Founded in 2017, Nanonets provides no code and AI-powered automation software products to large businesses, mainly focused on finance functions – common examples include invoice processing, expenses management and accounts reconciliation. Once the process is set up on the Nanonets platform, it can take over the task, automatically processing as much of the workload as possible.

Two years ago, Nanonets shared the pitch deck they used to raise a $10M Series A round after graduating from Y-Combinator. Now, they’re back with a $29 million Series B funding round led by Accel India. This latest funding round, which also saw participation from existing investors Elevation Capital, Y-Combinator, and others, brings Nanonets’ total funding to an impressive $42 million.

“Legacy systems and processes mean companies asking their employees to review and validate complex documents manually, and then to enter the data into a system or spreadsheet such as CRM, ERP or Excel. It’s tedious, time consuming, prone to manual error – not to mention extremely boring for the people stuck doing this job.” Sarthak Jain, Co-founder and CEO, Nanonets, said.

For example, manually processing an invoice might take up to 15 minutes to complete, following an upload into the company’s system, and then checking against a completed purchase order.

Nanonets claims it can reduce this process to around one minute through innovations in Straight Through Processing. In this system, less manual processing is needed for an AI to complete a task, without hallucinations.

To circumvent the issue of hallucinations Nanonets prefers transformers, unlike many other AI startups that rely on large language models (LLMs) and GPTs. The startup has also embraced multimodal architectures after it saw that they were more accurate than existing machine learning technologies.

“Right now, in the back end, we have multiple architectures. Whenever we get a new customer, we train all of these models on the customer data and see which one gets better accuracy,” Prathamesh Juvatkar, co-founder and CTO said in an interview.

In the past two years, Nanonets has experienced significant growth in its customer base, with over 34% of Global Fortune 500 companies utilizing its AI-based workflow automation platform across various sectors including Finance, Accounting, and Operations.

“The funding is a critical next step in bringing Nanonets’ world-class document workflow solutions to customers across the globe. Nanonets operates with a customer-obsessed approach to doing business. We’re constantly asking ourselves how to make the experience of document management easier for our customers and their end users.” Sarthak said.

The startup intends to use the fresh funding for R&D to improve the accuracy of its system and invest in sales and marketing. Nanonets has about 100 employees, which includes most of its engineering team that’s based in India.

Check out Nanonet’s 23-slide Series B pitch deck that won backing from Accel below:

What were the slides in the Nanonets Series B pitch deck?

Browse the exact example slides from the pitch deck that Nanonets used to raise a $29M Series B round led by Accel India.

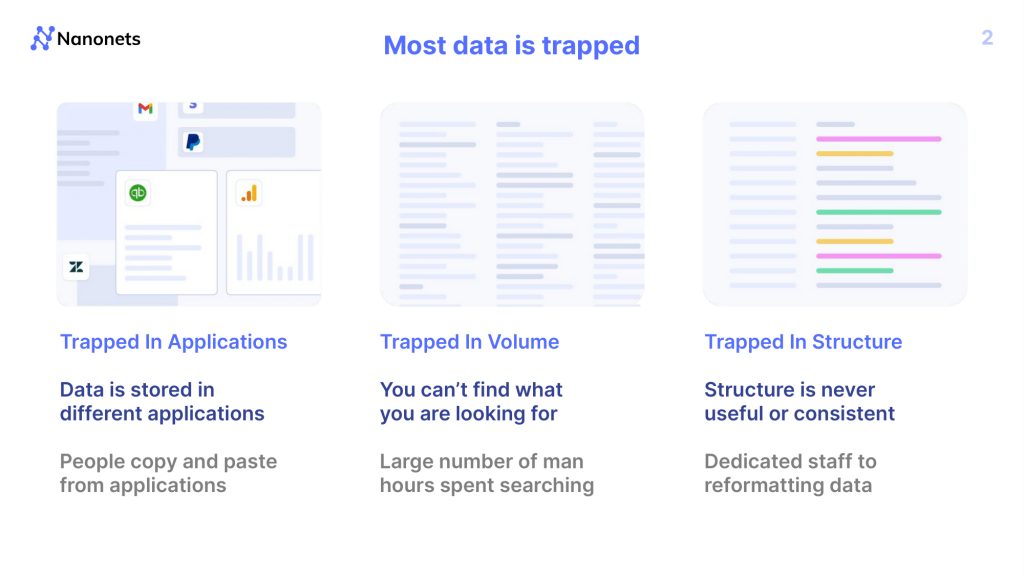

1. Problem Slide

Understanding the pain points of your customers is not only the linchpin of any compelling investor pitch deck, but arguably the most important thing for any startup founder to understand. Only after gaining deep knowledge of how a problem is affecting your target audience can you create a product that will generate interest among potential stakeholders, including customers and investors.

