Meniga, a company that helps banks make better use of customer spending data, has raised $16 million in Series D funding.

The London-based business, originally founded in 2009 in Reykjavik, Iceland, has developed a suite of digital banking tools for banks spanning areas including personal finance, open banking, and data enrichment. Beyond banks, the company also sells to payment service providers (PSP), fintechs, and other financial services providers.

“Meniga provides a vast product suite that allows customers total transparency in controlling cashflow, providing concise and clear financial insight, and even allows customers insight into the carbon footprint of their spending,” Raj Soni, Meniga’s CEO, who joined the company earlier this year said in an interview to TNF.

Meniga provides digital banking solutions for over 100 million banking customers across 30 countries in Europe, North America, the Middle East and Asia. Its customers include banks such as UOB, UniCredit, Groupe BPCE, Crédito Agrícola, Swedbank, and Commercial Bank of Dubai.

At the heart of Meniga’s success, says Soni, is their flexibility, “we do not decide how individual banks choose how to engage with their customers.” Instead, he says, Meniga seeks to “empower them with our sophisticated technological toolkit to engage the consumers they support as they see best.”

Previously, in March 2021, Meniga closed USD 10 million in additional funding led by Velocity Capital and Frumtak Ventures. This latest funding round boosts the company’s total funding to $60.5 million (€55 million). Contributors include major European banks, Groupe BPCE and Crédito Agrícola, Omega ehf, and several existing shareholders.

“We are excited to continue our partnership with Meniga, which currently empowers the digital banking experience for our over 10 million users, and provides more than 100 million insights for our users every year.”

Emmanuel Puga Pereira, Chief Digital Officer at Groupe BPCE, expressed enthusiasm for the continued partnership with Meniga.

“We are looking forward to seeing the firm’s continued focus on enrichment as well as personalised insights. These capabilities are critical for all BPCE banks to effectively engage with their end users and we have seen firsthand how Meniga’s solution is a key component for banks to succeed.”

As stated in the official press release, a portion of the investment will be allocated to clearing Meniga’s existing debt, a move that is anticipated to make the company nearly debt-free. The remaining funds will be dedicated to the execution of Meniga’s new strategy. This strategy is centered on strengthening its core capabilities in Data Enrichment and Hyper Personalized Insights for the financial services industry. Furthermore, the strategy seeks to facilitate payment capabilities for banks within the expanding Open Banking and Open Finance ecosystem.

Check out Meniga 25-slide Series D round pitch deck below:

What were the slides in the Meniga pitch deck?

Browse the exact example slides from the pitch deck that Meniga used to raise a $16M Series D round led by Groupe BPCE and Crédito Agrícola, alongside Icelandic VC Omega ehf, plus existing shareholders.

1. Cover Slide

Entrepreneurs often overlook the cover slide, dedicating minimal time, effort, or consideration to this crucial aspect of their pitch deck. This is unfortunate considering that pitch decks typically range from 10 to 15 slides, and with a limited number of opportunities to capture interest, every slide, including the title page, should be optimized.

In reality, the cover slide serves as your best chance to spark excitement about your company. It’s the initial impression a prospective investor gets when reviewing your deck, and you don’t get a second chance to make a first impression.

Creating an impactful cover slide doesn’t have to be complicated. With a logo, a catchy tagline, company branding, and a fitting image, you can craft a compelling slide. The Meniga pitch deck’s cover slide exemplifies this simplicity and effectiveness, incorporating all the essential elements. Notably, the included image showcases the product in action, adding a dynamic visual component. The only drawback of this slide worth mentioning is that the fonts are in Calibri (which may just be the result of someone exporting without installing the right fonts).

