Founded in 2018, Lolli is a browser extension and mobile app that gives shoppers small amounts of Bitcoin when they make an online purchase. The company has raised an $8 million Series B led by BITKRAFT Ventures. Sfermion, Ulta Beauty’s Prisma Ventures, Hypersphere Ventures, Rahul Pagidipati, 2 Punks Capital, and MZ Web3 Fund also participated.

The round also included funding from Serena Ventures and Seven Seven Six — VC funds founded by Serena Williams and her husband, Alexis Ohanian, respectively.

Lolli gives up to 30% back on purchases, with an average of 7% back in Bitcoin or cashback rewards. Since its inception, Lolli has given over $10 million in Bitcoin rewards, in addition to cashback rewards

The platform has grown significantly over the past few years from partnerships with less than 100 stores to over 1000+ stores. Additionally, Lolli has provided access to more than 500,000 shoppers to become Bitcoin investors simply by shopping online. The platform has partnered with reputable retailers like Nike, Macy’s, Grubhub, Hotels.com, Postmates, and many others.

“We are growing quickly, and over the next few months, we’ll be rolling out new features and merchant partnerships that we think our users will love,” founder Alex Adelmane said. “As crypto adoption keeps rising, we are focused on becoming a holistic solution for our users to earn money every day, multiple times a day, and to learn about and earn bitcoin.”

Lolli announced $5 million in Pre-Series A funding in 2021. Alexis Ohanian’s venture capital fund—Seven Seven Six led the round. YouTube creators Cody Ko and Casey Neistat also participated in the round, and so did Night Media, the management company that represents MrBeast, plus additional investors. To date, Lolli has raised over $28 million.

“We have historically raised the amount needed to win,” Adelman said. “We don’t take more money than we need to support our next phase of growth, and are very focused on operating efficiently and proving out our business model.”

Check out Lolli’s 10-slide Series B round pitch deck below:

What were the slides in the Lolli pitch deck?

Browse the exact example slides from the pitch deck that Lolli used to raise a $8M Series B round led by BITKRAFT Ventures.

1. Market / Opportunity Slide

In simple terms, market opportunity refers to the potential of a product or service to meet the needs of a specific target market. This opportunity can arise from tech innovation, changes in regulations, or shifts in consumer preferences.

Understanding the market opportunity is crucial for startups to create a product or service that fits well and meets consumer demand. For investors, a clear and solid market opportunity is vital because even a well-executed startup may struggle without a well-defined niche in the market, limiting ROI.

Convincing investors that your startup can capture a significant market share and addresses a viable opportunity should be the topic of the few first slides in any good pitch deck. The Lolli pitch deck does a great job on its market slide discussing the crypto & rewards space, and how Lolli will address them, even in volatile markets. The only criticism of this slide is that they could have done a better job using charts and visuals to show market size and growth without using so many words.