Explaining that problem is an integral part of any good pitch deck. Usually, the beginning portion of your deck will address the challenges your customer wants to overcome. The problem slide should also effectively turn your investor presentation into a rationale for your business.

Nanonets’ pitch deck does an excellent job of illustrating the issue of underutilized data, providing a broader perspective to audiences who may not be familiar with the space. The problem slide makes use of minimalist visuals with succinct and easy-to-read text, and a clear structure, making it easy for viewers to understand the key takeaways. Using skeleton screens instead of real UI screenshots is an excellent way to avoid designing slides that are too visually overwhelming.

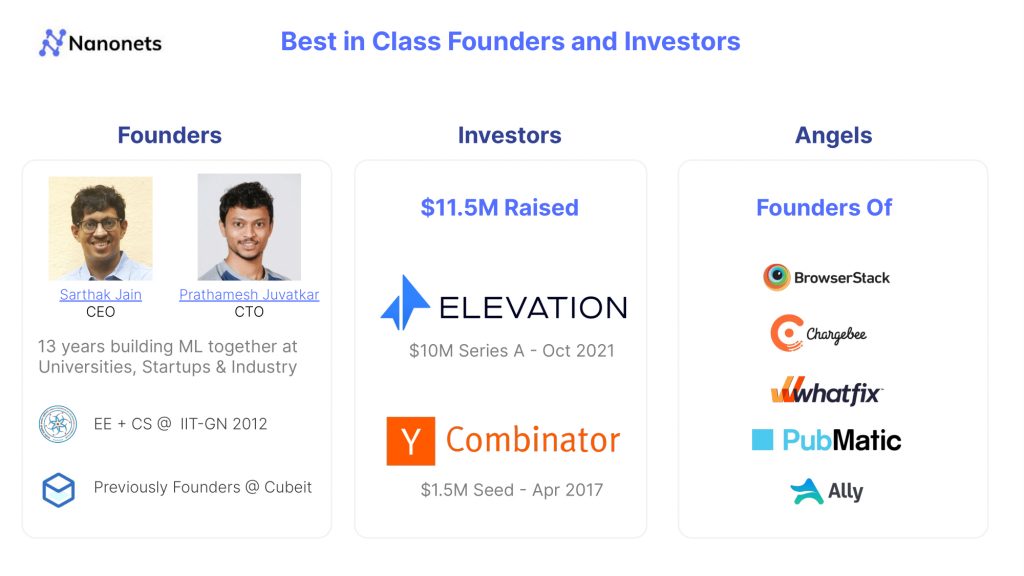

2. Team Slide

Often, investors do not reject startups because due to shortfallings in the business model, but rather because most funds adhere to a very specific investment thesis (usually framed in their pitch to LPs), and they only invest in startups that align with that thesis. For many investors in industries with technical and regulatory complexity, this thesis strongly revolves around the team.

One of the reasons the team is so crucial is that a strong team can pivot effectively. If an idea ultimately proves to be less promising than anticipated, and the entire venture hinges solely on that idea, it can lead to substantial losses.

Twitter, Groupon, PayPal, and Pinterest are some notable examples of renowned startups that pivoted from their initial ideas.

Nanonets’ pitch deck’s team slide provides detailed information about the founders, including their names, titles, and past experiences. This level of detail is generally sufficient for an investors pitch: long-winded bios are a surefire way to lose their interest. However, the slide goes one step further and provides a comprehensive overview of all the stakeholders involved (including investors and angels), as further social proof.