2. Market Size Slides

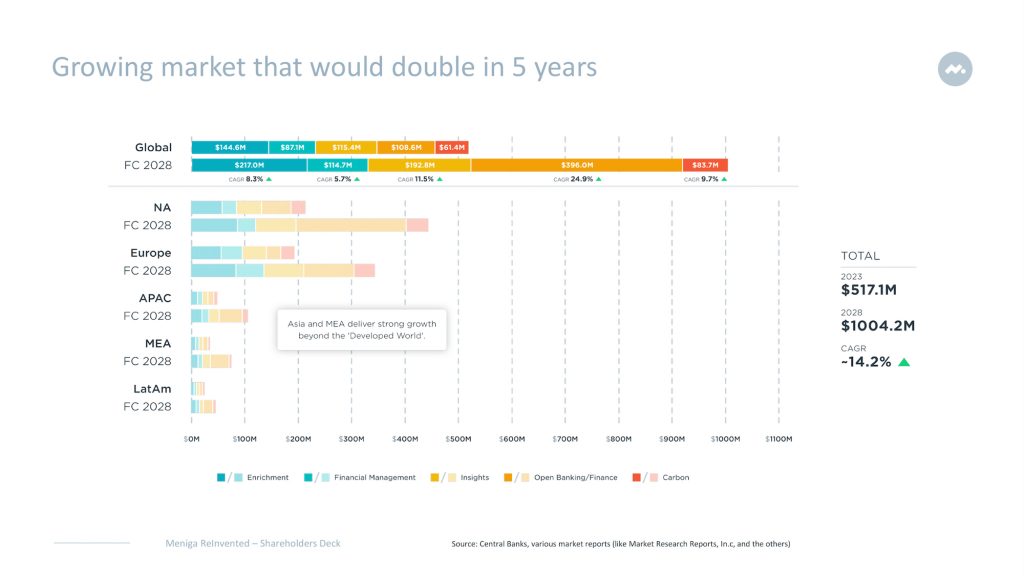

When it comes to the likelihood a startup will raise venture capital funding, the significance of market size cannot be overstated. In Scott Kupor’s book “Secrets of Sand Hill Road,” he highlights market size as one of the most critical elements venture funds consider when evaluating a startup. It plays a crucial role in helping investors gauge the potential future market for a product or service, and whether the startup has the right exit potential and timeline to fit their fund’s portfolio strategy.

Market size holds importance not only for early-stage startups but also for companies raising later rounds. In the early stages, where the likelihood of success is uncertain, investors seek a sizable market to ensure a substantial return on their investment if the startup succeeds.

For established companies like Meniga raising Series D rounds, the market is typically mature, and the focus shifts towards market expansion. In the Meniga pitch deck, numerous slides address market size and its projected growth. While content-wise the slides are comprehensive, the design may appear overwhelming and does not strictly adhere to Guy Kawasaki’s 10/20/30 rule. Despite this, the content remains robust, providing valuable insights into market dynamics and growth projections.

3. Roadmap Slide

Including a clear and workable roadmap in a pitch deck is crucial. During an investor pitch, it’s important to show not just your product vision but also your strategic go-to-market plan. A well-constructed roadmap should clearly outline your path forward, for both product and sales development.

The roadmap slide can prove challenging esp. for later-stage startups, as too much detail can overwhelm the audience whereas too little can indicate a lack of strategic vision. The Meniga pitch deck’s roadmap slide presents concise, actionable, and accountable steps, focusing on the near to mid-future and recognizing the dynamic nature of the business landscape.

In terms of design, the slide is visually appealing with an easy-to-follow quartery timeline. The overall aesthetic is simple and elegant, ensuring that the audience can easily absorb the information. This roadmap slide serves as an excellent example of how to effectively present a roadmap to investors—striking the right balance between simplicity, clarity, and visual appeal.

How-to create your own pitch deck like Meniga

We hope you learned something from the Meniga pitch deck, and that you are able to use these insights for your own business. If you’d like to, you can bookmark it at bestpitchdeck.com/Meniga

Although it probably goes without saying that having a successful business (outside just their pitch deck) was integral to their success, it is critical for any startup to ensure your vision is portrayed properly. That’s where crafting the perfect pitch deck comes essential:

You might find our other resources on how-to create a pitch deck helpful, or benefit from using one of our expert-designed templates:

Our team has helped create decks that have closed over $100M+ in deals & funding for leading startups and even VC firms. You can leverage this experience and get a jumpstart on your pitch with one of our easy-to-use presentation templates, one-pagers, or financial models.

Creating a deck? Check out our pitch deck templates.

Every pitch requires a unique approach tailored to its audience. Our team of experts has created pitch decks for different industries, as well as funding stages:

You might be interested in the popular Fintech Pitch Deck template designed by our team of experts at VIP.graphics. This investor presentation template is built specifically for Fintech startups looking to raise funding.

Accelerator Pitch Deck Template — The Accelerator Pitch Deck template was crafted for early-stage founders seeking to win funding &/or investment from pitch contests, accelerators, incubators, and angels or VC firms. Winning a pitch contest or being accepted to a prominent accelerator program requires a unique strategic approach to an investor pitch presentation.

Series A Pitch Deck Template — A pitch deck template for startups and founders raising funding: Smart, actionable slides that work. This is a pitch deck template built specifically for startups, entrepreneurs and founders raising their first seed or Series A round of institutional capital.

Mergers & Acquisitions Pitch Deck Template — Perfect Pitch Deck™ is a template crafted for later-stage businesses entering more sophisticated discussions such as mergers & acquisitions (M&A), late-stage investment (Series C+), or other partnerships & financing opportunities. Our team of experts created this presentation to empower founders to present with confidence to investment banks, private equity (PE) groups, and/or hedge funds (and vice versa).

Alternatively, feel free to browse our growing selection of pitch decks tailored for specific industries and businesses.