizing financial and customer traction at the expense of other crucial business achievements, such as partnerships. In the case of Defacto’s pitch deck, the traction slides thoughtfully incorporate statistics pertaining to partnerships, expansion, and Annual Recurring Revenue (ARR), ensuring a comprehensive representation of the company’s progress and success beyond mere numerical metrics.

The slide design maintains a balance of simplicity and modernity, ensuring ease of comprehension. The DeFacto deck as a whole successfully avoids information overload and cluttered graphics, presenting a clean and organized visual representation. The overall impression is one of thoughtful consideration, supported by an immaculate design that enhances the effectiveness of the traction slides in conveying key information to the audience.

3. Team Slide

Creating a successful business often hinges on a genuine passion for the venture. A study by Entrepreneur revealed that 23% of companies attributed their failure to team issues. This underscores the hard truth that without the right individuals driving a business, its chances of success are significantly diminished. Consequently, the composition of the team stands out as one of the pivotal factors influencing the fate of a startup, making the team slide a crucial element in any pitch deck.

Defacto’s pitch deck effectively incorporates key elements into its team slide, presenting essential details such as the co-founders’ names, areas of expertise, and prior experience. This comprehensive approach provides investors with crucial insights into the team’s qualifications. That said, the use of cropped photos and arrows to connect faces and names feels slightly out of place, creating a bit of visual imbalance. While the content is easy-to-grasp and succinct, adding some more details about the founders’ individual experience could enhance the overall impact.

How-to create your own pitch deck like Defacto

We hope you learned something from the Defacto pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/defacto

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

Fintech Pitch Deck — You might be interested in the popular Financial Tech Pitch Deck designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for the Fintech sector.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.