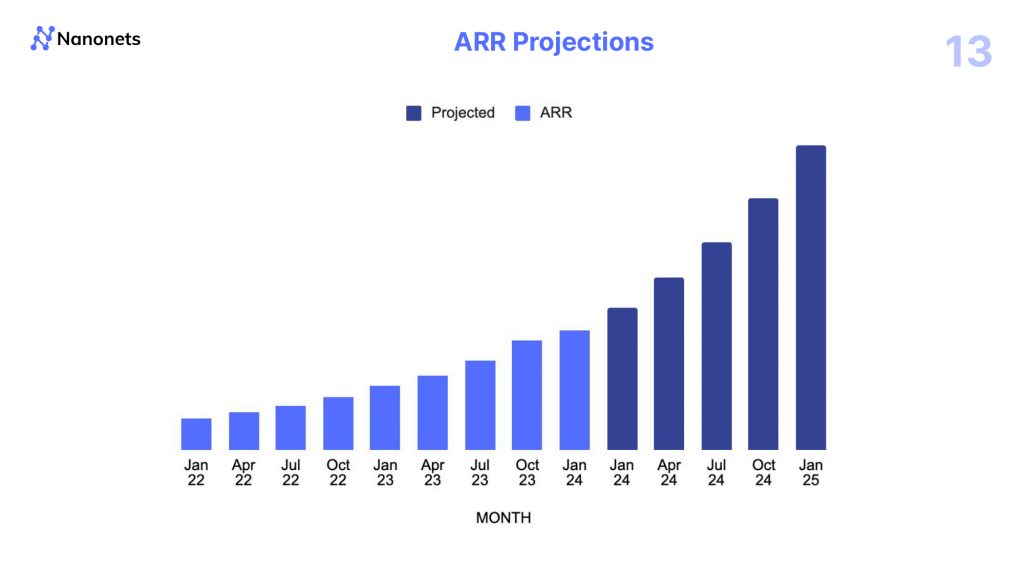

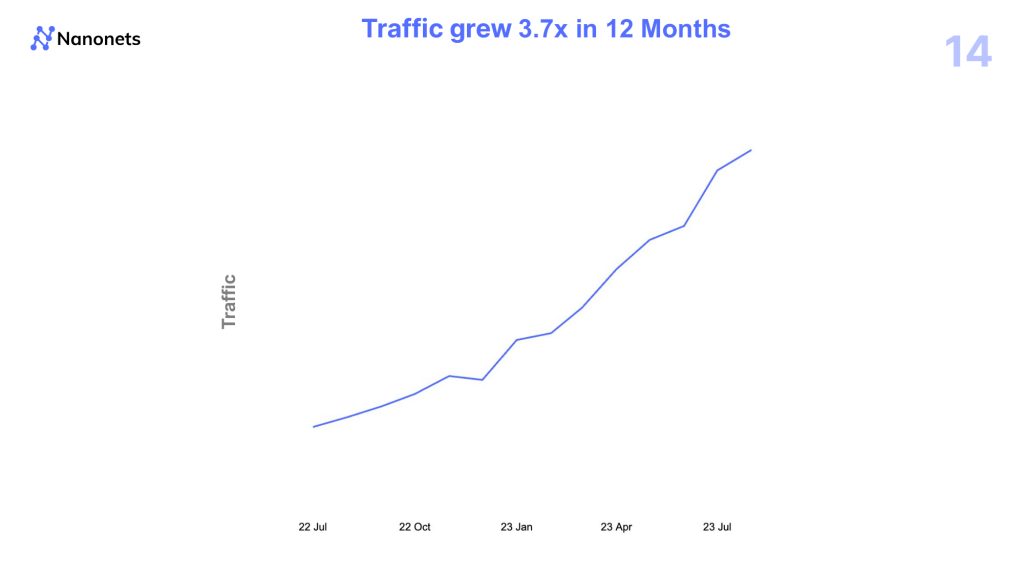

3. Projections Slides

Most pitch decks will conclude by presenting the milestones, financial projections, and Key Performance Indicators (KPIs) that the startup aims to achieve with this round of funding. While presenting milestones and KPIs, it’s essential to select the ones that are appropriate for the startup’s current stage, bearing in mind that these indicators will evolve with each growth phase.

Given that Nanonets is in the process of raising a Series B round, where investors typically prioritize growth over validation, their pitch deck’s projections slides are tailored accordingly. These slides present recent company growth metrics alongside future projections in a straightforward manner, utilizing simple charts to highlight the most pertinent data for investors. The numbers are presumably redacted in this public version of Nanonets’ deck, but you’ll want to include specific figures for historical and projected growth in revenue and users.

How-to create your own pitch deck like Nanonets

We hope you learned something from the Nononets pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/nanonets-series-b

You can also compare to Nanonets 2022 pitch deck used to raise a $10M Series A round after graduating from Y-Combinator, to see how pitch decks differ across fundraising stages.

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular AI Pitch Deck Template template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for AI startups seeking to raise funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.