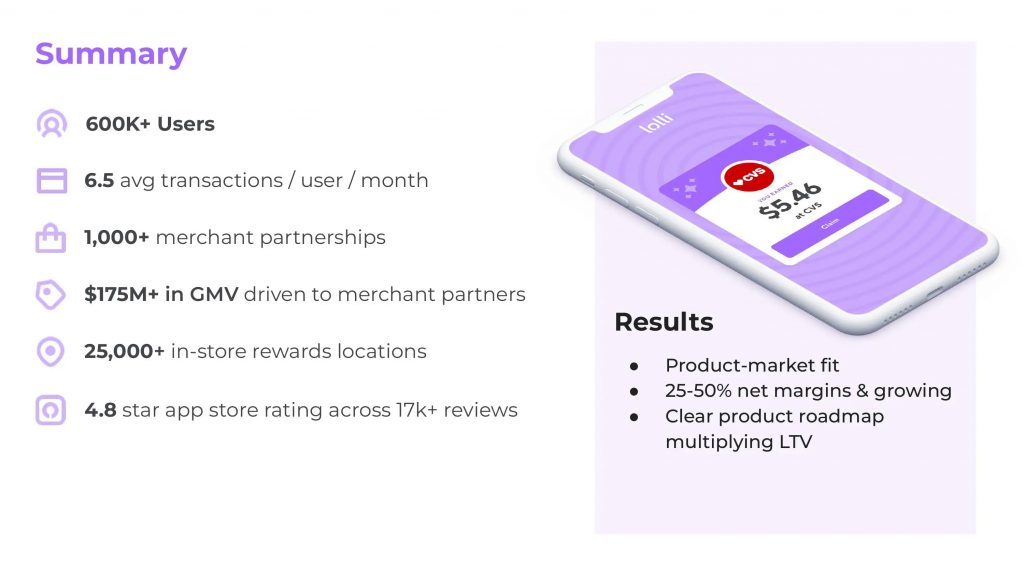

2. Summary Slide

The summary slide is a common element of Series A and later decks, and typically takes a prominent position at the beginning of a pitch deck (usually as the second or third slide). The purpose is to deliver essential details upfront, keeping potential investors informed and engaged. This slide should offer a brief and concise overview of the company, its traction, and future development, providing enough relevant information to prompt investors to consider the opportunity positively.

Some founders prefer to place the summary slide at the end of the presentation (to leave the reader with the highlights of the investment opportunity), or in a separate one-pager executive summary or tearsheet.

In the Lolli pitch deck, the summary slide heavily leans toward showcasing traction, to the point the slide be titled “Traction” instead. Nevertheless, the slide’s design is spot-on, featuring easy-to-read fonts, concise statistics, and a visually pleasing bullet point style. The use of the company’s branding color, modern icons, and sleek product imagery adds a visually appealing touch and effectively reinforces key points. Notably, the slide cleverly employs traction statistics to highlight the achievement of reaching product/market fit, a significant concern for investors.

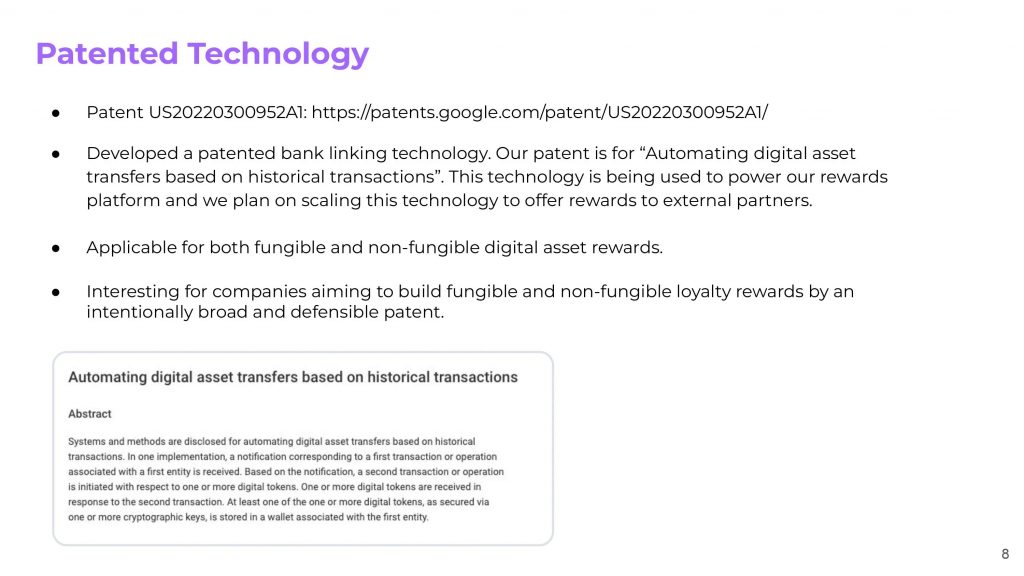

3. Moat Slide

A startup’s competitive moat is the secret sauce that will help the business succeed over competitors and defend their market share. In essence, the strength of your moat represents your company’s ability to sustain competitive advantages within its industry. These advantages can take various forms, including low-cost production, high switching costs, network effects, intangible assets like patents and trademarks, and efficiency at-scale.

Investors are particularly drawn to companies with strong moats because they provide a level of protection against competition, making investments less vulnerable in the long-term. A robust moat suggests that a company is better positioned to safeguard and expand its market share and profits over time, which resonates particularly well in the post-ZIRP era.

In the case of Lolli, the company’s moat revolves around their patented technology. The moat slide avoids overwhelming investors with technical details (which can be particularly-difficult with esoteric IP), and instead presents a simple design with a brief introduction and abstract. The inclusion of the patent’s URL adds a touch of credibility and offers a convenient way for investors to verify the information quickly.

How-to create your own pitch deck like Lolli

We hope you learned something from the Lolli pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/lolli

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular Web3 Pitch Deck Template template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for Web3 and cryptocurrency startups seeking to raise funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.